The stock markets fell further on Monday when investors around the world were concerned about the health of the US economy and companies that are braced for the destabilizing effects of rates on global trade.

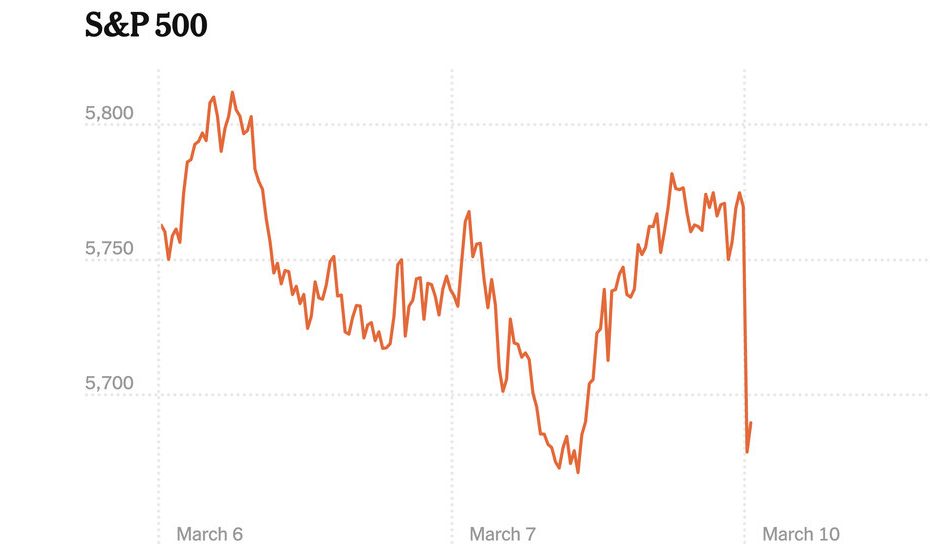

The S&P 500 fell 1.5 percent at the start of the trade on Wall Street, which contributed to last week's losses, which were the steepest in several months. After three consecutive weeks of selling, the index is now about 7 percent under a record set last month, with a “correction”, a Wall Street term for a significant decrease in a recent high.

The technically heavy Nasdaq has been particularly hard. It fell in a correction last week and fell another 2 percent on Monday. Tesla's shares fell by more than 5 percent, Alphabet lost 4 percent and Nvidia fell more than 2 percent.

Stocks in Europe and Asia also came under pressure. An index that followed the largest public companies of the eurozone, which reached a record high last week, fell by 0.9 percent. The Hang Seng index of Hong Kong fell by more than 1.8 percent.

Investors looking for ports continued to opt for the relative safety of bonds and pushed the 10-year-old US Treasury yield to 4.24 percent. (Bond prices are reversed to the yield.) The combination of falling shares and falling interest rates is often seen as a sign of economic unrest.

In a Fox News interview that was broadcast on Sunday, President Trump refused to exclude the possibility that his policy would cause a recession.

In recent weeks, Mr. Trump has threatened, imposed, suspended and resumed rates for the largest trading partners in America: Canada, Mexico and China. The dizzying shifts, including last-minute exemptions for some car manufacturers and energy products, have led to increased uncertainty, nerve-racking investors.

“Market volatility is much less about the bad news of rates and much more about the uncertainty of rates, especially uncertainty about what the policy is, where it goes, how long it will take and what the end result will be,” said David Bahnsen, the Chief Investment Officer at the Bahnsen Group.

According to most measures, the US economy is still solid, with the latest data on retaining retention. But economists have become more gloomy when they get a grip on Mr Trump's Wistory approach that companies have Hamstrung who try to plan investments and recruitments. Cutbacks on the federal workforce and freezing government spending also have a dented consumer sentiment.

Analysts at JPMorgan Chase said in a report that this year there was a 'equipment higher risk' for a worldwide recession due to 'extreme American policy'. They set the chance of such a decline at 40 percent. Strategen at Goldman Sachs increased the chances of an American recession in the coming year to 20 percent, with reference to 'policy changes as the most important risk'.

On Monday, retribution rates from China came into force on American agricultural products. On Wednesday, the Trump administration will set up a rate of 25 percent for all steel and aluminum imports. Mr. Trump has also threatened to impose “mutual rates” on all American imports to match the rates and trade policy of other countries next month.