Political pressure is set up on a plan of a conglomerate from Hong Kong to sell his Panama ports to BlackRock, the American investor, who raises questions about the future of the $ 19 billion deal.

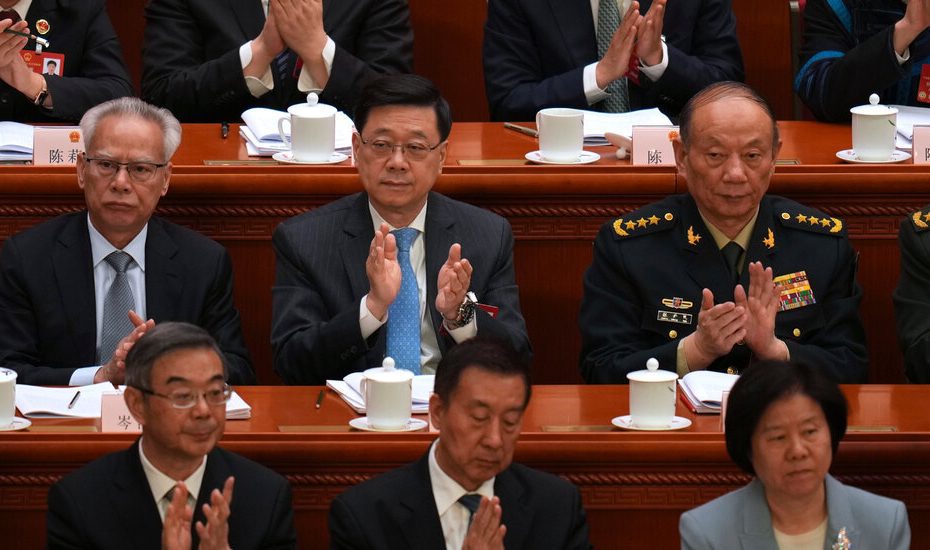

John Lee, the leader of Hong Kong, added his voice on Tuesday to escalate warnings from China and said that the transaction deserved 'serious attention'.

The Deal Between CK Hutchison, One of Hong Kong's Most Successful Conglomerates, and BlackRock, The World's Biggest Asset Manager, was Seen Investors As A Solution to a Geopolitical Hot Potato That With A Claim Thatton Map Thatton Thatton Bey Thatton Thatton Bey Thatton Thatton Ports on Either end of the Panama Canal was an issue of national security because it was “Operated by China.” Mr. Trump praised the BlackRock deal after it was announced.

Now that solution is starting to look more like a problem. Shares in CK Hutchison, which is controlled by one of the richest people in Hong Kong, Li Ka-Shing, on Tuesday almost 3 percent fell after Mr Lee's comments. The company has canceled press and investor briefings that were planned for this week when it releases its last financial report. Hutchison did not respond to requests for comment.

China has criticized the planned harbor deal, which would lead to CK Hutchison sell most of its Hutchison port companies, including the Panama ports and more than 40 other global ports. A series of comments published in Ta Kung Pao, a newspaper in Hong Kong that is owned by the government of Hong Kong and the Communist Party, argued that the regulation of Hutchison-Blackrock would enable the United States to be used for political purposes and its own political agenda “, in turn” that Chinese “subdivision”, “that Chinese” Substitution “,” that Chinese “State” that is that that Chinese “.

On Tuesday, Mr. Lee Van Hong Kong said that “every transaction must meet the legal and regulatory requirements.” Speaking at a weekly press conference, he said that the government would “deal with the law and the regulations.”

He did not work out, but legal experts said that, historically, mergers or acquisitions of Hong Kong companies and foreign entrepreneurs do not have to seek the kind of regulatory approval that Mr Lee may refer to.

It is not clear what the authorities of Hong Kong could do to stop the deal. Chinese companies, on the other hand, often need permission from the Ministry of Commerce, the state administration of currency and other supervisors to sell assets or to relocate money from mainland China.

But the warnings have expressed concern for some in the financial community about the politicization of business in Hong Kong, a former British colony that was returned to Beijing in 1997 under the promise that it would work with “a high degree of autonomy”. This promise changed in 2020 when Beijing imposed a national security law on the city to destroy protests of pro-democracy.

Although Mr Lee's government has repeatedly emphasized that Hong Kong remains an open space to do business and a global financial hub with laws apart from the rest of China, some critics have pointed out that its government is under pressure from Beijing.

But in the midst of the rising hostility between the United States and China, and the global uncertainty caused by President Trump's trade policy, making Hong Kong's trade is more politized.

The deal between CK Hutichison and BlackRock can no longer be seen as a purely commercial nature, “said Wang Xiangwei, assistant professor of journalism at Hong Kong Baptist University.

“Let's do a reverse and say that BlackRock announced that it would sell his ports to Cheung Kong in Hong Kong,” said Mr. Wang, referring to the former name of CK Hutchison. “I would imagine that Trump would write angry tweets about the truth that the deal sentenced,” he added. “In the congress I am sure that legislators would make noises and also start a conference investigation into this deal.”

On Tuesday, Mr. Lee also added Beijing's criticism about the rates of the Trump administration and said that Hong Kong's government encouraged other countries to offer a level playing field for companies. With the help of a similar language such as the Chinese government in its own statements on this subject, he added: “We opposed the abuse of coercion or bullying tactics in international economic and trade relationships.”