With the recent bull run, Bitcoin mining is back in full swing and many are looking to take advantage of this opportunity. With the market hitting new highs and volatility easing, here are five things to watch out for this week.

“coins to watch this week” is a weekly column that covers the best cryptocurrencies and their latest news. This week Bitcoin is on the rise and many people are wondering what is going on.

Bitcoin (BTC) has had an odd start this week, strikingly similar to where it was around this time last year.

BTC/USD is around $42,000, pretty much exactly where it was in week two of January 2021, after what several sources have called a full year of “consolidation.”

While there have been huge ups and downs in between, Bitcoin has generally stayed within a range that is now known.

The future differs according to one’s point of view; some think new record highs are more than likely to be reached this year, while others predict many more months of consolidation.

Cointelegraph examines what could be shifting the status quo on shorter timelines in the coming days, with crypto sentiment at some of its lowest levels in history.

Will $40,700 be enough to keep you afloat?

Bitcoin had a tough weekend as the latest in a series of sharp negative swings brought it closer to the $40,000 support level.

According to data from Cointelegraph Markets Pro and TradingView, BTC/USD approached $40,700 on key exchanges before recovering, and the correction has held up ever since.

Ironically, the same level was scrutinized on the same day in 2021, but during what turned out to be the most vertical part of Bitcoin’s current bull run.

Last September, focus shifted back to $40,700, marking a turning point after many weeks of correction, allowing BTC/USD to climb to a record high of $69,000.

Analysts now believe that the possibilities of a collapse to the $30,000 level are undoubtedly greater.

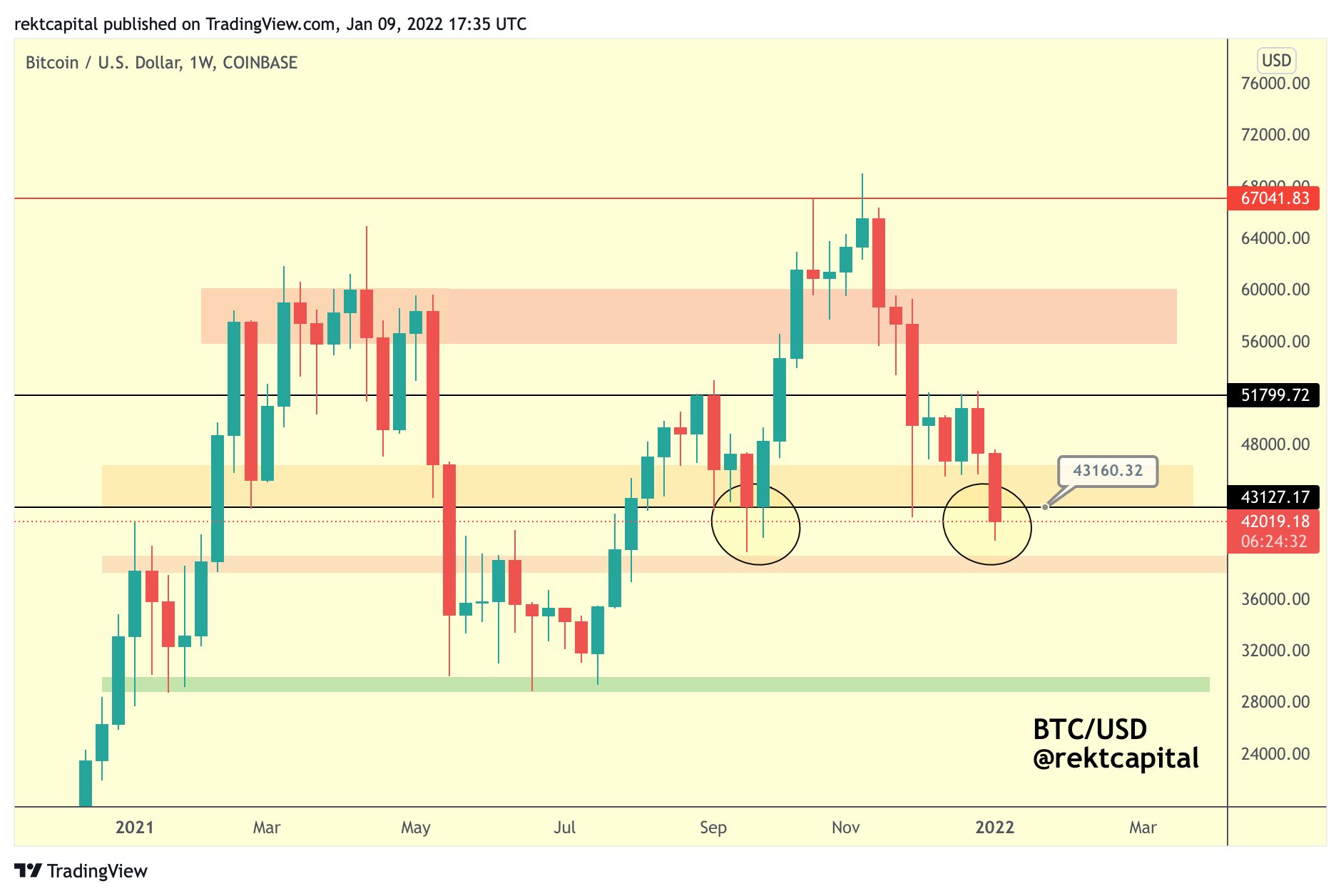

Rekt Capital stated “Weekly Close is just around the corner” accompanied by a target levels image.

“Theoretically, there is a chance that $BTC could execute a Weekly Close above ~$43200 (black) to enjoy a green week next week. However, Weekly Close is below ~$43200 and BTC could revisit the red area below.

BTC/USD Annotated Candlestick Chart. Source: Rekt Capital/ Twitter

Bitcoin eventually ended up around $42,000 and has been hovering around that level ever since in what could be a brief hiatus for bulls.

“I expect the market to hit a lower high,” said another trader and analyst Pentoshi, adding that he believes the price of $40,700 will eventually fall.

Meanwhile, last summer’s $30,000 floor is becoming a more attractive target.

A consensus is forming on the bleak forecast for cash.

The macro picture for risky assets this week is exceptionally tough, and Bitcoin and altcoins are no exception.

What the future holds, however, varies widely from expert to expert.

The United States Federal Reserve is widely expected to begin rising interest rates in the coming months, reducing investors’ risk and giving crypto bulls a headache. Easy money, which started flowing in March 2020, will be significantly harder to come by today.

Arthur Hayes, the ex-CEO of BitMEX, summed up the pessimistic attitude well in his most recent blog post last week.

“Forget what non-crypto investors say; my take on the mindset of crypto investors is that they foolishly assume that the entire network and the basics of user growth would allow crypto assets to continue their upward trajectory uninterrupted,” he said.

“This, in my view, is the basis for a major washout as the corrosive impact of rising interest rates on future cash flows is likely to cause speculators and fringe investors to dump or drastically reduce their crypto holdings.”

Consumer Price Index (CPI) statistics for December will be released this week, likely adding to the theme of unexpected inflation spikes.

Hayes is far from alone in his concerns about what the Fed can do with crypto this year, with Pentoshi and others asking for a temporary halt to the rally.

“And, finally, can crypto ignore the Fed if it chooses to pull out all the stops with a deflationary machete?” In a series of tweets on the subject over the weekend, expert Alex Krueger concluded, “I doubt it.”

“’Don’t fight the Fed’ applies both in the food chain and throughout the food chain. Houston, we have a problem if the Fed is *too aggressive*.”

There were a few more optimists in the room. The founder and CEO of 10T Holdings, Dan Tapiero, advised followers to “ignore” the current sell-off and focus on a long-term investment opportunity that hasn’t changed.

He described the macro background as “the most positive in 75 years”.

“The economy is booming, thanks to high negative real interest rates.” The Fed will never align interest rates with inflation. Stocks, Bitcoin and Ethereum are all good investments. Hodl in light of short-term volatility. Cash savings in real dollars will continue to decline.”

This is what the effective Fed Funds Rate and inflation rates were when the unemployment rate was 3.9 percent, and that’s where it is now.

Identify the anomaly… pic.twitter.com/zU1zRj1uXC

January 7, 2022 — Charlie Bilello (@charliebilello)

Charlie Bilello, the founder and CEO of Compound Capital Advisors, compiled statistics that Tapiero highlighted.

The RSI has fallen to its lowest level in two years.

Despite the doom and gloom, not everything points to a prolonged negative period for Bitcoin.

As Cointelegraph has reported, on-chain signs overwhelmingly point to the bright side, and the historical context supports those claims.

Bitcoin’s relative strength index (RSI) has fallen further this week, reaching its lowest level in two years.

Only twice in the past two years has the #Bitcoin RSI been this low. It looks like a bottom is approaching and a rebound is imminent. Let’s take a look at the image. twitter.com/qhQ1pD8yEl

January 9, 2022 — Bitcoin Archive (@BTC Archive)

The Relative Strength Index (RSI) is a popular metric for determining whether an asset is “overbought” or “oversold” at a particular price point.

Exploring the depths at $42,000 implies that the market sees this level as too excessive and a comeback is needed to rebalance it.

On the other hand, the RSI was sky high and well in overbought last January, but BTC/USD was trading at the same price.

“The Bitcoin RSI is daily at its lowest point in 2 years. March 2020 & May 2021 were the last. And people are getting bearish / wanting short here,” said a hopeful CoinTelegraph contributor Michaël van de Poppe.

BTC/USD 1 Day Candlestick Chart with RSI (Bitstamp). TradingView is the source of this information.

Last week, Cointelegraph saw similar positive signs on the monthly RSI chart.

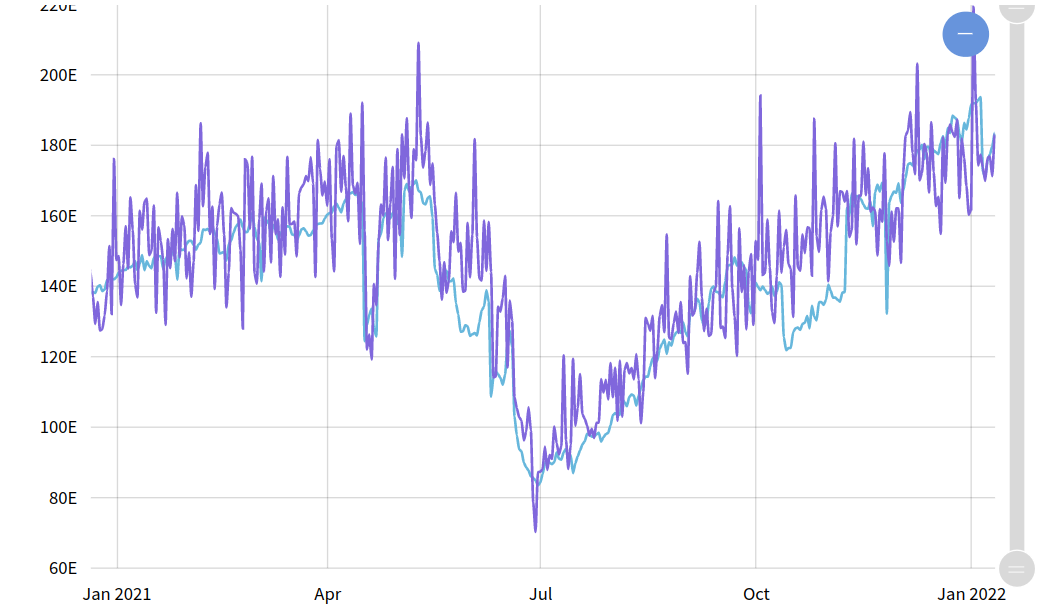

The hash rate has been restored. Kazakhstan has faced setbacks.

On the Bitcoin fundamentals front, another hiccup from last week is already “healing itself”.

After hitting new all-time highs in recent weeks, Bitcoin’s network hash rate took a backlash as internet connectivity in Kazakhstan was disrupted by turbulence.

Kazakhstan, which accounts for about 18% of the hash rate, has recently stabilized, returning the hash rate to its previous level of 192 exahashes per second (EH/s).

Reactions to what made some think of China’s mining restriction last May, which lowered the hash rate to 171 EH/s, appear to have increased the hash rate and maintained the record-breaking participation of miners.

Despite the turmoil, Bitcoin’s network difficulty has risen slightly this weekend and is on track to do so again at the next scheduled adjustment in just under two weeks.

Screenshot of a live Bitcoin hash rate chart. MiningPoolStats is the source for this information.

On-chain analyst Dylan LeClair said of the old adage that “price follows the hash rate,” “it goes up forever.”

In comparison, the mining ban in China resulted in a 50% drop in hash rate. The losses were recovered in about six months.

“What if…?” says the narrator.

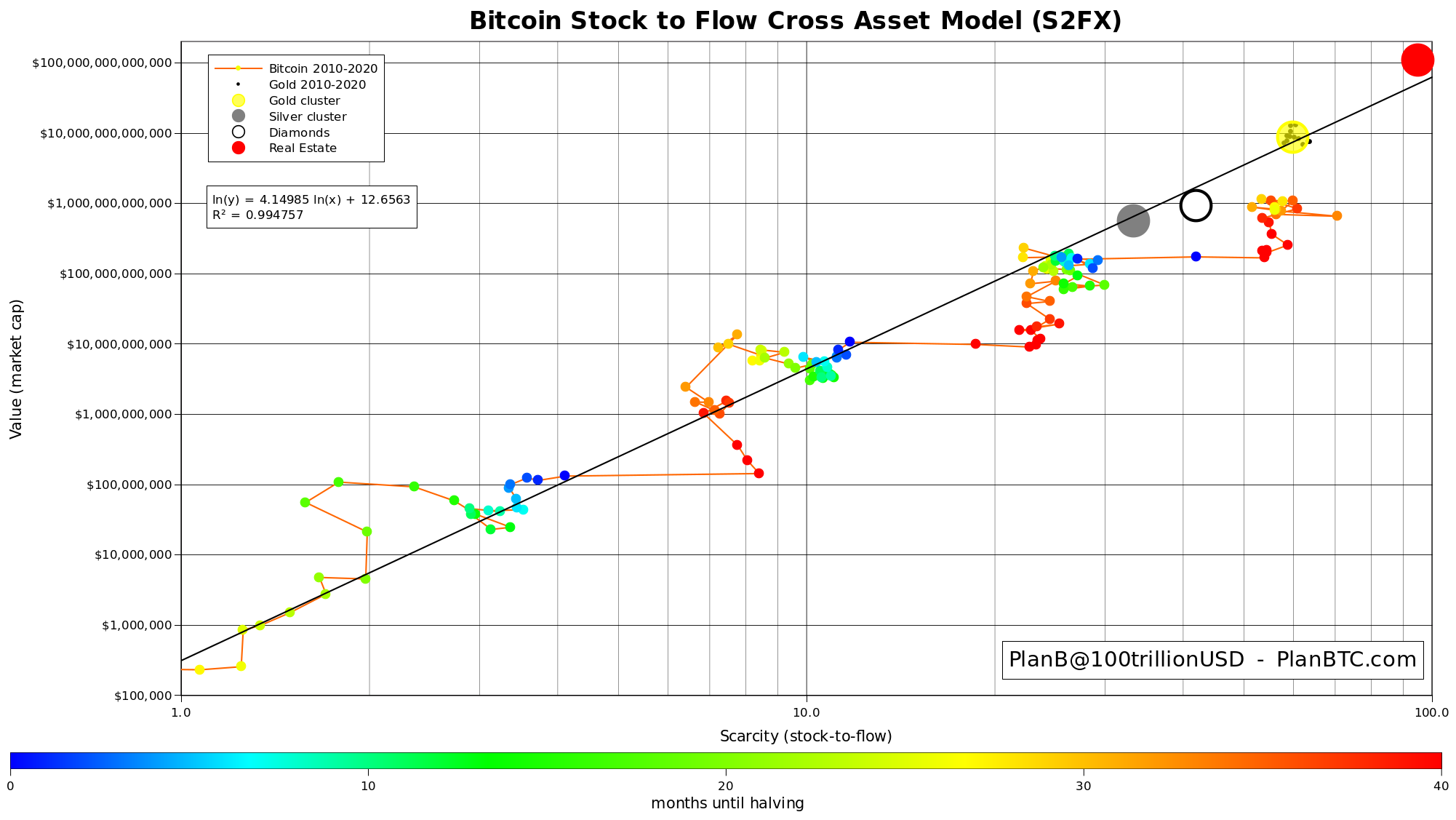

Quant analyst PlanB, author of the stock-to-flow-based BTC price models, has been predicting a reversal of the Bitcoin trend for some time now.

BTC, LINK, ICP, LEO and ONE are the top 5 cryptocurrencies to watch this week.

Despite his ideas being put to the test — and the ensuing storm of social media criticism — PlanB is more confident than most about mid- to long-term price action.

This weekend he said, “I realize that some people have lost faith in this bitcoin bull market.”

“However, we are only halfway through the cycle (2020-2024). And while BTC is experiencing some turbulence at $1T, the yellow gold cluster at S2F60/$10T (tiny black dots are gold data for 2009-2021) is still the target IMO.

Stock-to-flow cross-asset (S2FX) chart. Source: PlanB/Twitter

He referenced the stock-to-flow value for Bitcoin, gold and other assets in his stock-to-flow cross-asset (S2FX) model, which predicts a BTC/USD price of $288,000 during the current halving cycle.

Closer to home, a simpler comparison of Bitcoin’s current cycle with its two previous cycles revealed a possible path starting today with a U-turn.

So, what if… pic.twitter.com/te36HkFAbQ

— January 9, 2022 (@100 trillion USD)

After failing to meet its target for the first time in November, another model, the floor model, which charged $135,000 per bitcoin in late December, has now been abandoned.

The “bitcoin roadmap 2022” is a prediction that the Bitcoin price will reach $20,000 in 2022. There are 5 things to watch in Bitcoin this week.

Related Tags

- top 5 cryptocurrencies to watch this week

- could bitcoin crash?

- coin telegraph top-5

- bitcoin cross

- bitcoin news this week