In recent weeks there has been a massive increase in Bitcoin. The price of BTC is now over $7000, and many people expect it to continue rising until at least March 2020. But since the bank run that Tether claimed would never happen was about to happen (and for good reason), they announced that their money would not be affected by this bank run and will still have value as usual.,

Evergrande Group, a Chinese conglomerate that owns Evergrande Real Estate Group and Hong Kong-listed Hengda International Holdings, has announced it is ready for this bank run. The company had recently released their own cryptocurrency called “Evergrande Tether”.

Last month, Tether’s CTO, Paolo Ardoino, informed us that Tether was ready for a bank run. Ardoino and the Tether team have run simulations to simulate a financial crisis similar to that of 2008 and they believe they will be able to make all repayments even if a similar event occurs.

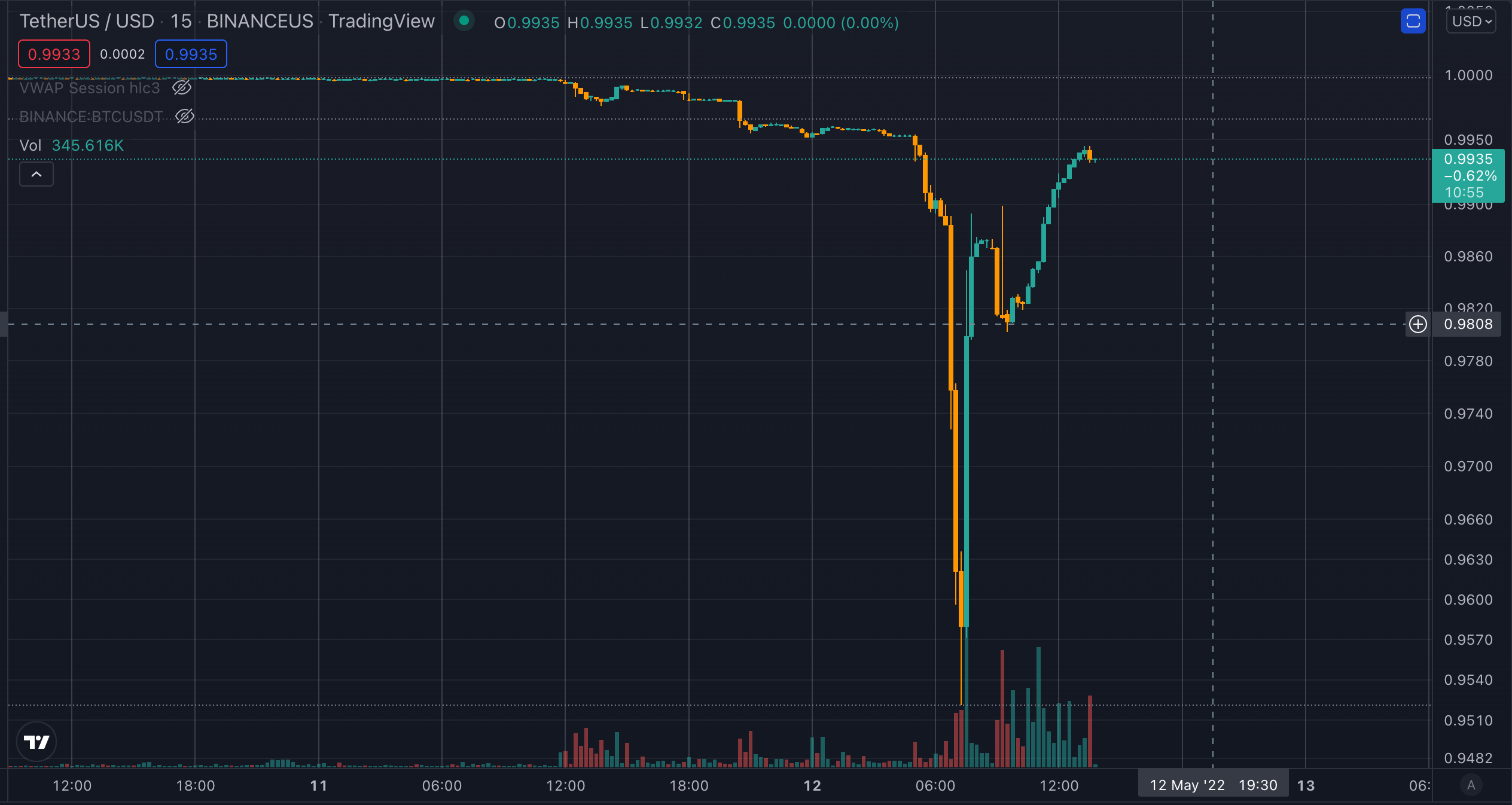

Tether’s dollar peg was shattered yesterday as it sank below Tether’s peg to the US dollar, swinging to $0.95 yesterday on major exchanges such as Binance.US and Coinbase. The token has been trading below $0.995 for the longest time since March 2020, closing several four-hour candles below the 0.005 level. Currently it has been restored to $0.993 and it looks like the link will be restored soon. If the pin comes back, Tether can consider a pain drop of up to 5% and a 48 hour recovery as a successful stress test. However, the potential for this level of volatility could now be priced into the crypto market as a whole. When stablecoins have the potential to fluctuate 5%, confidence will no doubt be reached..95 on major exchanges including Binance.US and Coinbase. For the first time since March 2020, the coin trading under Tether’s peg to the US dollar was shaken yesterday as it fell to $0.95 on major exchanges such as Binance.US and Coinbase. The token has been trading below $0.995 for the longest time since March 2020, closing several four-hour candles below the 0.005 level. Currently it has been restored to $0.993 and it looks like the link will be restored soon. If the pin comes back, Tether can consider a pain drop of up to 5% and a 48 hour recovery as a successful stress test. However, the potential for this level of volatility could now be priced into the crypto market as a whole. When stablecoins have the potential to fluctuate 5%, confidence will no doubt be reached…995 closing many four hour candles below the 0.005 threshold. It has already reverted to Tether’s peg to the US dollar that fluctuated yesterday as it fell to $0.95 on major exchanges such as Binance.US and Coinbase. The token has been trading below $0.995 for the longest time since March 2020, closing several four-hour candles below the 0.005 level. Currently it has been restored to $0.993 and it looks like the link will be restored soon. If the pin comes back, Tether can consider a pain drop of up to 5% and a 48 hour recovery as a successful stress test. However, the potential for this level of volatility could now be priced into the crypto market as a whole. When stablecoins have the potential to fluctuate 5%, confidence will no doubt be reached…993, and it looks like the peg will be restored soon. If the pin returns, Tether can consider a 5% maximum pain reduction and 48 hours recovery as a satisfactory stress test. However, this amount of volatility can now be priced into the cryptocurrency market as a whole. When stablecoins have the ability to fluctuate 5%, trust will almost certainly be damaged.

“Reminder tether honors USDt redemptions for $1,” Ardoino tweeted in response to the current market situation. Ardoino indicated in our conversation that Tether had never denied redemption. However, it appears that in order to use their redemption service, investors must have at least $100,000 worth of Tether and be located outside of the United States unless they qualify as an eligible contract participant. Tether said they had processed more than $300 million in Tether redemptions in the past 24 hours.

Ardoino said when asked if Tether will always be pegged to the dollar:

“If we have to model what a bank run crisis might look like on a Tether portfolio, we’re taking into account the worst times in financial history.”

He goes on to say that if we have hyperinflation and a “pizza costs $1 million”, it will cost “1 million USDT”. The topic of discussion was escalating global inflation and the possible death of fiat money. Today, however, stablecoins are in the headlines, with fears that they would be wiped out due to fluctuating market conditions.

For more on how Tether planned a bank run, watch the full interview here (audio quality is poor due to a technical issue):

Tether released the following statement in response to an immediate request for comment on current market conditions:

Tether is pleased to report that business has resumed, despite some anticipated market panic following this week’s market moves.

Tether continues to respect standard purchases, where verified customers (in approved territories) can exchange USDt for USD$1 on Tether.to. Tether has honored more than 300 million USDt redemptions in the past 24 hours alone and processes more than 2 billion today.

Tether has held steady through many black swan events and highly unpredictable market conditions, and Tether has never failed to honor a redemption request from any of its verified consumers, even in the darkest of days. Tether will continue to do this, as it has done in the past.

Tether is the most liquid stablecoin on the market, backed by a strong, conservative portfolio made up of cash and cash equivalents, such as short-term Treasury bills, money market funds and commercial paper holdings from issuers rated A-2 and above. The value of Tether’s reserves is published daily and updated once a day. The most recent information can be found here: https://tether.to/en/transparency.

Gain a competitive advantage in the crypto market

Join Edge to access our very own Discord community, as well as more exclusive material and commentary.

Research in the chain

Pricing Snapshots

more information

Join today for $19 a month. View all benefits.

Tether claims they were ready for this bank run. The cryptocurrency is a digital asset that can be transferred between people or used to pay for goods and services in the real world. Reference: what is tether.

Related Tags

- coinage stablecoins

- evergrande crypto crash

- jamie boom – youtube

- tether usdt

- necklace coin price