An analysis of trading data from the past week reveals that traders had slowly regained confidence and returned to the market as Bitcoin’s price hit recent lows. However, it is likely that this rally cannot be sustained for long with a global sense of regulatory uncertainty in many countries.

The “crypto-currencies” is a term that refers to cryptocurrencies, such as Bitcoin. The $110 Billion Crypto Inflow as Bitcoin Reclaims $30K.

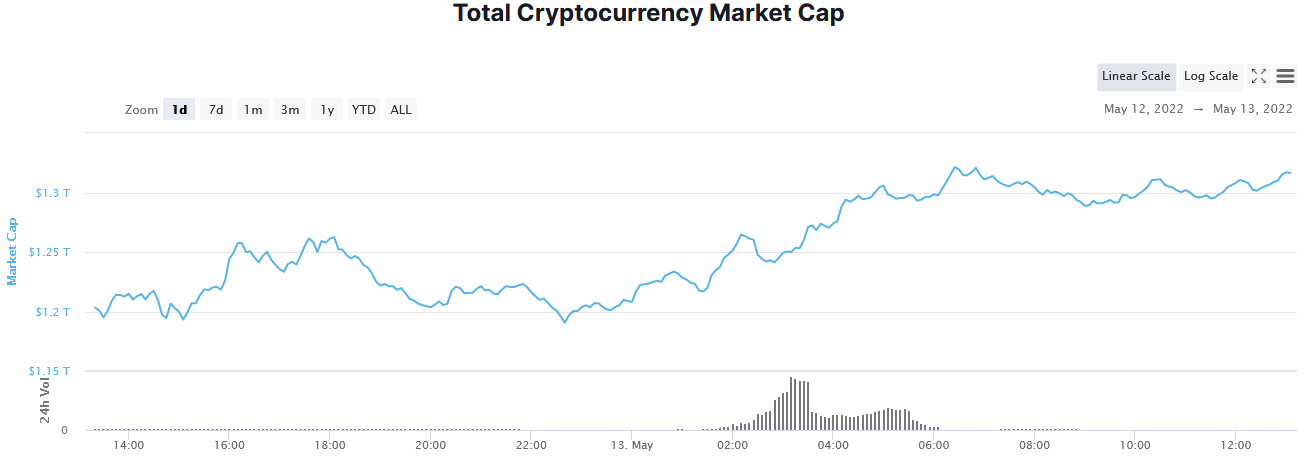

With $113 billion in cash pouring back into total crypto market value in the past 24 hours, the work week is likely to end on a positive note.

Capital inflows boost altcoins.

Volume surged around 02:00 (GMT) on May 13 and peaked at around 10:00 AM, according to the market cap analysis. Despite the fact that the volume has declined since then, the influx has continued to rise, indicating fatigue.

CoinMarketCap.com (source)

YouTuber Lark Davies noted that certain cryptocurrencies had gained 70% during this rally, bringing in some much-needed good emotion.

Here’s a big jump! Some altcoins jump between 20% and 70%!!!! #crypto

May 13, 2022 — Lark Davis (@TheCryptoLark)

Gala, STEPN and Kadena were among the top 100 in the past 24 hours with gains of 57 percent, 57 percent and 47 percent, respectively. Meanwhile, Bitcoin, the market leader, gained 8% on the day, claiming $30,000. BTC is now sitting at $30,600, which is pretty close to that level.

Over the next two days, Bitcoin dominance rose dramatically from 41.6 percent to 45.2 percent (a six-month high). However, investors have returned to cryptocurrencies, resulting in a dip to 44.5 percent at the time of writing.

BTC.D source from TradingView.com

What is the future of cryptocurrencies?

The upswing provided a much-needed respite from the hard sell-off caused by events in the Terra environment. Despite this, the entire crypto market value is still 20% lower than on a weekly basis and 55% from its peak in November 2021.

The story evolved from uncertainty in the current market cycle to a bear market as events unfolded. Few economists believe the latest sell-off is just a hiccup in the bull market.

On the contrary, there is a more solemn and protective tone. Will Clemente predicts more suffering for Bitcoin, forecasting a $20k low-mid price range.

“The bottom is most likely around $20K, consistent with the hypothesis that past ATHs are leading the way based on the sum of these indicators and price levels.”

Meanwhile, gold bug Peter Schiff warned that Bitcoin’s return to $30k should not be seen as a bottom.

“This is certainly no longer support, but opposition.” The new support is a lot lower.”

Schiff also mentioned Bitcoin’s link to tech stocks in his tweet, saying that “even if the Nasdaq has a bear market, Bitcoin is unlikely to participate.”

Schiff rightly points out that there is a macro effect at work, even though he has no objective evidence for it. With some experts predicting a major global economic slump, now is not the time to take even more risk.

Posted in: Analysis, Bitcoin

Gain a competitive advantage in the crypto market

Join Edge to access our very own Discord community, as well as more exclusive material and commentary.

Research in the chain

Pricing Snapshots

more information

Join today for $19 a month. View all benefits.