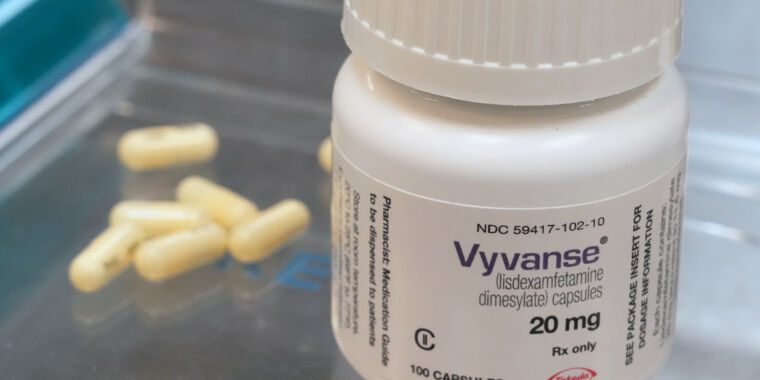

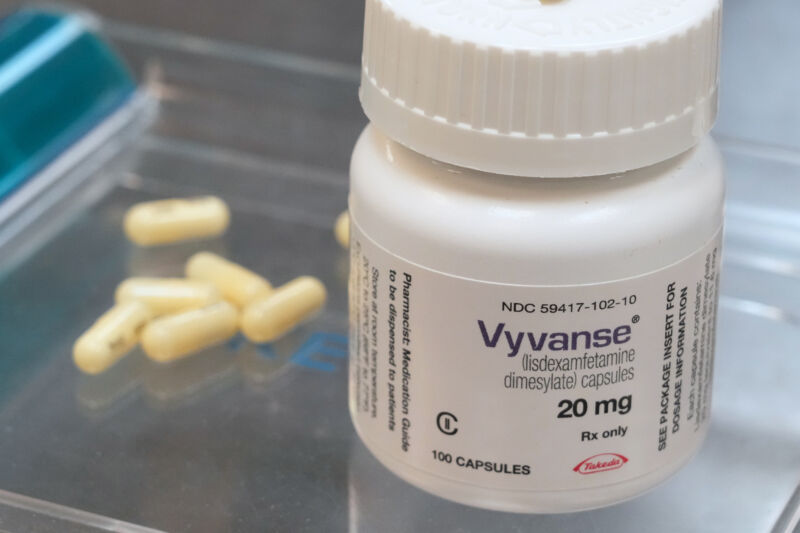

While supplies of Adderall and its generic versions are finally recovering after a years-long shortage, the Drug Enforcement Administration is now working to address the shortage of another drug for attention deficit hyperactivity disorder: Vyvanse (lisdexamfetamine) and its generic versions.

This week, the DEA said it will increase the allowable production amount of lisdexamfetamine by about 23.5 percent, increasing the current quota of 26,500 kilograms by 6,236 kilograms, for a new total of 32,736 kilograms. The DEA also authorized a corresponding increase in d-amphetamine, which is needed to produce lisdexamfetamine.

“These adjustments are necessary to ensure that the United States has an adequate and uninterrupted supply of lisdexamfetamine to meet the legitimate needs of patients, both domestically and internationally,” the DEA said.

Quotas

Like Adderall (amphetamine/dextroamphetamine salts), Vyvanse (lisdexamfetamine) is a stimulant in the amphetamine class that is classified by the DEA as a Schedule II drug. As such, the DEA monitors production levels to ensure that demand is met and to prevent an oversupply that could spill onto the black market. The administration does this by establishing an “aggregate production quota” — which the DEA revised this week for lisdexamfetamine — and handing out undisclosed allotments to drugmakers.

While several factors have contributed to the ADHD drug shortage, some medical and industry groups have blamed the DEA for underestimating demand and stifling supply. The Adderall shortage, for example, began in 2022 after a labor shortage on the product’s production line at Teva, the maker of Adderall. But even as that production problem was resolved, prescribing rates rose significantly, in part because of increased awareness of ADHD, expanded diagnostic criteria and greater access with the rise of telehealth services, which have surged during the COVID-19 pandemic. In a report earlier this year, the American Society of Health-System Pharmacists criticized the DEA’s quotas, saying they were “exacerbating” the shortage.

In a joint letter dated August 2023, the DEA and FDA responded to such criticism, suggesting that quotas are not to blame. Rather, some manufacturers are not using up their allotment of controlled drugs.

“Based on the DEA's internal analysis of inventory, production, and sales data submitted by manufacturers of amphetamine products [which include the two ADHD drugs]“Manufacturers sold only about 70 percent of their allotted quota for the year, and there were about 1 billion extra doses they could have produced but did not make or ship. Data for 2023 so far show a similar trend,” the FDA and DEA wrote.

The FDA and DEA said they would work with manufacturers to ensure they either ramp up production of drugs in short supply or give up their remaining quantities.

Vyvanse shortage

A similarly complicated situation is evident in the current shortage of Vyvanse and its generics. The DEA increased the quota after urging from the Food and Drug Administration. In July, the FDA sent the DEA a letter requesting a quota increase. However, the shortage had already begun in June 2023. At the time, Vyvanse’s maker, Takeda, said a “production slowdown exacerbated by increased demand” had led to low supplies.

In August 2023, the FDA approved multiple generic versions of Vyvanse after Takeda’s patent exclusivity expired, raising hopes that the shortage would ease with the injection of new generic drugs. But supply problems persisted. In November, the Association for Accessible Medicines, which represents generic drugmakers, sent a letter to the DEA saying that generic manufacturers could not obtain enough raw materials to “launch their products at full commercial scale” because quotas were in the way, according to a report by Bloomberg.

FiercePharma noted another potential factor cited by lawmakers and industry watchers. Those observers noted the timing of Takeda’s “production delays” just months before generic drugs hit the market. With the significantly thinner profit margins of generics and off-patent drugs, there’s concern that manufacturers may deprioritize production.

Finally, the DEA noted another factor in the supply chain: exports to foreign markets. While the FDA estimated a 6 percent increase in domestic demand for lisdexamfetamine between 2023 and 2024, the DEA’s export data showed a 34 percent increase in lisdexamfetamine exports between 2022 and 2023, with exports expected to continue to increase this year and beyond. As such, the current 23.5 percent quota increase for lisdexamfetamine is only partially intended for domestic production. In fact, only a quarter of the 6,236 kg is intended for the U.S. Of the increased allocation, 1,558 kg is earmarked for domestic drug production, while the remaining 4,678 kg is targeted to increase foreign demand, the DEA said.