Google let a few senior executives leave this week. The first was Bill Ready, Google’s “President of Commerce, Payments & Next Billion Users,” who left to become CEO of Pinterest. The second major departure is Javier Soltero, who was vice president and GM of Google Workspace, Google’s paid business app, and the leader of Google Messaging. Both executives have made major changes to Google in their nearly three-year tenure at the company. Now that they’re leaving, it’s unclear what the future holds for their respective products.

Ready had only been with Google for two and a half years, where his most notable move presided over the disastrous rollout of a major Google Pay overhaul. The new Google Pay app was led by Ready’s payments team, led by another recently ousted executive, Caesar Sengupta. The Google Pay overhaul brought an app originally developed for India to the US, where the requirement for phone number-based identity came with a huge list of downgrades: the Google Pay website had to be stripped of payment functionality, the app didn’t support longer multiple accounts, and you couldn’t be logged in on multiple devices.

The rollout of the new app was also clumsy. Slowly, over a month or two, users were kicked out of the old Google Pay and had to move to a new app. However, the new identity system was not backwards compatible with the old Google Pay, meaning users still in the old app couldn’t send money to users in the new app.

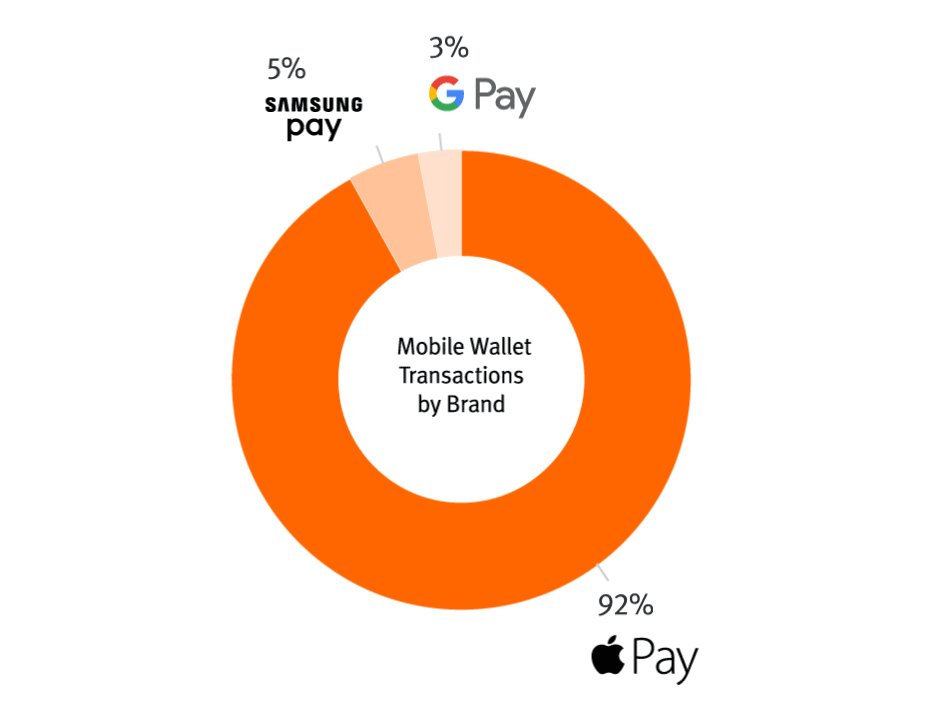

According to the Pulse network (a wing of the Discover card), Google Pay controls 3 percent of the entire US NFC market. Keep in mind that Google entered this market years before Apple.

The new Google Pay was announced a year after Ready’s tenure at Google and launched in March 2021. The app initially came with major expansion plans, including a wild announcement of Google-branded bank accounts. Sengupta left Google a month after the US launch of the new Google Pay, triggering an “exodus” of employees, according to Insider. The report said “Dozens of employees and executives” left the payments team after Sengupta’s departure, with one employee saying there was “frustration” that the new Google Pay “wasn’t growing at the pace we wanted”.

What happened next appears to be a complete abandonment of the original “New Google Pay” game plan. Google generally launches a product in the US first and then slowly rolls it out to the rest of the world, but after the initial poor reception, the new Google Pay never saw a wide rollout outside the US. Google canceled its heavily promoted plans for a Google bank account, even though the company had already signed up to 400,000 curious users on the public waiting list, according to the Wall Street Journal.

Ready named a new Payments leader in January, a move Bloomberg described as a “reset” of Google’s payments strategy. Ready also made headlines at the time, saying, “Crypto is something we pay a lot of attention to,” although no Google product has emerged.

Four months later, at Google I/O 2022, another Google Pay revamp was announced, renaming the product to “Google Wallet”. That’s right, after a major revamp of the Google payments app in 2021, there’s now another revamp in 2022. Ready is now leaving five months after appointing a new Payments lead and kicking those plans in motion, but he won’t be there for the launch of Google Wallet. Between the departures of longtime Payments leader Sengupta, Sengupta’s boss Ready, and “dozens” of team members, it seems the payments team has finally cleaned the house.

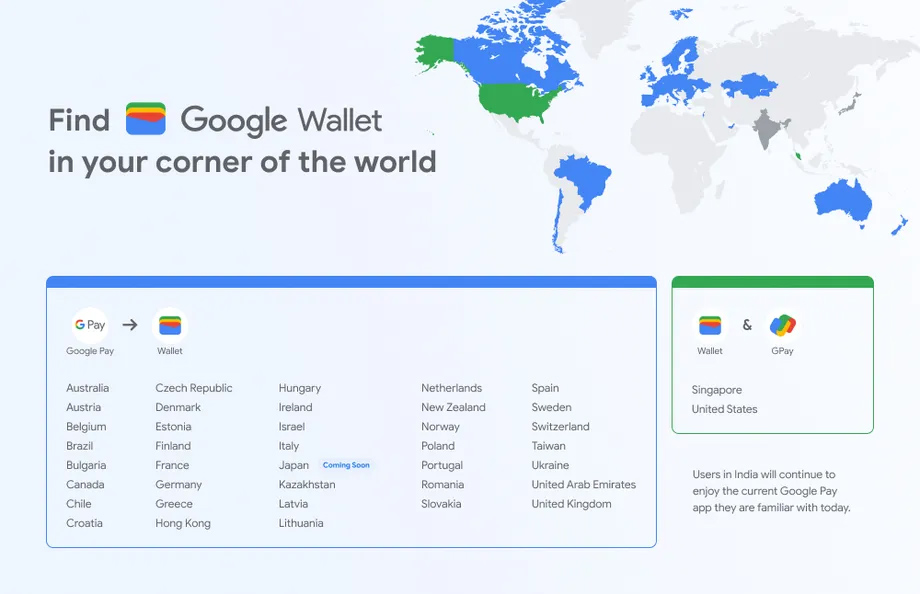

This nightmare of a card has the US with Google Pay and Google Wallet side by side, while the rest of the world gets a cleaner solution from one payment app: Wallet.

At the heart of Google’s payment turbulence is probably the fact that Google Pay is by most estimates at 3-4 percent of the US NFC payments market, which is way behind Apple’s nearly 92 percent market share. It’s an embarrassing loss, given that Google pioneered NFC payments, entering the market three years before Apple.

A big part of Google’s payment woes is this kind of instability, with Google’s payment app running through four different brands in a decade (Google Wallet, then Android Pay, then Google Pay, now Google Wallet again). It still doesn’t look like the company has come up with a great solution with the new Google Wallet. The current plan, which may change once Ready’s replacement is hired, is for Google Wallet and Google Pay to… coexist in the U.S. In the rest of the world there will be one payment app, Wallet, which sounds like a clean, reasonable offering. However, in the US and Singapore, Google doesn’t want to destroy the widespread new Google Pay app, so Google Wallet and Google Pay will be available. Why? If Wallet is rolling out to the rest of the world, the codebase will obviously have the full set of payment features, why not just roll it out everywhere?

Google is still looking for a VP to replace Bill Ready, but the interim president of Payments will be longtime Googler Nick Fox. Fox was earlier front and center in Google’s tech landscape as head of Google Messaging when the company produced Google Allo. Allo was Google’s main messaging app from 2016-2018 and stayed on the market for about 576 days. Fox has been running Google Search since Allo.