This open letter was originally published on Medium. The text of the letter is below:

Hi Elizabeth,

My name is _____ and I am a 8th grade student from New Jersey. To be honest, I never really knew who you were until recently, when my mom told me what a big deal your book A Fighting Chance had been to her life story growing up as a single mom in the backcountry of America with no health insurance or support system to speak of… It turns out that Senator Warren has advocated policies that would help people like my mother get ahead by giving them access to affordable health care and education without being saddled with debt caused by predatory lending practices. the only politicians willing to stand up to the Wall Street executives who make billions from taxpayer bailouts when doing little more than jack up their own salaries to multi-million dollar levels, but at the one somehow still expect us mere mortals to struggle, just trying to keep our heads above water and not give in to their greed anymore! It helps that she knows how hard it must have been, since she was born white and rich enough parents could afford “private schools” before most Americans had electricity, but now she fights every day so we can all have a better life . That alone makes her worth supporting politically whether you’re Democrat or Republican, because no one wants anyone else to live a worse life than her. This country needs leaders like Elizabeth Warren who are willing to take risks in the face of public criticism rather than avoid confrontation and only look out for themselves and then return when they are safe and say nothing has changed during the pre-election rhetoric (and here we go again). So please vote! And make sure everyone you know does too! We desperately need this!!

The “leon cooperman letter to elizabeth warren pdf” is an open letter written by Leon Cooperman, a former Goldman Sachs partner and the founder of Omega Advisors. The letter was published in response to Senator Elizabeth Warren’s recent criticism of Goldman Sachs.

Senator Warren, Greetings!

Please help us maintain the impartial status of crypto.

There are certain things we need to achieve together in this fractured political climate. One of these is cryptocurrency investments.

I believe you have the potential to become a major force in the crypto sector for good. But I had to contact you again after reading your letter to Fidelity CEO Abigail Johnson, in which you wondered why people should put a portion of their 401(k) into bitcoin.

Fidelity allows US clients to invest a portion of their retirement funds in bitcoin, which is a groundbreaking move. Rather than being against it, I believe bitcoin is here to stay, and you can be a strong champion for investors in this new financial reality – hopefully with your conservative peers.

The champion of the everyday investor

First and foremost I am a fan.

I attended your meetings as a voter in Massachusetts. I frequently cite your book All Your Worth as a fantastic guide to getting out of debt as a financial writer. As a citizen of the United States, I have always appreciated how you have dealt with the big banks and improved consumer protection, which I assume is a lonely battle.

No one can disagree that you are on the side of the individual US investor, no matter what others say. To keep the U.S. financial system in check, you created the Consumer Financial Protection Bureau.

I can see why your zealous advocacy for consumers – all of us – would make you wary of cryptocurrency. They are whimsical. They are hypothetical. True and accurate!

Cryptocurrencies, on the other hand, have been one of the best performing asset classes of the past decade for individuals who had the guts and patience to invest.

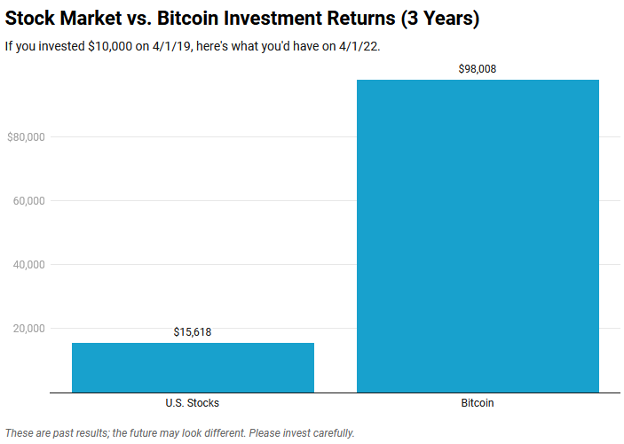

Here’s how the stock market in the United States has fared against bitcoin over the past three years:

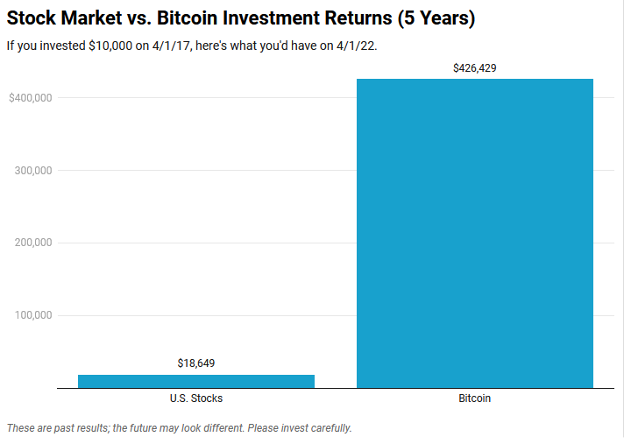

Even more astonishing are the achievements of the past five years:

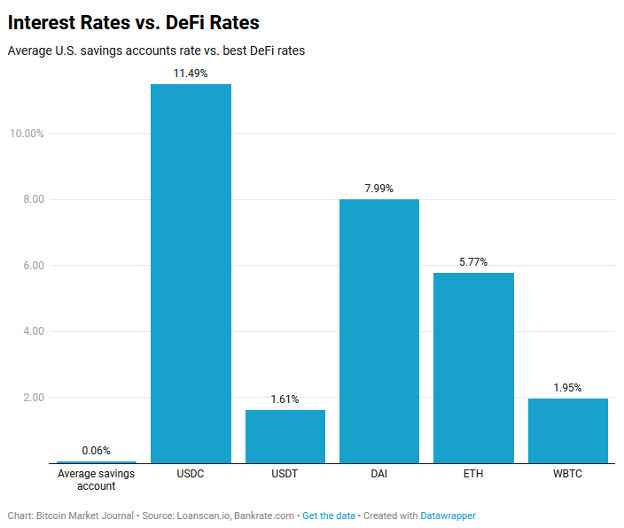

Here are the interest rates that customers can receive by saving their money in crypto “DeFi” services at a time when banks offer savers almost no interest:

In other words, banks have failed customers again. There are almost no items that promote saving, which is why the stock market is so volatile. Bitcoin and other cryptocurrencies can be a viable solution for Americans looking to develop wealth.

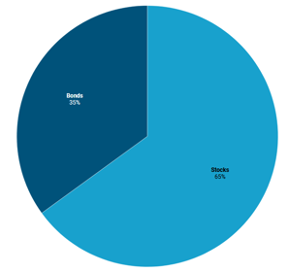

I see a wonderful match between the financial principles you have learned for so long and prudent bitcoin investments. Consider a typical investment portfolio:

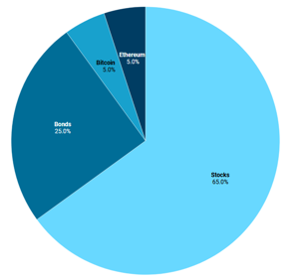

With only a modest portion of the budget spent on cryptocurrency (no more than 10%):

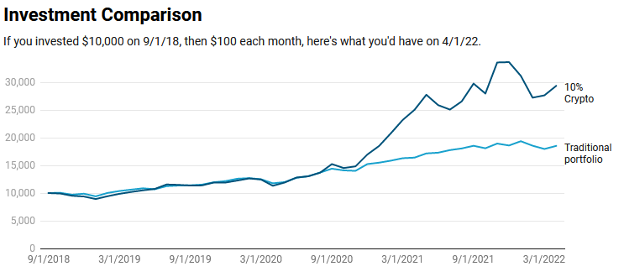

Comparing the two options, here are the 3-year returns for the typical US investor:

Allowing Americans to invest a modest portion of their retirement funds in bitcoin is arguably the single most important financial benefit for this generation. That has certainly been the case thus far.

However, they are long-term results. How can customers be protected from bitcoin’s daily price swings? I have a thought.

“A whopping 10% in Bitcoin”

Consider going to the Boston Public Garden and riding the famous Swan Boats. You buy your ticket and take a seat, only to discover that they have been converted into an intense, thrilling park ride known as ‘Screamin’ Swans’.

Investors expecting bitcoin to be a smooth sailing experience will quickly discover that with more profits comes greater danger. So you’re right to worry about millions of Americans investing 20% of their 401(k) funds in bitcoin, anticipating a smooth ride, without realizing the risk.

While I welcome Fidelity’s initiative to allow customers to contribute up to 20% of their 401(k) savings (as defined by the employer), I believe that the maximum bitcoin contribution should be capped at 10% .

While bitcoin is technically an “alternative asset” and most financial gurus accept up to 20% in alternative assets (see Fidelity’s argument), I approach it from a psychological point of view. What would the investor think if he lost 20% of his investment?

It seems that 10% losses are achievable. It is painful to lose 20%.

Coupled with an active education campaign explaining the benefits and dangers of bitcoin, ten percent is a realistic level of risk to take advantage of bitcoin’s future profits. (You may also need Fidelity to spend a lot of money on bitcoin education.)

On the other hand, if that ten percent performs well, you have dampened the exuberance of the market and prevented things from getting out of hand. You have made it possible for investors to share in the benefit while reducing their risk.

Senator Warren, the mind is no longer in control. The demand for bitcoin is unstoppable, especially among the younger generation of investors. You can help protect them by limiting the maximum amount of bitcoin you can invest in your 401(k) to 10%.

The bitcoin genius is already out of the bottle for millions of investors.

Keep it twofold, please, please, please.

Finally, I believe that if you can work down the aisle on crypto-related topics, your results will be much more successful.

I can’t believe how heavy this must be in reality. However, Republicans and Democrats are best served when they work together to help us navigate this new financial ecology.

When we are at our best, the two major parties act as a check on each other, tempering each other’s excesses. We arrive at excellent compromises that serve the common good. It turns into Twitter feuds when we’re at our worst.

I recommend being careful when it comes to crypto as I believe your opinions will evolve over time. I believe you will find that, when used wisely, bitcoin and cryptocurrencies can benefit the common investor.

Despite the occasional excesses, most people agree that the stock market has been a long-term force for good. Despite their occasional excesses, most people agree that banks have always been a powerful force. Despite the occasional excesses, I think crypto will prove to be a long-term force for good.

Senator Warren, your efforts have such a crucial purpose: to keep these excesses in check. Without brave leaders like you stepping on the brakes, the train would accelerate dangerously, causing disaster.

As our consumer watchdog, the crypto business relies on you. I beg you not to resist the adoption of bitcoin – that war has already been won – but rather to aid in its moderation. Help us regulate it. Help us to invest responsibly.

Please work with your colleagues across the aisle so I can continue to vote for you.

Hargrave, John Kieser in Massachusetts