Every September, Apple unveils its latest phones at its futuristic Silicon Valley campus. A few weeks later, tens of millions of its latest handsets, assembled by legions of seasonal workers hired by its suppliers, are shipped from Chinese factories to customers around the world.

The annual release of Apple’s iPhones usually runs like clockwork, a prime example of how the US tech giant has become the most profitable company of the globalization era by navigating seamlessly in the world’s two largest economies.

But this year, a smooth rollout for the iPhone 14 has been the latest victim of growing difficulties in doing business in China. Beijing’s rampant approach to stop Covid-19 and heightened tensions with the United States have forced Apple to re-examine key aspects of its business.

A recent outbreak of coronavirus cases in the region surrounding Apple’s largest iPhone factory, in central China’s Zhengzhou, prompted local officials last week to order a seven-day shutdown. As a result, the company said on Sunday that it cannot produce enough phones to meet the demands of the holiday season.

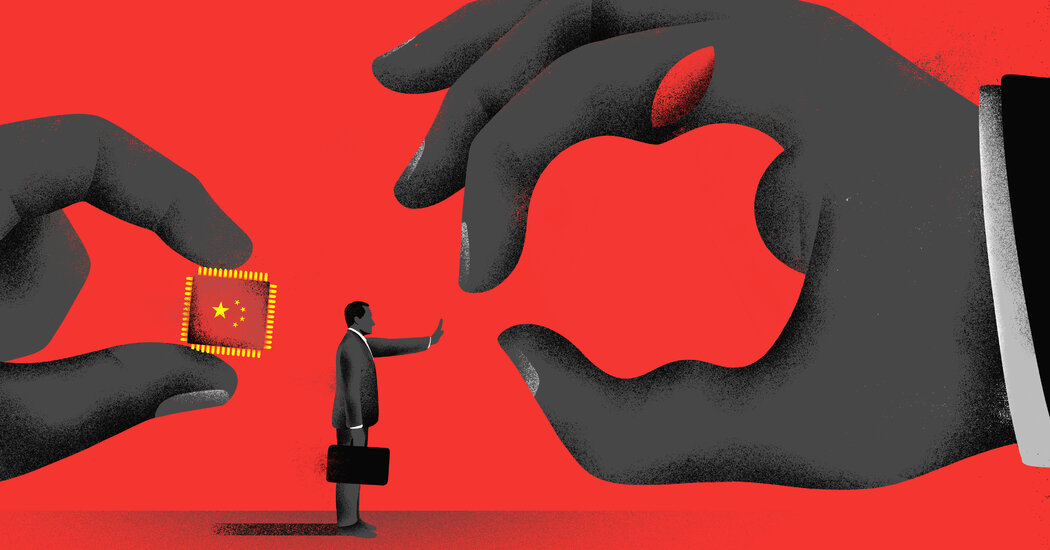

For much of this year, Apple has also been the focus of a two-pronged intervention in Washington, where alarm over Beijing’s military provocations and technological ambitions has turned free trade orthodoxy on its head.

In March, word trickled out that Apple was in talks with an obscure Chinese memory chip maker, Yangtze Memory Technology Corporation, or YMTC, to provide components for the iPhone 14.

That clashed with the work of a coalition of lawmakers and more than a dozen congressional officials, who spent months researching the ins and outs of Apple’s supply chain in China. The Commerce Department last month issued restrictions prohibiting US companies from selling machines to YMTC, making it difficult for Apple to go through with the deal.

Apple has publicly confirmed that it has spoken to YMTC, which has not responded to requests for comment. But an Apple spokesperson declined to comment on whether the company had dropped its ability to partner with the Chinese memory maker.

Recent developments underscore how Apple’s close ties to China, once considered a strength of its company, have become a risk.

It’s no coincidence that Apple’s rise from near bankruptcy in the 1990s to become the world’s most valuable company has closely followed China’s economic growth. It pioneered a best-of-both-worlds business model: Products designed in California were assembled cheaply in China and sold to the country’s growing middle class.

Apple made a profit while the Chinese economy boomed. But as US-China relations falter and both governments meddle in Apple’s affairs, the company has gone from one of globalization’s greatest success stories to become a symbol of the rift.

“Apple is discovering that geopolitics drives business models — not the other way around,” said Matthew Turpin, a visiting lecturer at the Hoover Institution who specializes in US policy toward China. “This whole collection of supply chain risks creates a real liability for them.”

China’s leader, Xi Jinping, has forced business leaders to rethink long-held assumptions about operating in the country. For decades, economic growth has been the top priority of the Chinese government. But Mr Xi used a major Communist Party congress last month to make it clear that security issues and the party’s more ideological stances would take precedence over business interests.

Xi’s “zero Covid” policy has slowed factory output and slowed the country’s economic growth, and his administration has faced pressure from business leaders and markets to ease restrictions. But it has not clearly stated that it will make a change.

Easing Covid restrictions could allow Apple to fill some of its supply shortages and meet some demand, but the company will still lose sales this holiday season, said Jeff Fieldhack, an analyst at Counterpoint Research, a technology research firm.

It would be difficult for Apple to break away from China. The company worked for two decades with manufacturing partners to build massive factories, supported by an extensive network of suppliers in the country. Over time, it has added more Chinese components to its products and benefited from their lower prices.

To limit its exposure to China, Apple started manufacturing a small percentage of its latest iPhones in India. It shifted production of several other products to Vietnam. But both markets offer factories with only tens of thousands of employees — a tiny fraction of the scale Apple enjoys in China, where its manufacturing partners employ some three million workers.

Apple relies on factories such as the iPhone factory in Zhengzhou, which is operated by Foxconn, its largest assembly partner. As Covid-19 cases began to rise in the area, Foxconn walled its roughly 200,000 employees on the premises of a factory that can produce as much as 85 percent of the world’s iPhones, according to Counterpoint Research. It wasn’t long before Covid started to spread and Foxconn struggled to balance business demands with the country’s ultra-tough pandemic policy.

As stories of unrest and food shortages flooded Chinese social media, workers began to fear for their lives. Hundreds fled. The mechanic initially offered workers an extra $14 per day to continue working. Later, that amount nearly quadrupled to $55 a day.

When officials ordered the region around the plant, the plant was forced to operate at “significantly reduced capacity,” Apple said on Sunday. It is unclear when operations will return to full capacity.

The production slowdown in Zhengzhou forced Apple to warn investors — for the third time in three years — that sales would be impacted by pandemic-related disruptions to its operations in China.

While Beijing’s strict Covid policies complicate Apple’s iPhone production plans, Washington keeps a close eye on what goes into its products.

YMTC, the small Chinese chipmaker, was founded in 2016 with a government investment of $2.9 billion and a mission to help reduce China’s reliance on foreign chipmakers.

Apple, which declined to comment, was in talks about a supply deal with the Chinese company, according to two people familiar with the discussions. Memory chips, the specialty of YMTC, are one of the most expensive components of the iPhone, accounting for about 25 percent of the material cost, according to Susquehanna International Group, a financial company.

Because it would offer lower prices to gain market share, YMTC could help Apple pressure its current Western suppliers to cut costs, said Walter Coon, a semiconductor analyst at Yole Group, a market research firm.

But YMTC’s importance to China made it a target of US national security investigators. In late 2020, a team led by James Mulvenon, a Chinese linguist and researcher at US defense contractor SOS International, released a 17-page report detailing YMTC’s connections, through its parent company, Tsinghua Unigroup, with entities that produce products. sold to China’s military.

In February 2021, Mr. Mulvenon presented his findings to about two dozen Republican and Democratic staffers on Capitol Hill. He outlined the risks he believed YMTC entailed because the government subsidies could allow the company to undercut competitors on price.

“It never made sense to cluster the entire supply chain in a country that was the biggest cyber threat to the United States,” said Mr. Mulvenon.

As Apple prepared for this year’s iPhone release, Wall Street analysts at Credit Suisse released a report saying Apple could include YMTC chips in future models. While Apple and YMTC did not confirm or deny the report, the potential deal prompted lawmakers including Senators Chuck Schumer, New York Democrat and majority leader, and Marco Rubio, Florida Republican and member of the Senate Intelligence Committee, to send letters. urges the Biden administration to investigate Apple’s plans.

Semiconductor industry officials have also raised concerns with lawmakers that Apple helped recruit engineers from Western companies to help YMTC improve manufacturing, according to three people familiar with the matter.

Apple later tried to reassure lawmakers by telling them it would only use YMTC chips for iPhones sold in China. But that didn’t ease congressional leaders’ greater concern that any purchase from YMTC would hurt the memory chip market.

Lawmakers urged Gina Raimondo, the trade secretary, to put YMTC on the United States’ “entity list,” a designation that would prevent it from purchasing U.S. technology and components without a waiver. On October 7, the department shut down and imposed export restrictions on YMTC and 30 companies believed to have links with the Chinese military.

The new restrictions cost YMTC access to critical US machinery for a new factory in Wuhan and could limit its ability to work with a company like Apple.

In the days after the restrictions were enacted, Japanese business firm Nikkei released a report saying Apple had dropped its plans to use YMTC. When asked whether the Nikkei report was accurate, an Apple spokesperson declined to comment.

Lawmakers continue to put pressure on Apple and YMTC. In a statement to The New York Times, Mr Rubio said, referring to Apple’s CEO, “If Tim Cook understands the risks YMTC and the rest of the Chinese Communist Party’s chip manufacturing efforts pose to American national security and of our allies, then he and his company must make a clear commitment not to proceed.”

Ana Swanson and Edward Wong reported from Washington.