SAN JOSE, Calif. — For years, scientists in labs from Silicon Valley to Boston have searched for an elusive potion of chemicals, minerals and metals that could charge electric vehicles in minutes and travel hundreds of miles between charges, all for a lot of money. lower cost than batteries currently available.

Now some of those scientists and the companies that founded them are approaching a milestone. They are building factories to produce next-generation battery cells so that automakers can test the technologies on the road and determine whether they are safe and reliable.

Factory operations are usually limited in scope, designed to perfect manufacturing techniques. It will be several years before cars with the powerful batteries appear in showrooms, and even longer before the batteries are available in reasonably priced cars. But the start of production on the assembly line offers the tantalizing prospect of a revolution in electric mobility.

If the technologies can be mass-produced, electric vehicles could compete with fossil fuel vehicles for convenience and undercut them on price. The harmful emissions from car traffic can be significantly reduced. The inventors of the technologies could easily become billionaires – if they aren’t already.

For the dozens of young companies working on new types of batteries and battery materials, the emergence of secluded labs in the harsh conditions of the real world is a moment of truth.

Producing millions of battery cells in a factory is much more difficult than making a few hundred in a cleanroom – a space designed to minimize contaminants.

“Just because you have a material that has a right to work doesn’t mean you can make it work,” said Jagdeep Singh, founder and chief executive of QuantumScape, a battery manufacturer in San Jose, California, at the heart of Silicone. valley. “You have to figure out how to produce it in a way that is free from defects and has high uniformity.”

In addition to the risk, the collapse of technology stocks has stripped billions of dollars in value from publicly traded battery companies. It will not be so easy for them to raise the money they need to build production operations and pay their staff. Most have little or no income because they have yet to start selling a product.

A critical year for electric vehicles

While the general car market is stagnating, the popularity of battery-powered cars is rising worldwide.

QuantumScape was worth $54 billion in the stock market shortly after its IPO in 2020. Recently, it was worth about $4 billion.

That hasn’t stopped the company from moving forward with a factory in San Jose that by 2024, if all goes well, will be capable of wiping out hundreds of thousands of cells that can charge cars in less than 10 minutes. Automakers will use the output from the factory to test whether the batteries can withstand rough roads, cold hits, heat waves and car washes.

The automakers will also want to know if the batteries can be recharged hundreds of times without losing their ability to store electricity, if they can survive a crash without catching fire, and if they can be manufactured cheaply.

It is not certain that all new technologies will live up to the promises of their inventors. Shorter charge times and longer range can come at the expense of battery life, said David Deak, a former Tesla executive who is now a battery materials consultant. “Most of these new material concepts bring huge performance metrics, but compromise something else,” said Mr. deak.

Yet QuantumScape, with support from Volkswagen, Bill Gates and a who’s who of Silicon Valley figures, illustrates how much trust and money has gone into companies that claim to be able to meet all those demands.

Mr. Singh, who previously started a telecommunications equipment company, founded QuantumScape in 2010 after purchasing a Roadster, Tesla’s first production vehicle. Despite the Roadster’s notorious unreliability, Mr. Singh believed that electric cars were the future.

“It was enough to get a glimpse of what could be,” he said. The key, he realized, was a battery that can store more energy, and “the only way to do that is to look for a new chemistry, a chemistry breakthrough.”

Mr. Singh worked with Fritz Prinz, a professor at Stanford University, and Tim Holme, a researcher at Stanford. John Doerr, known as one of the early investors in Google and Amazon, provided seed capital. Tesla co-founder JB Straubel was another early supporter and serves on the board of QuantumScape.

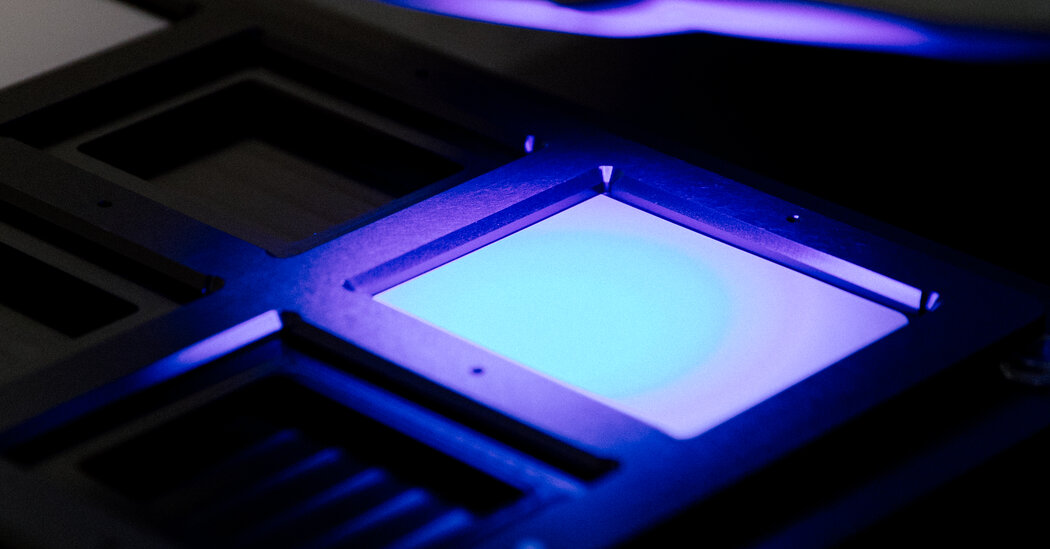

After years of experimentation, QuantumScape developed a ceramic – its exact composition is a secret – that separates the positive and negative ends of the batteries, allowing electrons to flow back and forth while avoiding short circuits. The technology makes it possible to replace the liquid electrolyte that carries energy between the positive and negative terminals of a battery with a solid material, allowing it to hold more energy per pound.

“We spent about the first five years looking for material that might work,” said Mr. Singh. “And after we thought we’d found one, we spent another five years or so working on how to properly manufacture it.”

While technically a “pre-pilot” assembly line, the QuantumScape plant in San Jose is nearly the size of four football fields. Recently, rows of empty booths with black revolving seats waited for new hires and machines on pallets were ready to be installed.

In labs around Silicon Valley and elsewhere, dozens, if not hundreds, of other entrepreneurs have pursued a similar technological goal, leveraging the nexus of venture capital and university research that fueled the growth of the semiconductor and software industries.

Another prominent name is SES AI, founded in 2012 based on technology developed at the Massachusetts Institute of Technology. SES is backed by General Motors, Hyundai, Honda, Chinese automakers Geely and SAIC, and South Korean battery manufacturer SK Innovation. In March, SES, located in Woburn, Massachusetts, opened a factory in Shanghai that produces prototype cells. The company plans to start supplying large volumes to automakers in 2025.

SES shares have also fallen, but Qichao Hu, the chief executive and co-founder, said he was not worried. “That’s a good thing,” he said. “If the market is bad, only the good will survive. It will help the industry reset.”

SES and other battery companies say they have solved the basic scientific hurdles needed to make cells safer, cheaper and more powerful. Now it’s a matter of figuring out how to make them millions.

“We are convinced that the remaining challenges are technical in nature,” said Doug Campbell, chief executive of Solid Power, a battery manufacturer backed by Ford Motor and BMW. Solid Power, based in Louisville, Colorado, said in June it had installed a pilot production line that would begin supplying cells for testing purposes to its automotive partners by the end of the year.

Indirectly, Tesla has spawned many of the Silicon Valley startups. The company trained a generation of battery experts, many of whom left and went to work for other companies.

Gene Berdichevsky, the chief executive and co-founder of Sila in Alameda, California, is a Tesla veteran. Mr. Berdichevsky was born in the Soviet Union and immigrated to the United States with his parents, both nuclear physicists, when he was 9 years old. Roadster battery.

Tesla has effectively created the EV battery industry by proving that people would buy electric vehicles and forcing traditional automakers to consider the technology, Berdichevsky said. “That’s what’s going to make the world electric,” he said, “everyone is fighting to make a better electric car.”

Sila belongs to a group of start-ups that have developed materials that significantly improve the performance of existing battery designs, increasing the range by 20 percent or more. Others include Group14 Technologies in Woodinville, Wash., near Seattle, with support from Porsche, and OneD Battery Sciences in Palo Alto, California.

All three have found ways to use silicon to store electricity in batteries, instead of the graphite common in existing designs. Silicon can hold much more energy per pound than graphite, making batteries lighter, cheaper, and faster to charge. Silicon would also reduce the US’s reliance on graphite refined in China.

The downside to silicon is that it expands three times when charged, potentially putting so much stress on the components that the battery would fail. People like Yimin Zhu, OneD’s chief technology officer, have spent a decade baking various mixtures in labs packed with equipment, looking for ways to solve that problem.

Now Sila, OneD and Group14 are in various stages of ramping up production at Washington state locations.

In May, Sila announced an agreement to supply its silicon material to Mercedes-Benz from a facility in Moses Lake, Wash. Mercedes plans to use the material in luxury SUVs from 2025.

Porsche has announced plans to use Group14’s silicon material by 2024, albeit in a limited number of vehicles. Rick Luebbe, the chief executive of Group14, said a major manufacturer would deploy the company’s technology next year — saying a car can be charged in 10 minutes.

“At that point, all the advantages of electric vehicles are accessible without drawbacks,” said Mr Luebbe.

The demand for batteries is so strong that there is enough room for multiple companies to succeed. But with dozens, if not hundreds, of other companies pursuing a share of a market that will be worth $1 trillion once all new cars are electric, there are bound to be failures.

“With any new transformational industry you start with a lot of players and it gets limited,” said Mr Luebbe. “We’re going to see that here.”