For most retirees, Social Security is more than a check. It represents a necessary source of income that most retired workers can do without.

For the past 23 years, national pollster Gallup has surveyed seniors to determine how much they rely on their Social Security benefits. At no point in this more than two-decade-long annual survey has the percentage of retirees who rely on their Social Security income to get by fallen below 80%. By 2024, 88% of retirees said their Social Security benefits are a “large” or “small” source of income.

Given the key role that America's most important pension program plays in laying a financial foundation for America's aging workforce, it should come as no surprise that the Social Security cost-of-living adjustment (COLA) announcement, scheduled for Oct. 10 at 8:30 a.m. ET, is the most anticipated announcement of the year.

As we get closer to this revelation, the 2025 COLA projection has been significantly lowered, offering both hope and disappointment to beneficiaries.

What is the purpose of the Social Security COLA?

The much-discussed Social Security COLA is the mechanism the Social Security Administration (SSA) uses to adjust benefits annually based on changes in the prices of goods and services.

For example, if a broad basket of goods and services regularly purchased by seniors cumulatively increases in price by 2%, 3%, or 5%, Social Security benefits should ideally increase by a proportionate amount to ensure that purchasing power is not lost. The annual cost-of-living adjustment is designed to keep program beneficiaries on track with the inflation (i.e., rising prices) they face.

From the first mailed check to retired workers in January 1940 through 1974, benefit adjustments were entirely arbitrary and passed by special sessions of Congress. After the absence of COLAs throughout the 1940s, there were 11 fairly large adjustments from 1950 through 1974.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was assigned the task of tracking inflation for Social Security and became, in effect, the inflationary guide responsible for determining the annual COLA. The CPI-W has more than a half-dozen major expenditure categories and a laundry list of subcategories, all of which have their own respective percentage weights. It is these weights that allow the CPI-W to be expressed as a single, concise figure each month.

Most importantly, only the trailing-12-month CPI-W values from July through September count toward the COLA calculation. If the average CPI-W value for the third quarter (July through September) in the current year is higher than the average CPI-W value for the comparable period last year, inflation has occurred and benefits will increase.

The amount of increase to be expected is determined by the year-on-year percentage increase in average CPI-W values in the third quarter, rounded to the nearest tenth of a percent.

The 2025 Social Security Cost of Living Adjustment has been significantly narrowed

Over the past 20 years, the average COLA has been a fairly modest 2.6%. This period includes three years of deflation (falling prices) and no COLA was reported (2010, 2011, and 2016), as well as the smallest positive COLA ever (0.3% in 2017).

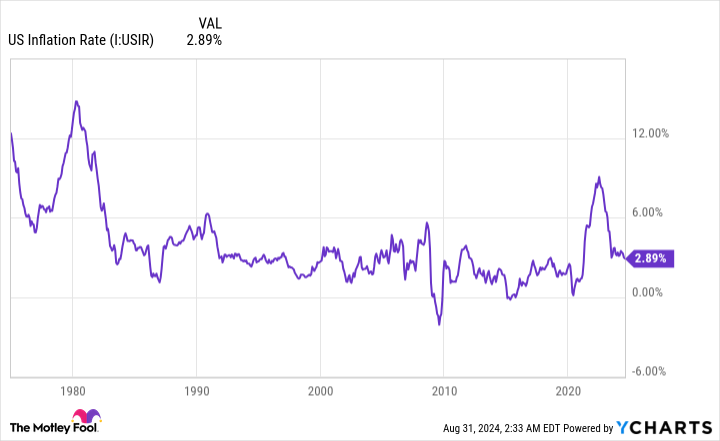

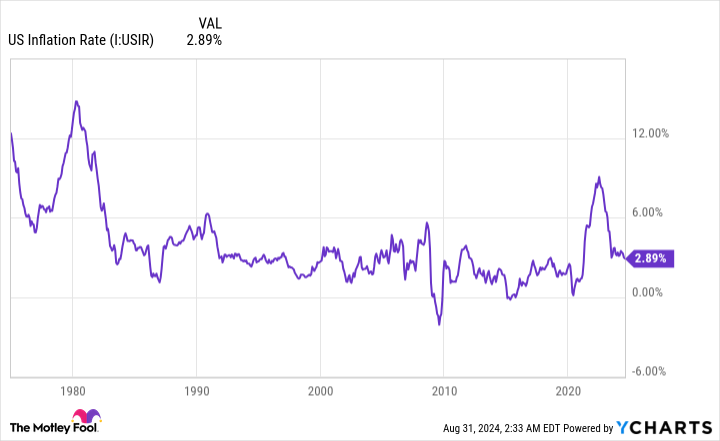

The last three years, however, have somewhat broken this anemic COLA trend. The fastest increase in the prevailing inflation rate in four decades led to a 5.9% COLA in 2022, 8.7% COLA in 2023, and 3.2% COLA in 2024. Notably, the 8.7% cost-of-living adjustment in 2023 was the highest on a percentage basis in 41 years.

Now that the Bureau of Labor Statistics' July inflation report is behind us and the August inflation report is due on September 11, we've seen significant tightening of forecasts for the 2025 COLA.

The Senior Citizens League (TSCL), an independent seniors advocacy group, started the year by predicting a paltry 1.4% COLA for 2025. After July’s inflation report, that estimate jumped to 2.57%, which by definition would be rounded to 2.6%.

Meanwhile, Mary Johnson, an independent policy analyst covering Social Security and Medicare who recently retired from TSCL, saw her 2025 COLA forecast drop from 3.2% after the April inflation report to 2.6% after the last report.

Although they are both at opposite ends of the spectrum, TSCL and Johnson now effectively agree that the cost of living adjustment will be 2.6% in 2025.

For the average Social Security beneficiary (nearly 68 million recipients), a 2.6% COLA would amount to an additional $46.35 per check, based on the average payment of $1,782.74 in July 2024. However, this benefit increase could vary by individual and by type of beneficiary.

For retirees, who make up more than 51 million of the program's nearly 68 million beneficiaries, a 2.6% COLA equates to an average monthly increase of $49.90.

By comparison, the average amount for the approximately 7.2 million workers with disabilities and the nearly 5.8 million survivors would increase by $40.01 and $39.25, respectively, next year.

The 2025 COLA could make history and disappoint at the same time

Assuming TSCL and Johnson’s projections are correct, a 2.6% cost-of-living adjustment would be the smallest percentage increase in four years. While that may sound disappointing, it would still be in line with the average COLA over the past 20 years.

Even more impressive, it would be the first time since 1997 that Social Security’s COLA has been at least 2.6% for four consecutive years. On a cumulative basis, benefits will have increased by nearly 22% as of the end of 2021, based on a 2.6% cost-of-living adjustment next year.

While it's great on paper to see benefits rising faster than ever before, there are two disappointing conclusions to be drawn about the Social Security COLA in 2025.

To begin with, a 2.6% COLA will likely result in a loss of purchasing power for beneficiaries, which has unfortunately been a common occurrence since the early 2000s.

TSCL has published two studies comparing cumulative COLAs over certain time frames to total price increases for a basket of goods and services regularly purchased by seniors. Between January 2000 and February 2023, it estimates that the purchasing power of a Social Security dollar has fallen by 36%. In a separate study published in July 2024, TSCL found that the purchasing power of Social Security income has fallen by 20% since 2010.

Given that two of the biggest expenses for seniors, housing and medical care, are facing inflation rates of over 2.6% over the past twelve months, a loss of purchasing power seems almost certain.

The other disappointment comes in the form of Medicare Part B premiums, which are rising rapidly for the second year in a row. Part B is the segment of Medicare that covers outpatient services.

In May, the Medicare Trustees Report predicted that monthly Part B premiums would rise to $185 in 2025, representing a 5.9% increase. This is consistent with the percentage increase experienced in 2024.

Most Social Security beneficiaries enrolled in Medicare will have their Part B premiums automatically deducted from their monthly benefits. In other words, a second year in a row without a silver lining from Medicare Part B will minimize the impact of Social Security's upcoming COLA.

Next year looks set to be one of those rare moments when history is made, but disappointment is inevitable.

The $22,924 Social Security Bonus That Most Retirees Completely Overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” can help boost your retirement income. For example, one easy trick could save you $22,924 more… every year! Once you learn how to maximize your Social Security benefits, we think you can retire confidently with the peace of mind we all seek. Click here to learn how to learn more about these strategies.

View the “Secrets of Social Security” »

The Motley Fool has a disclosure policy.

Social Security's 2025 Cost of Living Adjustment (COLA) Has Been Narrowed — Here's How Much the Average Salary Is Expected to Rise Next Year was originally published by The Motley Fool