Economists warn that Ukraine's fight in the war against Russia will push up British households' energy bills by as much as £190.

Asset manager Columbia Threadneedle Investments predicts that the energy price cap will rise from its current level of £1,568 to £1,762 in October, leaving the average household paying £194 more a year.

The forecast is based on recent jumps in energy futures contracts, which Colombia's chief economist Steven Bell said is partly due to the fact that “Ukraine is losing the war.”

Mr Bell said: “There are concerns that storage and transhipment facilities [storage warehouses] “The gas supply in Ukraine will be in jeopardy.”

Ukraine's underground gas storage facilities are the largest in Europe and can store 31 billion cubic meters of gas.

Mr Bell said concerns about their safety had helped trigger “quite a big move in a couple of weeks”, which had seen investors' assessment of the price limit shift from below £1,500 to £1,762.

The economist added: “That may not seem like a huge increase, but it's 19% higher than seemed likely a few weeks ago, and 12% higher than we're currently in. If you're looking for one reason why Rishi Sunak surprised us all by calling an early election instead of November, I think this is it.”

Deutsche Bank analysts also predict that energy bills for British households will rise by between 7 and 10 percent from October.

This would see the energy price cap rise from its current level of £1,568 to around £1,709 in the last three months of the year.

Chief economist Sanjay Raja said Ukraine's struggle in the war could “certainly be a contributing factor” to the recent market price movements.

Mr Raja added: “Tensions in the Middle East may also have played a role.”

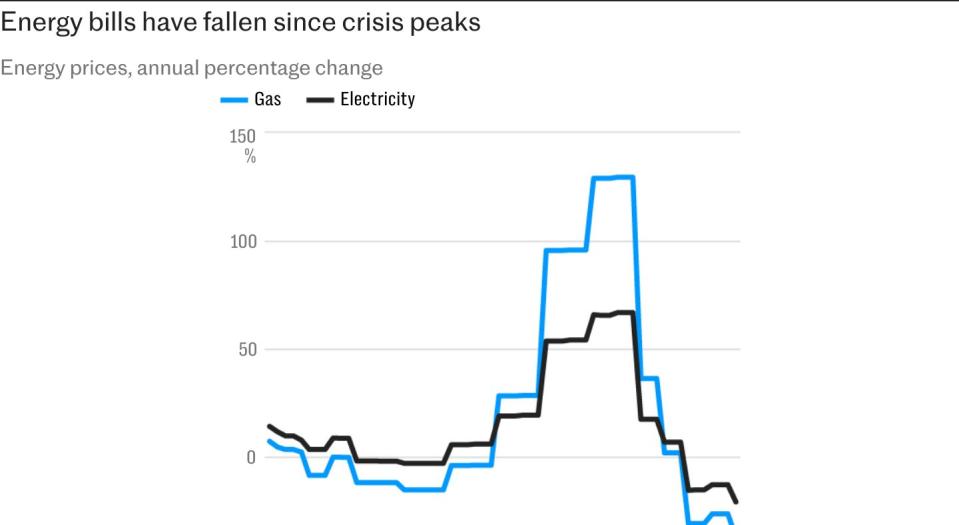

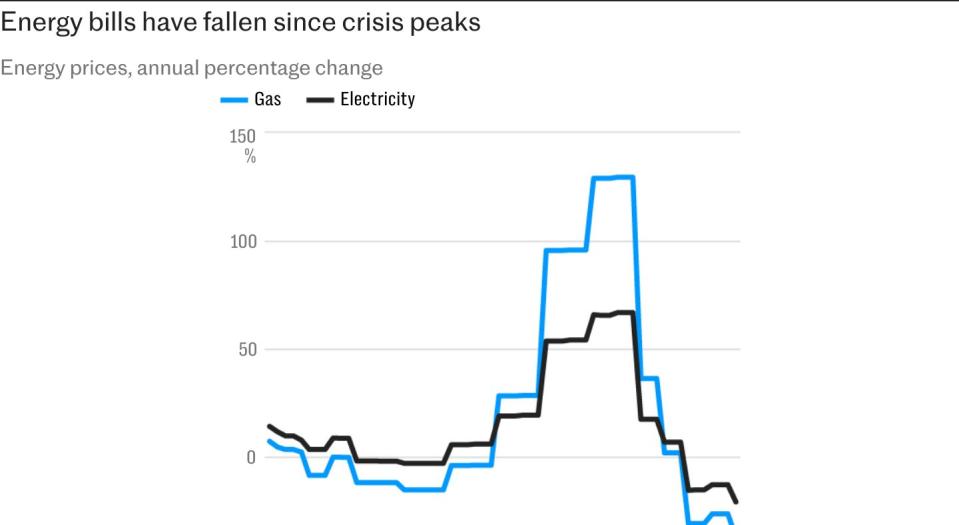

The rise in energy bills threatens to lead to higher inflation, which has finally returned to the Bank of England's 2% target after three years.

Analysts at Nomura separately warned that markets are underestimating inflation risks posed by rising shipping costs as Houthis attacks on ships in the Red Sea intensify.

High shipping costs could increase inflation by as much as 0.5 percentage points by September next year, according to Nomura.

The bank warned in a letter to customers: “There is a risk that interest rates will not fall as much in 2025 as we currently expect. In an extremely unfavorable scenario, there is even a risk that central banks will have to raise interest rates again.”

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 3 months with unlimited access to our award-winning website, exclusive app, money-saving offers and more.