Companies that act as middlemen in negotiating and controlling access to prescription drugs in the U.S. “wield enormous power,” largely through “extraordinarily opaque” business practices. They may be “driving up drug costs and squeezing high-street pharmacies” to make a profit, according to a damning interim report released Tuesday by the Federal Trade Commission.

As national attention focuses on the extraordinarily high cost of medications in America, the FTC is taking aim at companies that operate largely deep in the labyrinth of the nation's health care system, well hidden from public understanding and scrutiny: pharmacy benefit managers (PBMs).

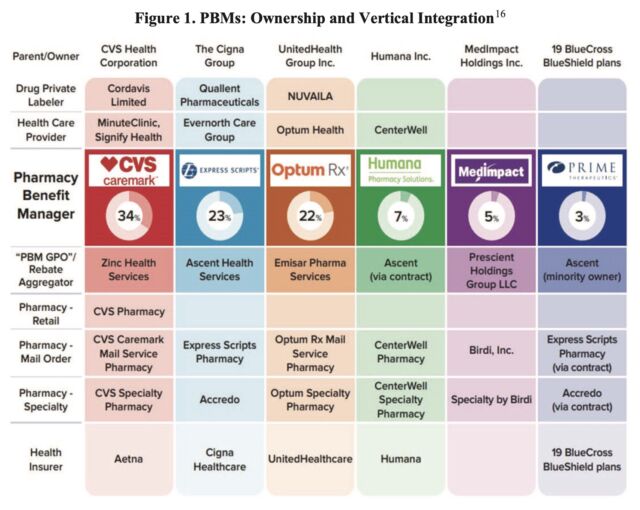

PBMs were originally hired by various payers — employers, health insurers, government health plans and others — to administer prescription drug benefits through various plans. But PBMs have evolved over the years to also negotiate rebates from drugmakers, set reimbursements for pharmacies that dispense medications and develop drug formularies (the list of medications a health plan covers). While those functions alone give PBMs considerable power, consolidation and integration in recent years have concentrated that power in troubling ways, the FTC report found.

The three largest PBMs in the country today – CVS Caremark, Express Scripts and Optum Rx – will fill nearly 80 percent of the nearly 6.6 billion prescriptions dispensed in 2023. But these large PBMs aren’t standalone companies; they’re integrated into massive corporate conglomerates that include some of the nation’s largest health insurers, as well as retail pharmacies, including specialty pharmacies, mail-order pharmacies and, in the case of Caremark, one of the nation’s largest retail pharmacy chains. Recently, these massive conglomerates have even moved into private drug labeling, where they partner with drugmakers to distribute medications themselves under various brand names.

Gross income

In the FTC’s investigation to date, the commission has found evidence that PBMs are steering people to their member pharmacies, which disadvantages small, independent pharmacies, and allowing their member pharmacies to rake in payments that are “grossly higher” than average drug costs. For example, for two generic cancer drugs (one for prostate cancer and the other for leukemia), pharmacies affiliated with the top three PBMs collectively brought in nearly $1.8 billion in revenue from 2020 to 2022. That represents a $1.6 billion excess in revenue over the national average cost for the drugs. In other words, pharmacies not affiliated with the top PBMs would otherwise have had less than $200 million in revenue for the same drug dispensing.

Furthermore, the FTC found evidence that large PBMs and large pharmaceutical companies collude to exclude a competing manufacturer's lower-priced drugs from a PBM's drug list in exchange for certain prices and discounts.

“The FTC’s interim report details how dominant pharmacy benefit managers can drive up drug costs, including overcharging patients for cancer drugs,” FTC Chair Lina Khan said in a statement. “The report also details how PBMs can squeeze out independent pharmacies that many Americans, especially those in rural communities, rely on for essential care. The FTC will continue to use all of our tools and authority to investigate dominant players in health care markets and ensure that Americans have access to affordable health care.”

The commission released the report on a 4-1 vote. The two Republican commissioners issued statements expressing concern that the interim report was based on limited data and evidence. The FTC report noted that some PBMs have not fully responded to the commission’s orders from two years ago. However, the FTC said that if PBMs do not comply or continue to delay, the commission will take them to court.

In a response to The New York Times, Justine Sessions, a spokesperson for PBM Express Scripts, disputed the FTC's report. “These biased conclusions will do nothing to address the rising prices of prescription drugs that are driven by the pharmaceutical industry,” she said.