Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) reported results in line with analyst expectations in Q2 CY2024, with revenue growing 28.1% year-over-year to $63.08 million. The company’s full-year outlook also came in close to analyst estimates, with revenue estimated at $236 million at the midpoint. The company suffered a GAAP loss of $0.05 per share, narrower than earnings of $0.16 per share in the year-ago quarter.

Is Now the Time to Buy Kura Sushi? Find out in our full research report.

Kura Sushi (KRUS) Q2 CY2024 Highlights:

-

Gain: $63.08 million vs. analyst estimates of $63.1 million (small miss)

-

EPS file: -$0.05 vs analyst estimates of $0.03 (-$0.08 miss)

-

Company has dropped its full-year revenue forecast from $244.5 million to $236 million at the midpoint, down 3.5%

-

Gross margin (GAAP): 17.3%, down from 21.1% in the same quarter last year

-

Locations: 64 at the end of the quarter, up from 46 in the same quarter last year

-

Same store sales were the same year-on-year (10.3% in the same quarter last year)

-

Market capitalization: $695.9 million

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated: “We believe the current headwinds are macro-driven and temporary, but given the difficulty of predicting the duration of macroeconomic shifts, we believe the most prudent course of action is to position ourselves to continue delivering strong financial results and uninterrupted progress against our key strategic goals of at least 20% annual unit growth, G&A leverage and operational excellence, regardless of the broader economic environment. While the third quarter results were unexpected, there has been no change in Kura Sushi's tremendous potential.”

Kura Sushi (NASDAQ:KRUS) is a sushi restaurant chain known for its conveyor belt style of food brought to guests. They serve traditional Japanese cuisine with a modern, technological twist.

Dining at the table

Sit-down restaurants offer a full dining experience with table service. These establishments span a variety of cuisines and are known for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or just relaxing. Their extensive menus range from appetizers to delicious desserts to wines and cocktails. This space is extremely fragmented, and competition includes everything from publicly traded companies that own multiple chains to small, family-owned restaurants with one location.

Sales growth

Kura Sushi is a small restaurant chain, which sometimes has disadvantages compared to larger competitors that benefit from better brand awareness and economies of scale. On the other hand, an advantage is that growth rates can be higher because it is growing from a small base.

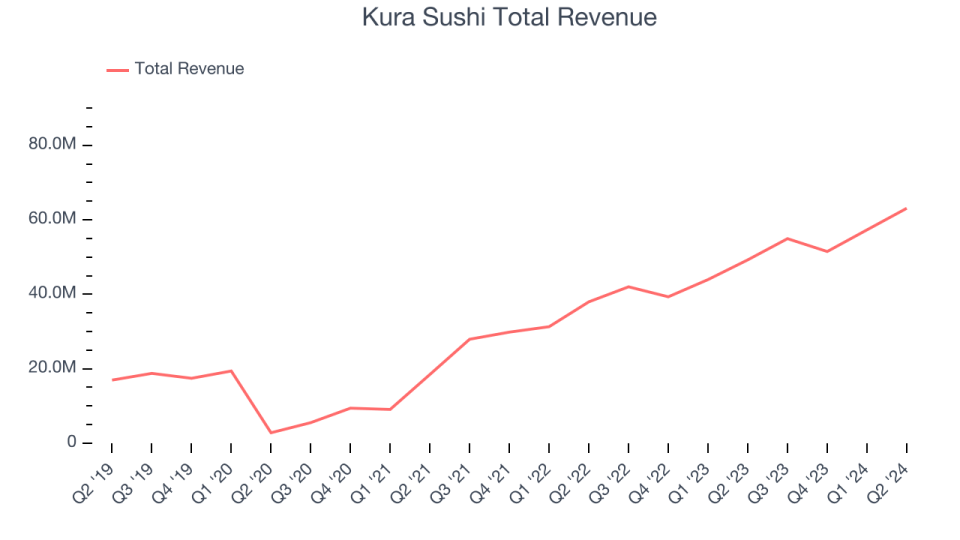

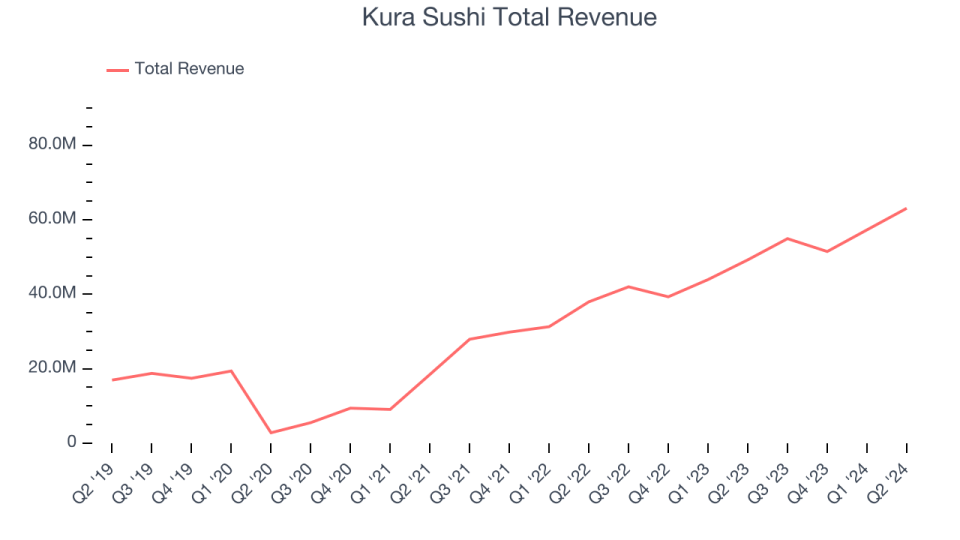

As you can see below, the company's annual revenue growth of 30.4% over the past five years has been incredible. The company has opened more eateries and increased sales at existing, established restaurants.

This quarter, Kura Sushi generated an excellent 28.1% year-over-year revenue growth, but the $63.08 million revenue fell short of Wall Street’s lofty expectations. Looking ahead, Wall Street expects revenue to grow 22.1% over the next 12 months, a slowdown from this quarter.

Unless you’ve been living under a rock, it should be clear by now that generative AI is going to have a huge impact on the way big companies do business. While Nvidia and AMD are trading near all-time highs, we favor a lesser-known (but still profitable) semiconductor stock that’s benefiting from the rise of AI. Click here for our free report on our favorite semiconductor growth story.

Same store sales

Sales growth in existing stores is a key performance indicator used to measure organic growth and demand for restaurants.

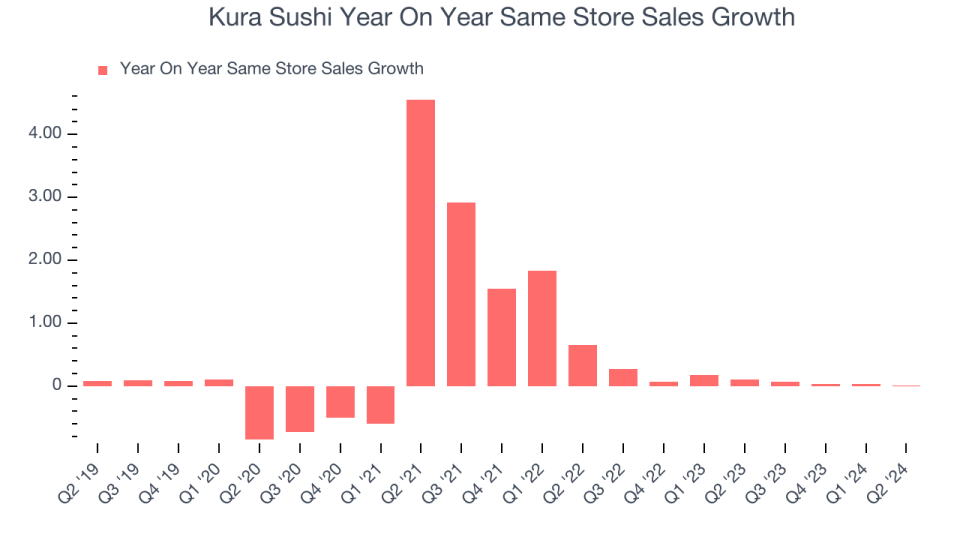

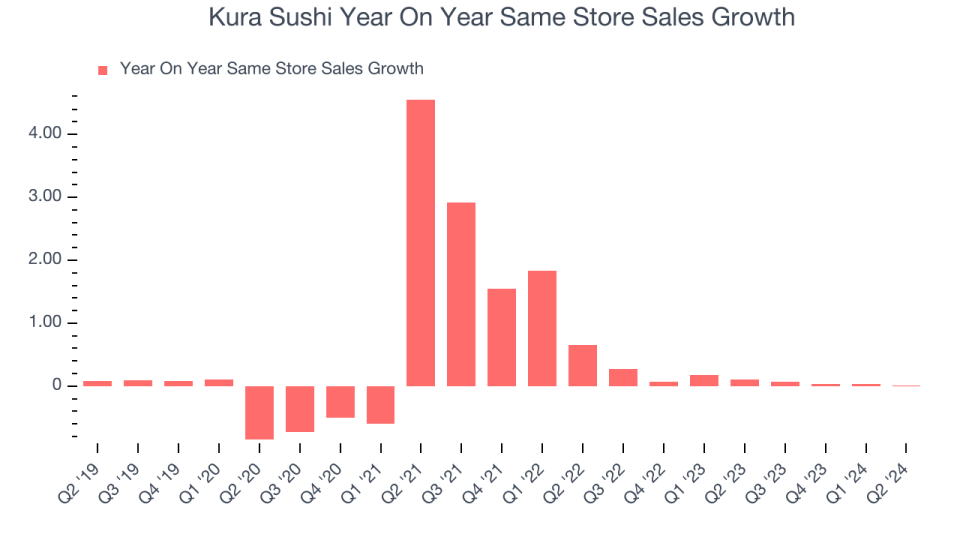

Demand for Kura Sushi has outpaced the broader restaurant industry over the past eight quarters. On average, the company has grown its same-store sales by a robust 9.5% year over year. With positive same-store sales growth amid a growing number of restaurants, Kura Sushi is reaching more guests and growing sales.

Kura Sushi’s same-store sales growth was flat year-over-year in the latest quarter. By the company’s standards, this growth was a meaningful slowdown from the 10.3% year-over-year increase it posted 12 months ago. We’ll be keeping a close eye on Kura Sushi to see if it can accelerate growth again.

Key Takeaways from Kura Sushi's Q2 Results

We struggled to find many strong positives in these results. Revenue, gross margin and EPS fell short of analyst expectations. Overall, this was a lackluster quarter for Kura Sushi. The stock was flat at $59.04 immediately following the report.

So should you invest in Kura Sushi now? When making that decision, it’s important to consider its valuation, its business qualities, and what happened in the last quarter. We cover that in our actionable full research report which you can read here, it’s free.