In fact, this company is increasingly entering Nvidia's territory.

Three stocks have now reached a market cap of $3 trillion: Apple, Microsoftand most recently Nvidia. Earnings growth in the technology sector has been phenomenal over the past decade, making investors increasingly excited about these stocks. Recently, innovations in artificial intelligence (AI) have further driven these shareholder gains.

Investors have seen stocks consistently breach trillion-dollar market cap thresholds. But what about $10 trillion? I think there's one stock that will reach this milestone first, and it's not one of the three companies mentioned above.

Amazon (AMZN -1.02%) could be the first stock to reach a market cap of $10 trillion and will once again be the most valuable company in the world. This is why.

E-commerce profits come from an unlikely source

For years, investors doubted the profitability of Amazon's e-commerce business. With thousands of warehouse workers and delivery drivers, there are many costs associated with running a vertically integrated online marketplace. The core model of e-commerce has razor-thin margins, which will never change. However, the company has built highly profitable business lines on top of the e-commerce market.

First, the company has its long-standing Amazon Prime subscription business. Subscription revenues reached $43 billion in the last twelve months, up from a paltry $2.76 billion in 2014. Amazon has the ability to sink these profits to the minimum if it decides to stop reinvesting in growth.

Second, Amazon now generates $54 billion in annual advertising revenue, mostly from sponsored listings on its e-commerce platform. These are high-margin revenues that can go directly into the bottom line, just like the subscription industry.

Add the two together and you have a profit potential of almost $100 billion, even if you think the major e-commerce, third-party sellers and physical retail locations will never generate an ounce of profit.

Why use these estimates? To showcase the profit potential of Amazon's global retail operations. These segments have the potential to generate nearly $100 billion in revenue in the near future. If revenue continues to grow at double-digit rates, segment profits could reach $150 billion or even $200 billion within the next decade.

A lasting advantage in cloud and AI

Amazon's most profitable industry is Amazon Web Services (AWS). The leading cloud computing giant generates approximately $100 billion in revenue and $36 billion in revenue, or a 36% profit margin. That makes it one of the most profitable companies in the world, and it's just a subsidiary of the Amazon complex.

Cloud computing revenues are only growing and are now being driven by AI spending. AWS appears to be well positioned to benefit from this trend, even investing in its own computer chips to absorb some of the huge fees it pays to companies like Nvidia every year. Analysts estimate that cloud computing spending will grow 22% annually between 2024 and 2030, fueled by AI.

Assuming AWS can maintain its profit margins and market share, six years of 22% profit growth would mean AWS will generate over $100 billion in revenue by 2030. An ambitious estimate, but feasible if the AI boom becomes reality. it looks more and more like it.

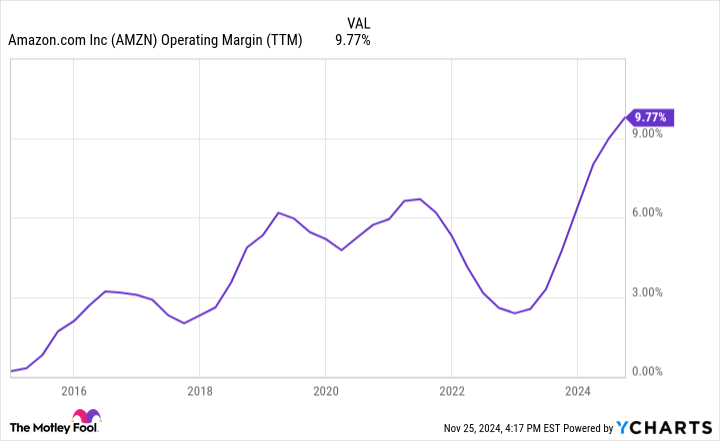

AMZN Operating Margin (TTM) data by YCharts

Calculate it to $10 trillion

Adding up all its segments, it appears that Amazon has the potential to generate approximately $300 billion in revenue by 2030. This figure could even be surpassed if the new projects in healthcare, pharmaceuticals and satellite internet with Project Kuiper yield any results. Either way, the company has tremendous momentum that should only continue over the next five years.

A market cap of $10 trillion on annual earnings of $300 billion is a price-to-earnings (P/E) ratio of 33. While that's a multiple of earnings, I don't think it's unreasonable for Amazon to trade at this valuation. For reference, Apple and Microsoft are both currently trading with a win ratio above 33.

With multiple tailwinds at its back and rapidly growing profit margins (operating margin has risen to a record 10% in the past 12 months), Amazon is poised to become the first company with a market cap of $10 trillion.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Brett Schafer has positions at Amazon. The Motley Fool holds positions in and recommends Amazon, Apple, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.