Aurich Lawson | Getty Images

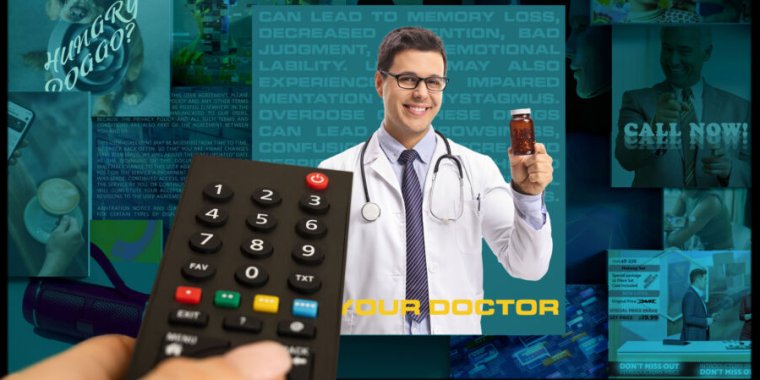

The TV business is no longer just about selling TVs. Companies increasingly see viewers, not TV sets, as their most lucrative asset.

In recent years, TV makers have seen growing financial success from TV operating systems that can serve ads to viewers and analyze their responses. Rather than selling as many TVs as possible, brands like LG, Samsung, Roku and Vizio are increasingly, if not primarily, seeking recurring revenue from TVs they’ve already sold through ad sales and tracking.

How did we get here? And what implications does an advertising- and data-obsessed industry have for the future of TVs and the people who watch them?

The value of software

Success in the TV industry used to mean selling as many TVs as possible. But as smart TVs become mainstream and hardware margins shrink, OEMs have been looking for new ways to make money. TV operating system vendors can tap into a more frequent, higher-margin source of revenue, which has led to an ad-filled viewing experience. These can appear from the moment you pick up your remote, with ads from streaming services taking the form of physical buttons.

Some TV brands are already prioritizing data collection and the ability to sell ads, and most are trying to broaden their appeal to advertisers. Smart TV OSes have become the cash cow of the TV industry, with providers generating revenue by licensing the software and sharing revenue from in-app purchases and subscriptions.

A large portion of TV OS’s revenue comes from selling advertising, including on the OS’s home screen and screensaver, and through free, ad-supported streaming TV channels. GroupM, the world’s largest media investment firm, reported that smart TV ad revenue grew 20 percent from 2023 to 2024 and is expected to grow another 20 percent next year to $46 billion. In September 2023, Patrick Horner, practice leader of consumer electronics at analyst Omdia, reported that “each new user of the connected TV platform generates about $5 per quarter in data and ad revenue.”

Automatic content recognition (ACR) technology is at the heart of the smart TV advertising business. Most TV brands say users can opt out of ACR, but we’ve already seen Vizio include the feature without user consent. ACR is also sometimes enabled by default, and the off switch is often buried in a settings menu. Whether or not a TV maker includes ACR says a lot about the priorities of a TV maker. Most users have almost nothing to gain from ACR and face privacy concerns by sharing information (sometimes in real time) about what they do with their TVs.

At this point, consumers have come to expect ads and tracking on budget TVs from the likes of Vizio or Roku. But the biggest companies in the TV world are also working to turn their sets into data-producing billboards.

If TVs are watching you, so are businesses

In recent years, we've seen companies like LG and Samsung expand the advertising capabilities of their TVs as advertisers increasingly want access to TV tracking data.

For example, LG began sharing data collected from its TVs with Nielsen, giving the data and market measurement company “the largest ACR data footprint in the industry,” according to an October announcement. The deal gives Nielsen streaming and linear TV data from LG TVs, and provides companies that buy ads on LG TVs with “‘Always On’ streaming measurement and big data from LG Ad Solutions” through Nielsen’s ONE Ads dashboard.

LG, which recently unveiled a goal to evolve its hardware business into an ad-pushing “media and entertainment platform company,” expects there to be 300 million webOS TVs in homes by 2026. That represents a huge opportunity for data collection and recurring revenue. In September, LG said it would invest KRW1 trillion (about $737.7 million) through 2028 in its “webOS business,” or the company behind its smart TV operating system. The company said updates will include improvements to webOS’s user interface, AI-based recommendations and search capabilities.

Samsung recently updated its ACR technology to track ad exposure on its TVs through streaming services, rather than just linear TVs. Samsung is also trying to make its ACR data more valuable for ad targeting, including through a deal it signed in December with analytics firm Experian.

Representatives for LG and Samsung declined to comment to Ars Technica about how much of their respective companies' business comes from ad sales. But the deals they've struck with data-collection companies indicate there's strong interest in turning their products into lucrative smart TVs. In this case, “smart” isn't about internet connectivity, but about how well the TV understands its viewer.