The US dollar (USD) is on the brink of a “death spiral” caused by excessive debt and inflation, resulting in an inevitable devaluation. The SwissBorg project aims to solve this problem through cryptocurrency-backed loans.

The “luna ust risk” is a report that explains the cause of UST’s “death spiral”. The report also includes a list of recommendations to avoid this issue in the future.

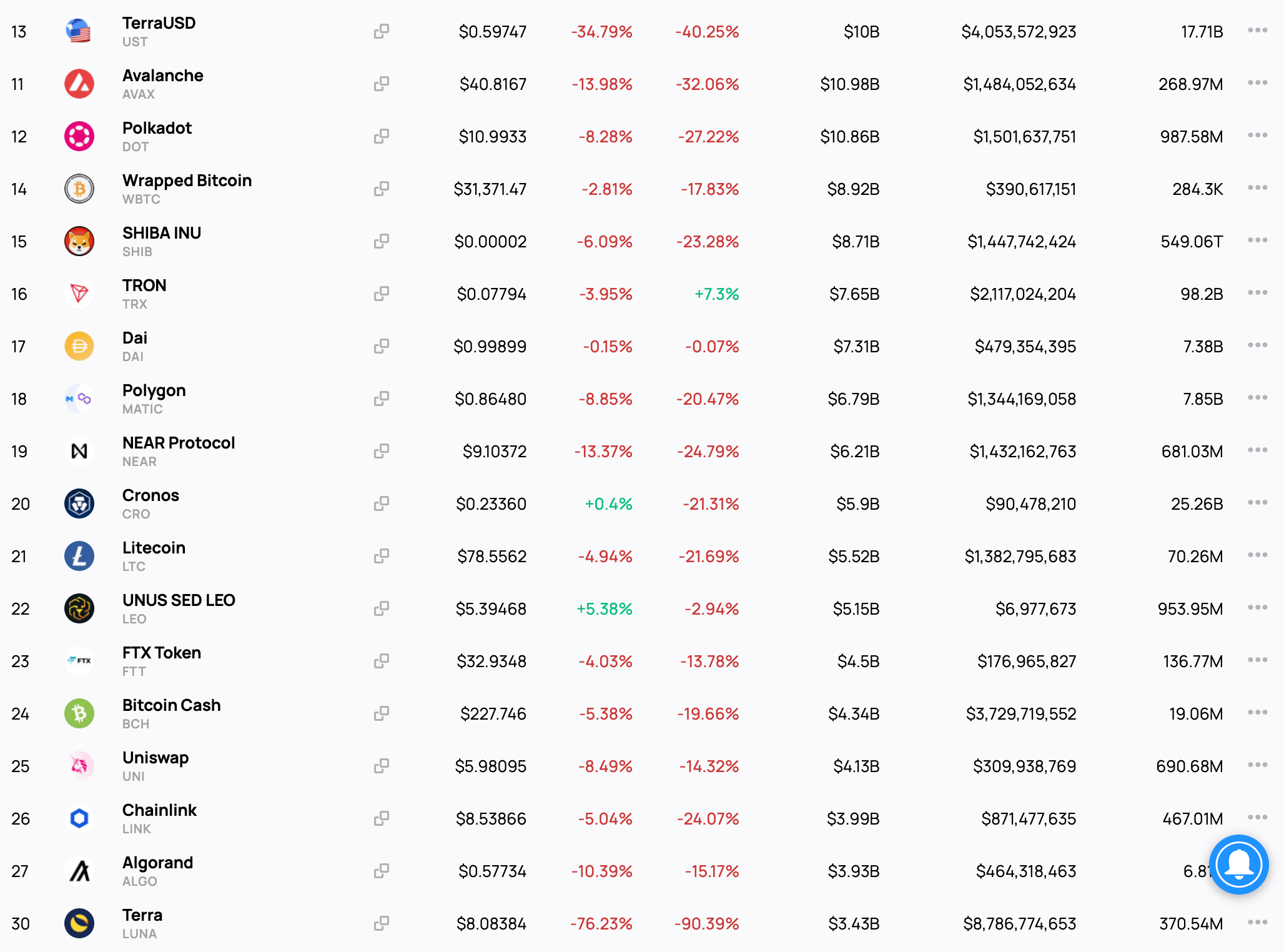

SwissBorg, a crypto exchange in Switzerland, has published an investigation into the dangers associated with Terra’s stablecoin, UST. The coin is currently experiencing severe volatility, with a price tag from Switzerland-based crypto exchange, SwissBorg, has released a report on the risks surrounding Terra’s stablecoin, UST. The token is currently undergoing extreme volatility and is trading at just $0.59 at the time of writing. SwissBorg issued a risk warning to users on May 10 and paused withdrawals from UST on the same day, hours before Binance followed suit. The report was completed in April and nearly all of the risks identified by them are currently unfolding..59 at the time of writing. On May 10, SwissBorg issued a danger warning to clients and halted UST withdrawals, hours before Binance followed suit. The assessment was completed in April and practically all the dangers that have emerged are now being realized.

TerraUSD Risks (UST)

UST is an algorithmically baked token, unlike other stablecoins such as USDT or USDC, which are backed by cash and other liquid assets. has received a report on UST hazards from SwissBorg’s DFi team. “Users on Terra can at any time burn $1 worth of LUNA to make 1 UST, or 1 UST to redeem LUNA worth $1,” the study said. As a result, the fates of UST and LUNA are intertwined, as are the dangers.” Important. It identified four key risk areas:

- A UST death spiral -TerraLuna

- The Dangers of Anchor Protocol

- UST has lost its pin.

- A standard model that is structured.

UST Death TerraLuna’s Spiral

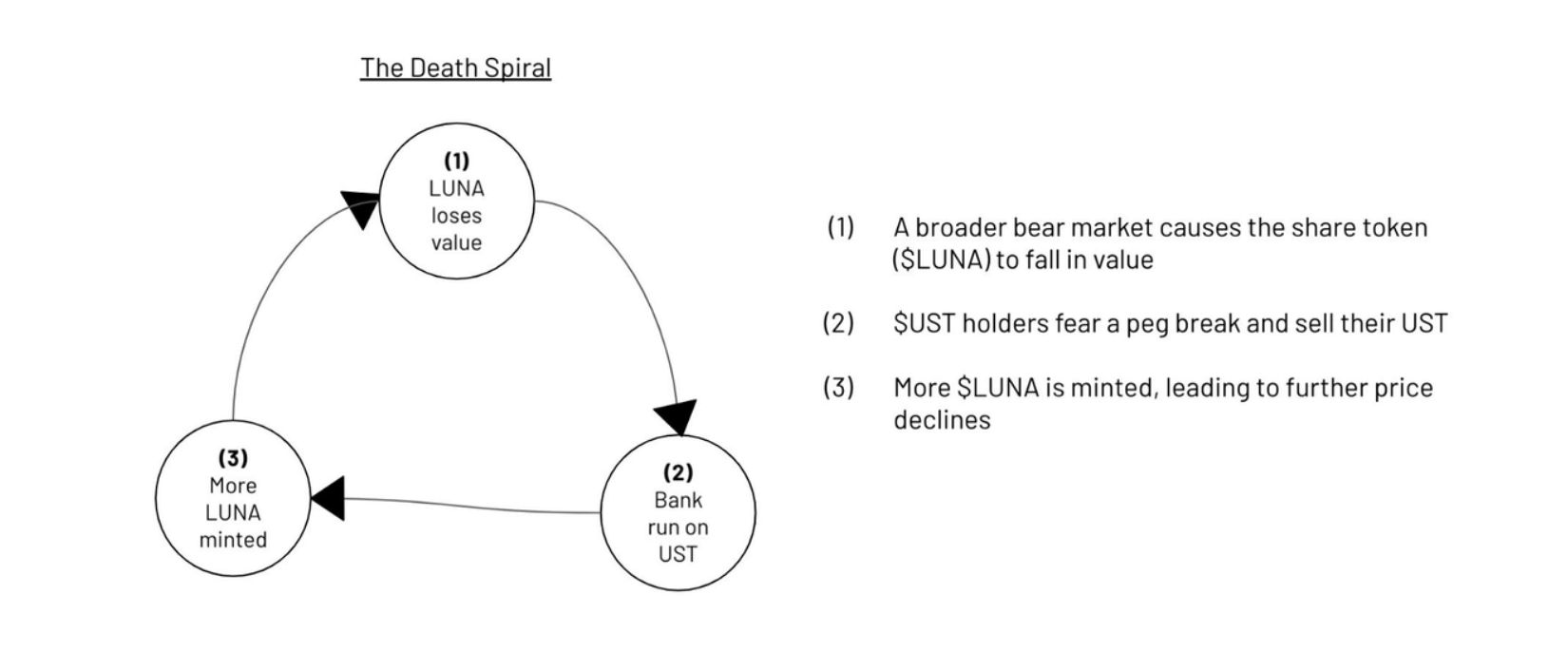

SwissBorg described a potential “death spiral” between TerraLuna and UST, in which LUNA would fail and UST face a bank run. LUNA is down 90 percent since May 9, showing that this scenario is now playing out, with UST down 30 percent. The death spiral is explained in detail in the study.

“If the price of LUNA falls, UST holders may worry that the UST peg may be compromised and choose to buy back their UST holdings.” To do this, UST is burned and LUNA is conceived and sold on the open market. This would accelerate the price decline in LUNA, causing additional UST holders to dump their holdings. The ‘bank run’ or ‘death spiral’ is the term for this destructive cycle.

SwissBorg UST Risk Report

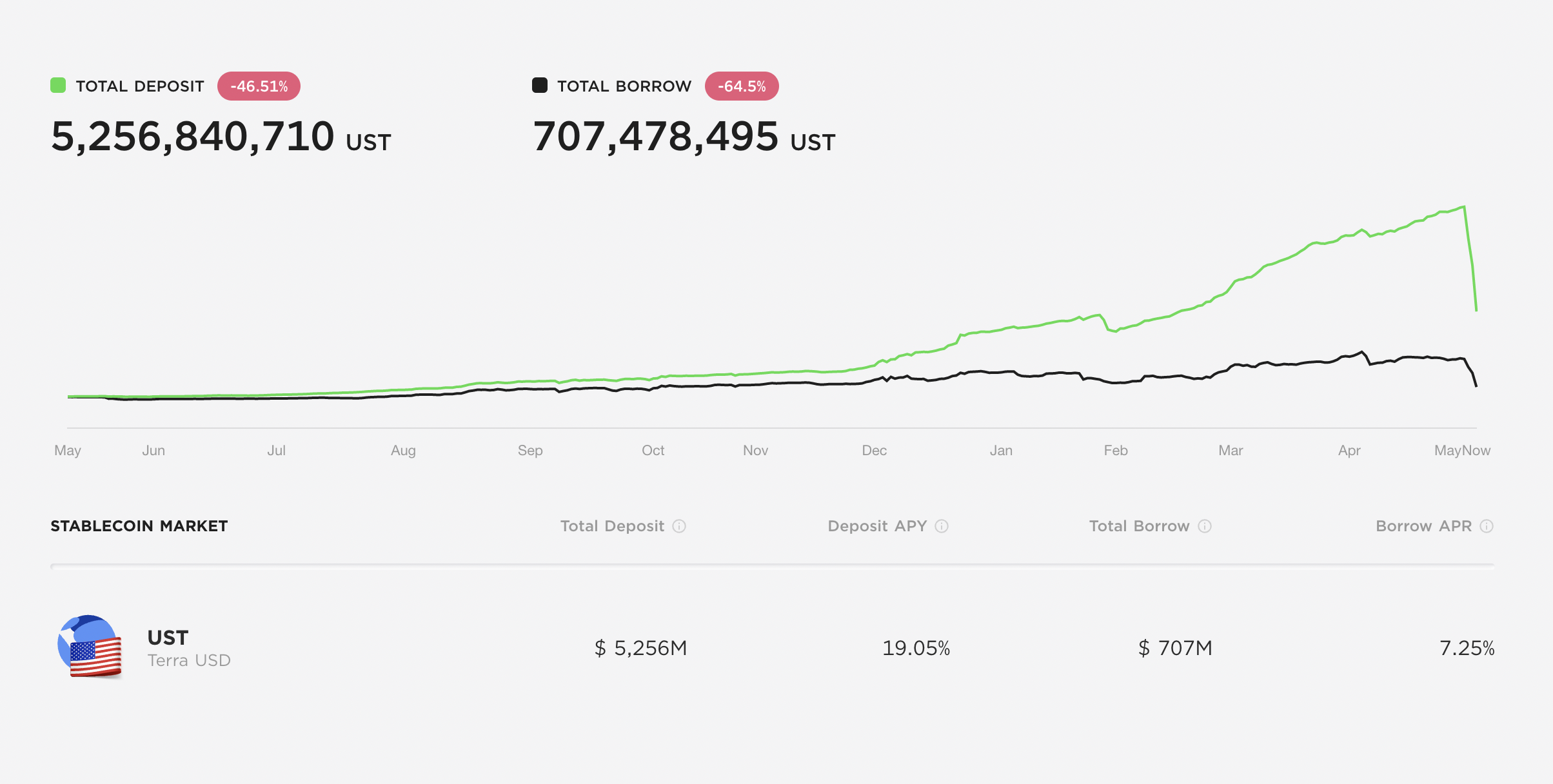

Anchor protocol risk

The Terra ecosystem platform Anchor Protocol has a lot of interest in UST staking. In recent weeks, the platform has offered up to 19 percent, with a high TVL of around $15 billion. The TVL has fallen dramatically in recent days, with both deposit and loan prices plummeting.

Anchor protocol (source)

“If the price of LUNA (and bLUNA) falls, it could lead to a liquidation of the LUNA collateral,” SwissBorg said. The UST would then be burned back into LUNA, pushing the LUNA price down even further.”

According to reports on Twitter, many Terra Station investors have been unable to access their wallets due to network congestion, leading to liquidations.

Users have been unable to deposit funds to lower their LTV due to lack of access to wallets, necessitating liquidation. LUNA’s sharp price drop over the past week appears to be largely due to this. “Any issue with Anchor would certainly generate a cascade of UST redemptions, with all the consequences already highlighted,” SwissBorg wrote in its study.

UST has lost its pin.

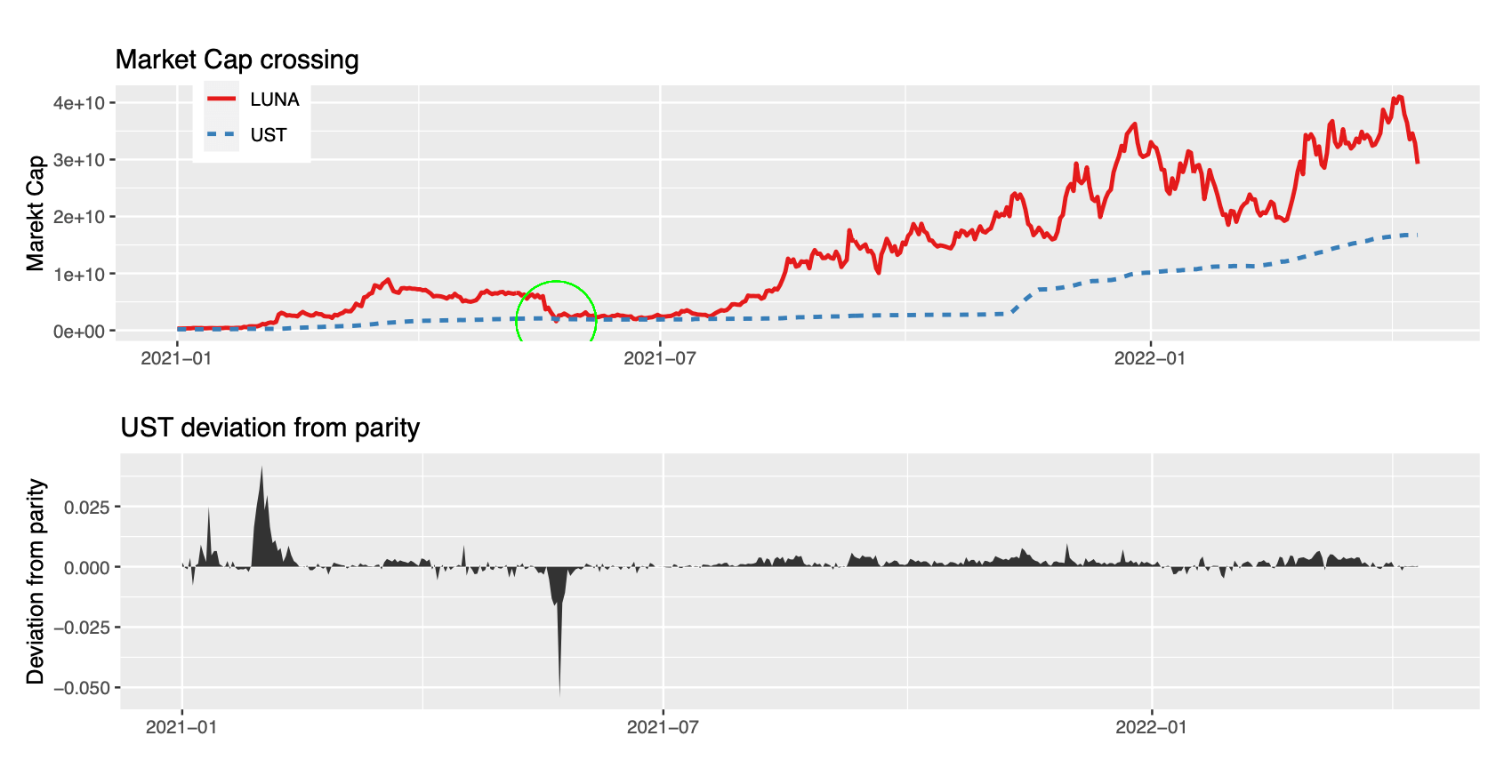

“A death spiral accompanied by a cascade of liquidations in Anchor could push LUNA’s market cap to below the market cap of the circulating UST,” Swissborg said. As can be seen from the coin tracker, LUNA’s market value has now fallen to around $370 million.

Source:

This position is strongly linked to the likelihood of UST depegging, according to SwissBorg. This is just one of the elements affecting the Terra ecosystem as it stands. The chart below shows an event in May 2021 where the market cap broke for a short time, as well as the impact on the UST peg.

SwissBorg UST Risk Report

Standard model with structure

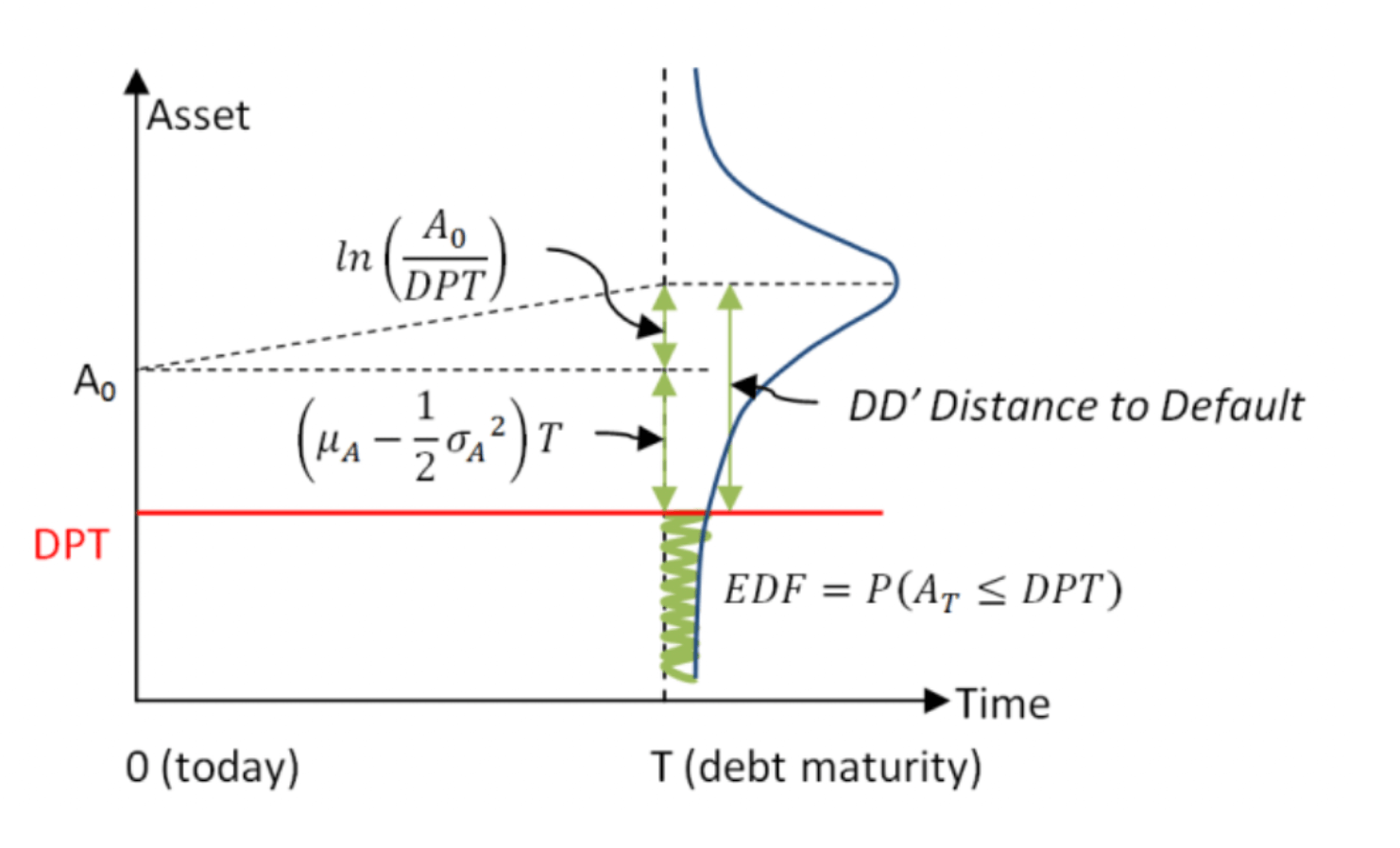

The Merton model for measuring default risk has been recognized by SwissBorg as being applicable for an assessment of the risks associated with UST.

“The Merton model is structural because it uses the Black-Scholes-Merton option pricing techniques and provides a relationship between default risk and the firm’s asset (capital) structure.”

As can be seen in the diagram below, the intricate formula of the Merton model analyzes the risk of an asset falling below its liability level.

SwissBorg UST Risk Report

The analysis calculated the probability that UST would lose its pin in the Terra ecosystem.

• LUNA’s market cap represents asset value A. • If Luna’s market value is lower than UST’s at a given time horizon T, the UST link is lost.

The accompanying chart shows the probability of UST losing its pen on a daily basis. The probability increased to almost 100% in May 2021, before falling to 20% in November. From April 2022, the danger has slowly increased to 60%. With a current price of The above data has been charted to show the likelihood of UST losing its clutch on a daily basis. In May 2021, the risk rose to just below 100%, before falling back to 20% in November. The threat had steadily climbed to 60% as of April 2022. At this point, UST, which trades at $0.59, has definitely lost its peg. 59, UST has officially lost its clutch.

Conclusions of risk

“The fate (and dangers) of UST are inextricably linked to that of LUNA,” concluded SwissBorg. Any convergence of LUNA’s market cap with UST’s creates a serious danger of the link being lost.” Their advice was to keep an eye on UST’s relationship with LUNA, keep an eye on Anchor Protocol’s TVL for signs of collapse, monitor market volumes for LUNA to maintain liquidity and monitor demand for Terra stablecoins.

All of these criteria are currently true. LUNA is down 90%, UST is down 30%, Anchor Protocol TVL is down 60%, while demand for Terra stablecoins has remained unchanged. In addition, a reduction in crypto’s entire market cap has created the ideal storm for a black swan in the Terra ecosystem. Will Terra weather the storm, or will tens of billions of dollars worth of tokens be wiped off the planet?

Regardless of whether Terra can recover, many investors will not be able to because of the Anchor Protocol liquidations.

And it’s no small amount, $133k was all I had, really, this crap wiped me out except for a few thousand savings. I was screwed to Sunday in ten different ways.

May 11, 2022 — Wicklidation (@Joe Cool Bitmex)

Gain a competitive advantage in the crypto market

Join Edge to access our very own Discord community, as well as more exclusive material and commentary.

Research in the chain

Pricing Snapshots

more information

Join today for $19 a month. View all benefits.

The “coin yuppie” is a term used to describe the phenomenon that many cryptocurrencies have experienced. The SwissBorg report explains what causes this phenomenon and how it can be remedied.

Related Tags

- luna death spiral

- us crash

- swissborg price forecast 2025

- swissborg news today

- why does luna crypto crash?