“The Biden administration believes the hype surrounding AI’s transformative potential in military applications is real,” said CSIS’s Allen. “The United States also has a pretty good understanding of what computer chips go into Chinese military AI systems, and they are American, which is considered unacceptable.”

The new export restrictions contribute to the steady deterioration of US-China relations in recent years, despite decades of technological interdependence in which Chinese manufacturing has become the foundation of the US technology industry. In recent years, the US government has sought to take a more active role in boosting its domestic AI industry and chip manufacturing due to an increased sense of competition with China.

Shares in several Chinese tech companies, as well as Nvidia and AMD, fell this week as the size of the restrictions hit investors. The Commerce Department had warned Nvidia and AMD last month that they would have to halt exports of advanced AI chips to China, but rules announced last week are much broader. The new export regulations add to a grueling 18 months for Chinese tech companies following a wide-ranging government crackdown on regulating the industry more tightly after years of freewheeling growth.

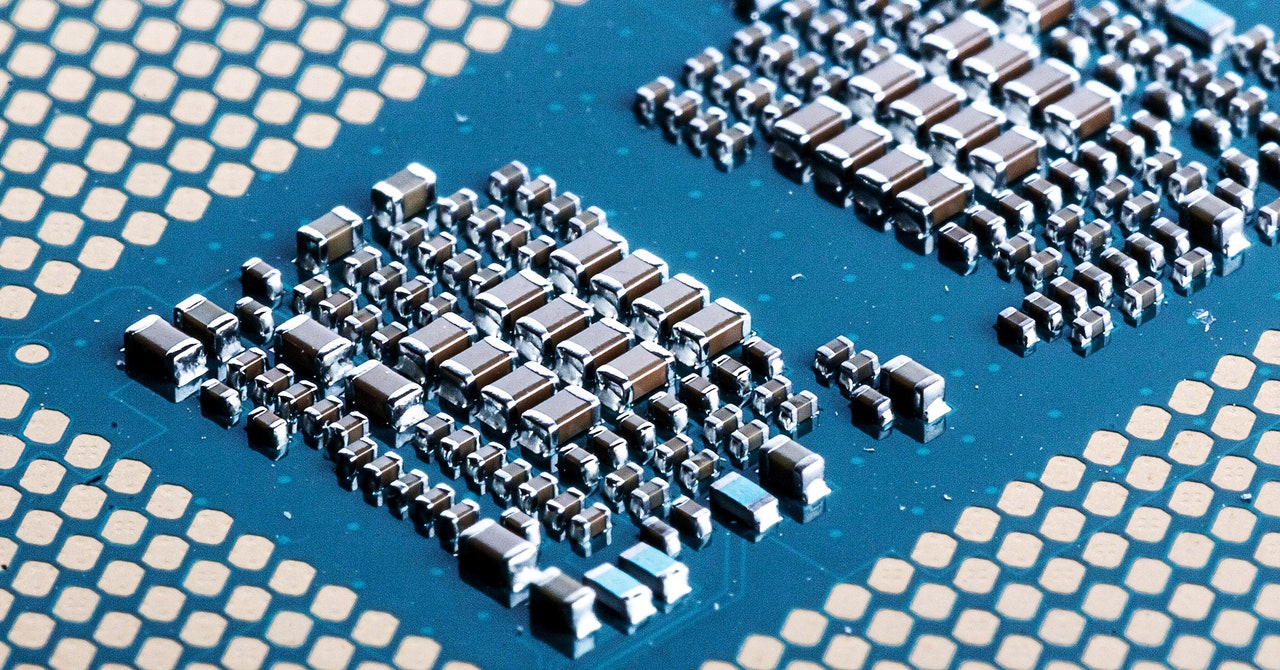

Being cut off from US chips could significantly slow down Chinese AI projects. China’s leading domestic chipmaker, Semiconductor Manufacturing International Corporation (SMIC), produces chips that are several generations behind those of TSMC, Samsung and Intel.

SMIC currently produces chips in what the industry calls the 14-nanometer generation of chip manufacturing processes, a reference to how tightly components can be packed on a chip. TSMC and Samsung, meanwhile, have moved to more advanced 5 nanometer and 3 nanometer processes. SMIC recently claimed that it can produce 7 nanometer chips, albeit at a low volume.

A Chinese company’s ability to keep up with advances in chip manufacturing is limited by the lack of access to the extreme ultraviolet lithography machines needed to make chips with components smaller than the 7-nanometer generation. The only manufacturer, ASML in the Netherlands, has blocked exports to China at the request of the US government.

David Kanter, executive director of MLCommons, a nonprofit that benchmarks the performance of AI chips, says that one of the 5 nanometer generation of semiconductor technology is about three times faster or more efficient than a 14 nanometer due to greater density of transistors and other design improvements. .

However, the move won’t shut down China’s AI industry overnight. Speaking anonymously due to the sensitive nature of the subject, a person at a Chinese venture capital fund specializing in AI says some Chinese companies have stockpiled GPU components since parts of the rule change were announced in September. It may also be possible for companies to train AI models outside of China using equipment installed elsewhere.

The CEO of a Chinese AI startup, who also spoke on condition of anonymity, said the new restrictions would slow AI progress at Chinese companies in the long term, but predicted they could keep up with the US in the short term by getting older. to become. hardware lasts longer, make AI models that can do more with the same computing power, or collect more data. “If the goal is to achieve certain accuracy, the amount of data can be more useful than computing power,” the CEO says. “For most AI tasks, training AI models doesn’t always require tremendous power.”

The key question now is how the rules are enforced, said Douglas Fuller, an associate professor at Copenhagen Business School who studies China’s technology industry. “In the short term, I think this will do what it plans to do: undermine China’s high-performance computing efforts,” he says. But Fuller says China will look to other countries that have expertise in chip manufacturing and may try to smuggle components in.