Fidelity Investments CEO Abigail Johnson said the cryptocurrency market is “technically oversold” and $40,000 in bitcoin could be a crucial fulcrum for prices.

The “cointelegraph price analysis” is a news article that discusses the Bitcoin market. The article states that Fidelity exec says Bitcoin is “technically oversold”, making $40K a “critical support”.

The price of Bitcoin (BTC) dropped below $40,000 for the first time since September 2021 after a painful correction in the market earlier this week.

Many observers expected the price to continue falling towards the $30,000 to $35,000 level, but on Wednesday, BTC made a sudden jump above $44,000, claiming $40,000 as support. This fueled optimism that Bitcoin could top out at around $40,000 before resuming its uptrend in 2022.

Jurrien Timmer, director of global macro at Fidelity Investments, called $40,000 a “critical support,” stating that Bitcoin is “technically oversold” near the level, which could result in a near-term comeback.

BTC/USD price chart for the day. TradeView as source

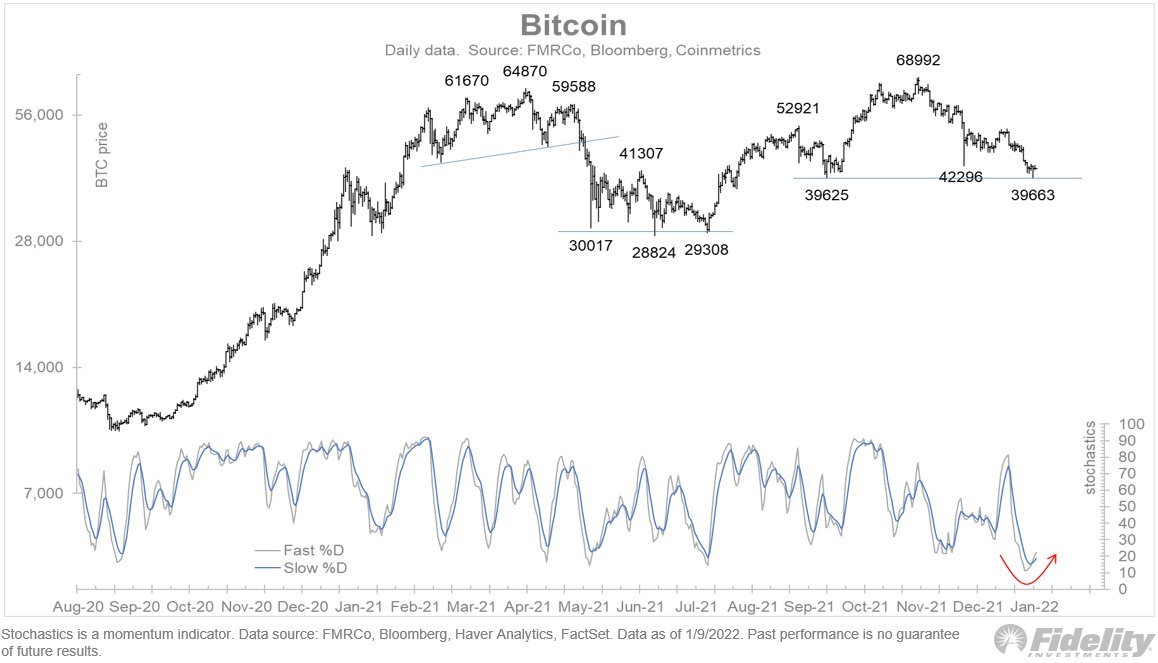

Three factors – a stochastic RSI, the so-called S-curve model, and a Bitcoin to gold ratio meter – were at the heart of Timmer’s positive forecast.

The stochastic RSI for Bitcoin has clearly risen.

The Stochastic RSI, in more detail, is a momentum indicator that evaluates an asset’s closing price in relation to its high-low range over a specified time frame. The indicator fluctuates between zero and one hundred, with the region above 80 indicating “overbought” situations and the area below 20 indicating “oversold” situations.

By tracking the correlation between the percentage K of the high-low range and the moving average of the high-low range, the indicator helps traders identify trend reversals (percentage D). Therefore, if the percentage K wave crosses the percentage D wave from below in the oversold area, the market gives a buy signal.

The same is true if the percent K line crosses the percent D line from above in the overbought area, returning a sell signal.

Timmer notes that Bitcoin’s percentage of K wave has been above the percentage D wave, indicating a buying trend as the price has maintained support above $40,000.

BTC/USD price chart showing the stochastic RSI values and the most recent pivot at support. Origin: Loyalty

On Wednesday, Timmer tweeted that “just like $30,000, the $40,000 level appears to be a critical support region” and that “Bitcoin has crossed the line at around $40,000 and is now technically oversold.”

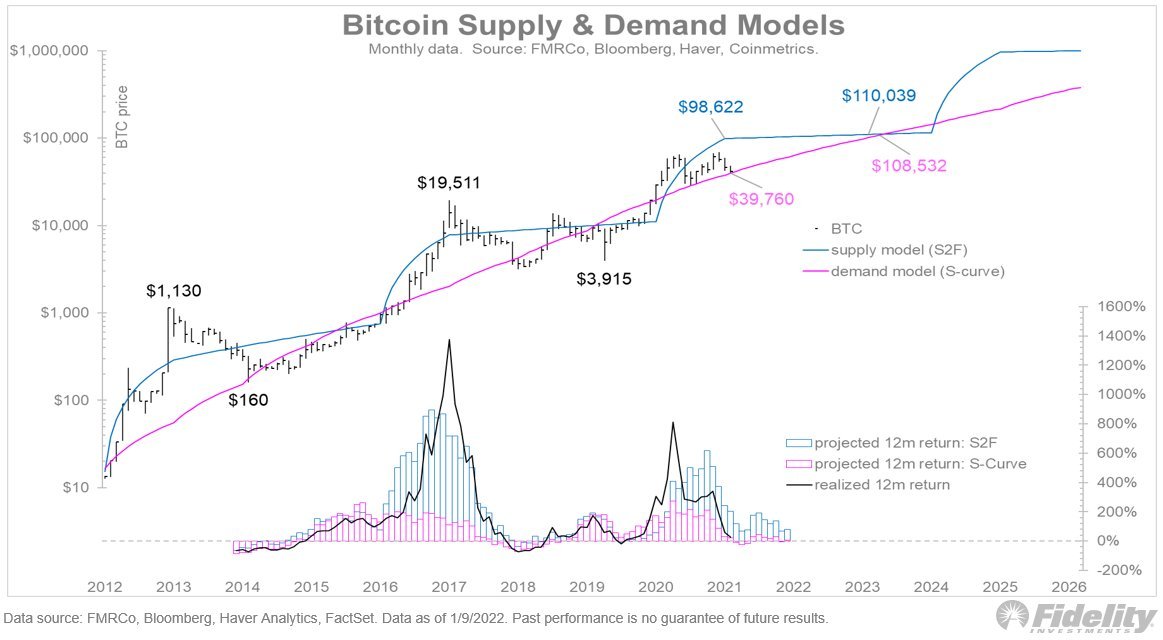

The S-curve pricing model is used.

Timmer also discovered a “demand curve” that has been instrumental in predicting the conclusion of Bitcoin’s negative cycles since 2012, as evidenced by the pin wave in the chart below.

Demand and supply models for bitcoin. Origin: Loyalty

The curve has served as the same support around $40,000 since the BTC price movement bounced back from $30,000 between April and June 2021, increasing the likelihood that the next BTC recovery will reach levels near $100,000.

Related: JPMorgan Survey: Wall Street Remains Uncertain About $100K Bitcoin This Year

According to my demand model (S-curve model), the $30,000 level provided support in 2021, Timmer noted, adding:

“Looks like the same level has moved up to $40,000 and is once again providing vital support. It’s a moving target that often acts as the fundamental anchor of price.”

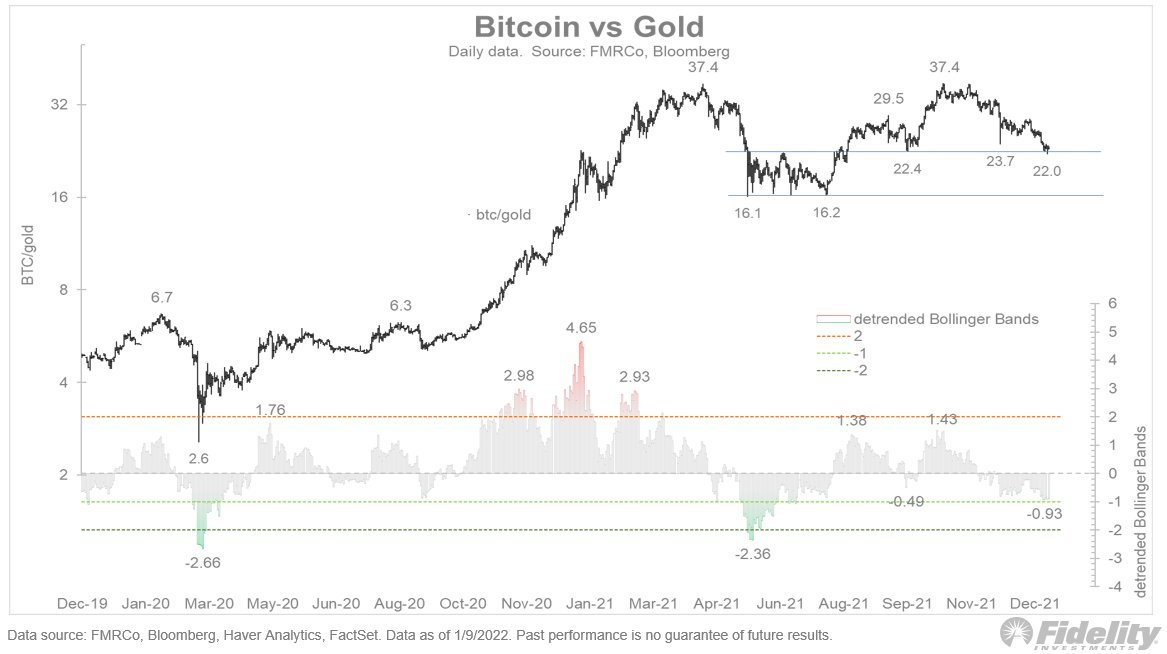

Bitcoin is oversold, according to the BTC/Gold ratio.

In terms of price performance against gold, bitcoin also appears oversold, but “moderate”. The so-called Bitcoin to Gold ratio, as Timmer noted, has fallen to support at 22 after peaking twice at 37.4 in 2021.

Gold against Bitcoin Fidelity, Bloomberg and FMRCo as sources

The decline also caused the ratio’s Bollinger Bands to move into oversold territory, a traditional buy signal that suggests money could start to shift from the gold market to the Bitcoin market.

Overall, these charts suggest Bitcoin should have support near $40k at both technical and fundamental levels. While it still looks like $40k is the new $30k, that doesn’t mean it can’t get much lower. /END

By Jurrien Timmer on January 11, 2022 (@TimmerFidelity).

The forecast was in line with Bloomberg Intelligence’s most recent cryptocurrency forecast. The research, written by Mike McGlone, their senior commodity strategist, uncovered the capital movement from the gold market to the Bitcoin sector. McGlone also said the trend will continue, especially in light of the US Federal Reserve’s lax monetary policy, which has fueled inflation for nearly four decades.

“We expect bitcoin to rise faster, but gold is likely to rise to $2,000 an ounce by 2022,” McGlone said.

Only the thoughts and opinions of the author, not necessarily those of Cointelegraph.com, are reflected in this article. Every investment and trading action has risks, so before making a choice, do your own study.

The “fidelity crypto report” is a document published by Fidelity Investments stating that Bitcoin is “technically oversold”, making $40K a “critical support”. The paper also discusses the potential for cryptocurrencies to replace fiat currencies in the future.

Related Tags

- faithfully accumulate bitcoin

- bitcoin options expire today

- when does crypto hit bottom?

- has bitcoin hit bottom

- bitcoin q4 predictions