Whenever a company seems too big to be challenged, there will always be a smart entrepreneur who will find the niches that are not being filled and break them open. That's what happens with coffee chains Dutch Bros (NYSE: BROS). It can't really compete with giant Starbucksbut instead it has found a way to connect with its customers through its own culture and rules, and it is paying off.

Investors had high hopes for Dutch Bros when it went public in 2021 amid unprecedented initial public offerings (IPOs) and wild investor sentiment. That bull market has exploded, and many popular stocks have moved into bargain territory. Here’s why you might want to add Dutch Bros stock to your buy list.

Don't try to compete

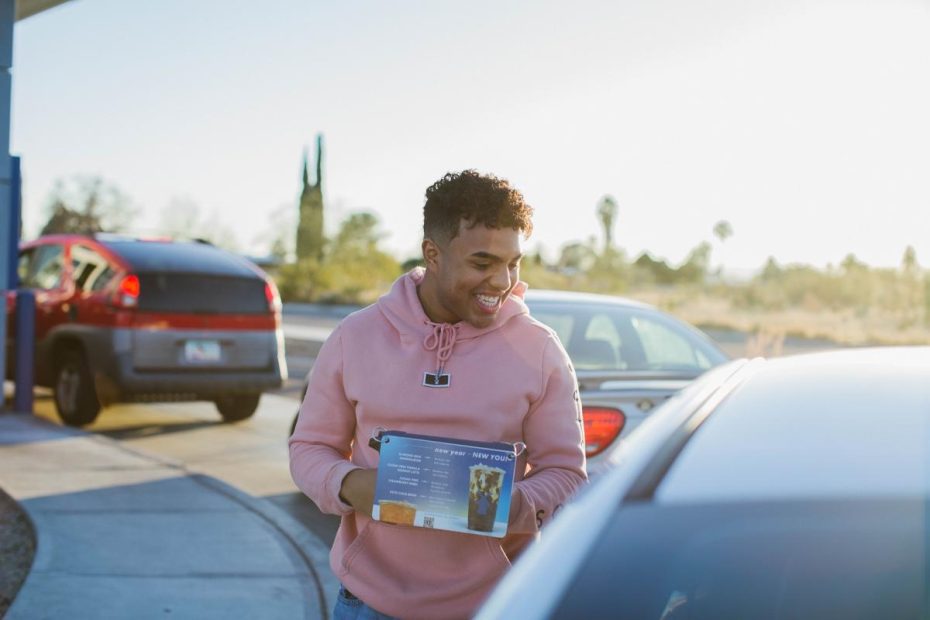

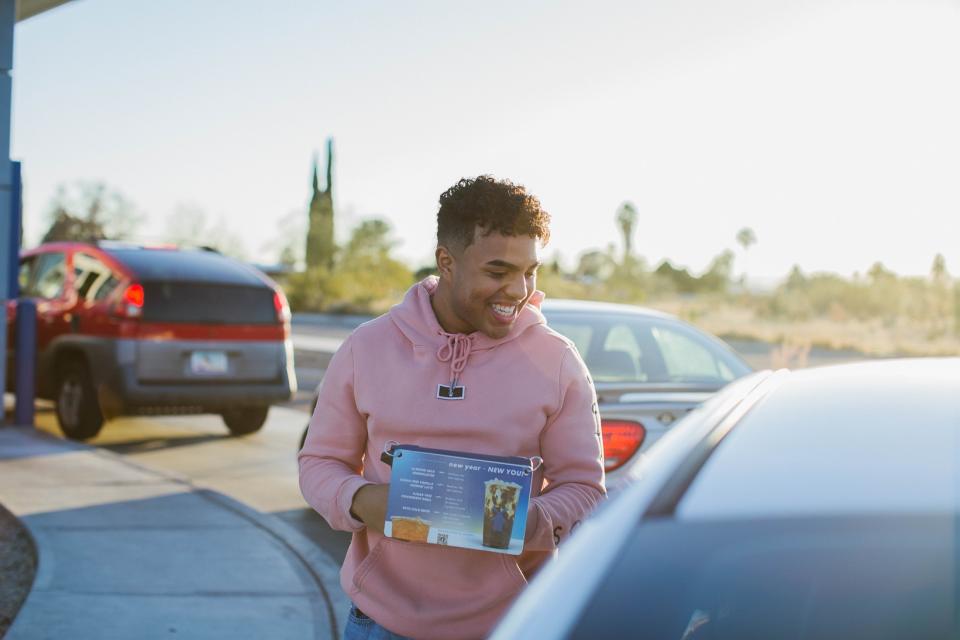

Dutch Bros isn’t trying to be the next Starbucks. It’s actually been around for 30 years as a small chain, and in that time it’s developed its own identity with a focus on friendly “broistas” and a laid-back, fun atmosphere. But it’s also serious about speed and customer service, with broistas often walking through the drive-thru to take orders (with a smile). It’s also cheaper than Starbucks.

It may be the work of a small entrepreneur, but it has already expanded to more than 800 stores in 17 states. Much of that growth has occurred recently, since the company decided to expand the chain and go public. The founding CEO has stepped down to make way for a serious executive team to lead the company forward as it continues to grow.

And it’s growing. Revenue rose 39% in the first quarter of 2024. Even better, the company’s same-store sales have bounced back after being under pressure last year, rising 10% year-over-year in the first quarter.

Where is Dutch Bros headed? Management is targeting 4,000 locations in the next 10 to 15 years. If the company can continue to grow at its current pace, it should be able to scale efficiently and profitably. It may not be the next Starbucks, but it could be a great stock to own if it can get there. That’s why restaurant stocks seem so appealing at this early stage of growth; if you get in on the ground floor, there’s a good chance you’ll go high. But there’s also risk, as any early-stage stock still has to prove its worth over the long term.

So far, Dutch Bros.’s trajectory looks strong. I say that partly anecdotally, having spoken to customers who really like the company’s coffee. The company is building the brand, and there’s no reason it can’t open new stores in new areas. The new, experienced management team is developing a plan to open new stores across the country without breaking the bank.

It’s already paying off. Dutch Bros opened 165 stores last year and another 45 in the first quarter. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) rose 120% year-over-year in the quarter with a 7-point increase in adjusted EBITDA margin, and adjusted selling, general and administrative (SG&A) expenses fell to 14.7% of revenue, below 15% for the first time since going public. That’s a strong increase in scale.

Dutch Bros could be a bargain

Dutch Bros shares are trading at 2.6 times trailing 12-month revenues and 85 times trailing 12-year earnings. Since it’s not yet reliably profitable, any earnings-based valuation is tricky. But based on revenue, Dutch Bros shares look pretty cheap.

The stock is up 25% this year, slightly outpacing the broader market, though it recently fell on analyst expectations that restaurant sales would decline over the summer. Will that affect Dutch Bros? It could, but it could also mean more people are switching to cheaper same-store coffee, which could work to their advantage.

Dutch Bros has a huge growth runway and is just getting started. Management inspires confidence that it can take the company far and it could be an excellent growth candidate for your portfolio, as long as you have some risk appetite.

Should you invest $1,000 in Dutch Bros now?

Before you buy Dutch Bros stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,626!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 15, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool has a disclosure policy.

1 Growth Stock Drops 47% to Buy Now was originally published by The Motley Fool