PARIS — Airbus on Thursday agreed to build a second assembly line at its factory in China and received a green light from Beijing to proceed with 160 previously announced aircraft orders. The announcement was a clear reminder of how China remains a critical market for European companies, even as US manufacturers are upping the ante.

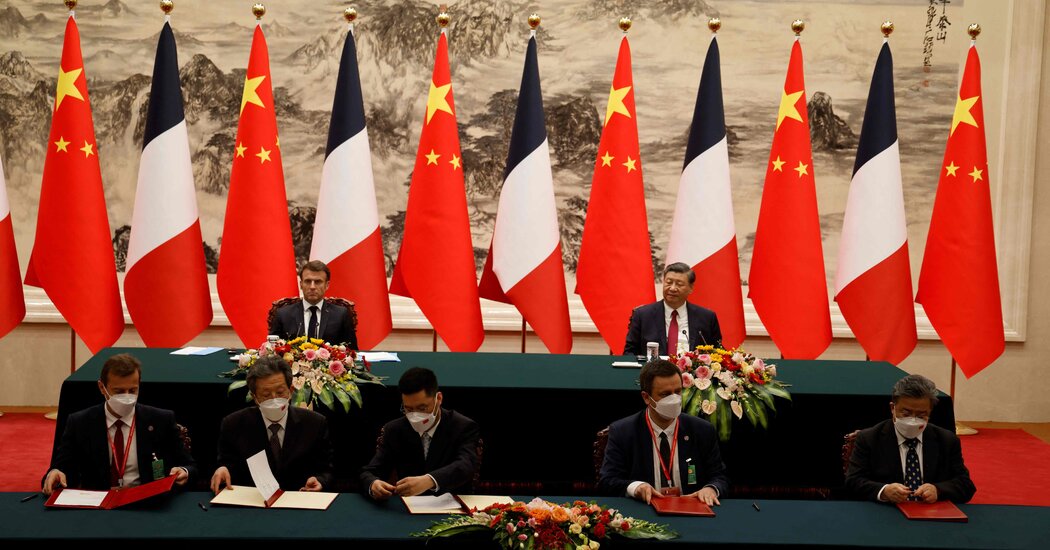

The agreement was signed in Beijing by Airbus CEO Guillaume Faury, who was part of an economic delegation that accompanied President Emmanuel Macron of France and President Ursula von der Leyen of the European Union on an ambitious state visit to China’s top leader Xi Jinping.

Airbus is working to expand production of its best-selling single-aisle A320 jet and bolster sales in China, whose leaders have recently struggled to show the world that the country is open for business after ending pandemic lockdowns doubled year. Under the agreement, the world’s largest aircraft manufacturer will double production capacity of the A320 at its plant in Tianjin, in an aviation market that is the fastest growing in the world.

And after announcing a major deal last year in which China pledged to buy 292 new Airbus planes, worth nearly $40 billion before rebates, the company said the Chinese government had given approval on Thursday for Airbus to buy 160 of those planes. going to make.

The deal “underpins the positive recovery momentum and prosperous outlook for China’s aviation market,” Faury said in a statement. He added that Airbus was “privileged to continue to be a preferred partner in shaping the future of civil aviation in China.”

Business and economy in Europe

- A fight against inflation: Central banks around the world have tried to cope with rising prices by raising interest rates. In Sweden, the strategy has paralyzed the economy and sent house prices down.

- A source of contention: A $7.8 billion factory planned by a Chinese company in eastern Hungary has caused divisions even within Prime Minister Viktor Orban’s party, who favored it.

- Nuclear energy: Europe moved quickly to get rid of Russian oil and natural gas in the aftermath of the war in Ukraine. Breaking dependence on the Russian nuclear industry is a much more complicated undertaking.

- Toblerone: The chocolatier must remove an image of the Matterhorn from the packaging to comply with Swiss law, as he moves some production abroad.

Europe is under pressure from the Biden administration to isolate Beijing by imposing more trade restrictions on sensitive technologies, such as semiconductors that have military uses. There is much talk of economic decoupling, and Apple has moved some manufacturing to India and Vietnam, though most of its revenue still comes from Chinese-made products.

Ms von der Leyen said in a speech ahead of the trip that EU countries should reduce risks and “rebalance” economic ties with China. But other European leaders, and Macron in particular, have tried to maintain strong economic ties despite China’s increasing assertiveness and support for Russia.

Mr Macron, who arrived in China on Wednesday, spent most of the visit trying to play a clear role for Europe avoiding confrontation, while also trying to give China a place in ending the war in Ukraine. About 50 French business executives accompanied Mr Macron in an effort to maintain commercial ties.

While the deal with Airbus was more modest than expected, it nonetheless underlined China’s continued importance as a major trading partner for Europe, a partner Macron is reluctant to give up.

China has overtaken the United States as Europe’s largest trading partner. Beijing was the third-largest destination for exports of goods from the European Union last year and the largest source of goods imported into the bloc. France is Europe’s second largest exporter of goods to China, after Germany.

During a whirlwind trip to China in November, German chancellor Olaf Scholz said Beijing and Berlin should work together amid a “complex and unstable” international situation. He traveled with a large German business delegation to send the message that business with China, the world’s second largest economy, must continue.

But many European countries also face widening trade deficits with China, as Beijing steps up a long-term goal of becoming self-reliant in science and technology. That has resulted in government subsidies for manufacturers of many goods that were once imported, eroding China’s demand for foreign goods.

Nevertheless, the Chinese market remains crucial for many European companies. In France, many companies are eager to sign contracts to produce goods and equipment in China, while Europe moves forward with an ambitious decades-long program to transform itself into a carbon-neutral economy.

Executives from major French companies including nuclear supplier Électricité de France, train maker Alstom and global waste management conglomerate Veolia were among those accompanying Mr Macron this week.

In line with a sustainability strategy at Airbus, the company has also signed a memorandum of understanding with the China National Aviation Fuel Group to step up Sino-European cooperation in producing common standards for so-called sustainable aviation fuels, which are expected to be used more and more to power jets.

While China’s rapid economic growth has slowed sharply in recent decades due to the pandemic, the domestic aviation market has been recovering since the lifting of strict “zero Covid” regulations in early December. Frequent quarantines, especially of intercity travelers, had severely hampered air traffic within China for three years.

Over the next 20 years, air traffic in China is expected to grow much faster than the rest of the world, representing 20 percent of demand for new aircraft, according to Airbus. Still, China has been wary of buying large numbers of imported single-aisle jets.

With huge subsidies, a state-owned company in Shanghai, Comac, has developed a commercial jet, the C919, which is almost identical to the Airbus A320 being built in Tianjin. Although repeatedly delayed, the C919 has completed test flights in preparation for its commercial launch with a subsidiary of Shanghai-based airline China Eastern.

It is still uncertain whether Europe will succumb to Chinese pressure to assemble widebody jets in China.

Airbus entered the Chinese market nearly 40 years ago, in 1985. By the end of the first quarter of 2023, the Airbus fleet in China will have grown to more than 2,100 aircraft, representing more than half of the market, the company said.

Keith Bradsher contributed reporting from Shanghai.