Snap, Snapchat’s parent company, reported its second consecutive drop in quarterly revenue on Tuesday as it continued to struggle to bring in more ads.

The social media company reported revenue of $1.07 billion for the second quarter, down 4 percent from a year earlier. In April, Snap reported a 7 percent year-over-year revenue decline, the company’s first quarterly drop in revenue since going public in 2017.

Snap posted a net loss of $377 million for the second quarter, which was smaller than a year earlier but its sixth consecutive loss.

“Our revenue growth continued to be challenging,” Snap wrote in an investor letter with its financial results, acknowledging that “we are a long way from achieving the revenue growth we are aiming for.”

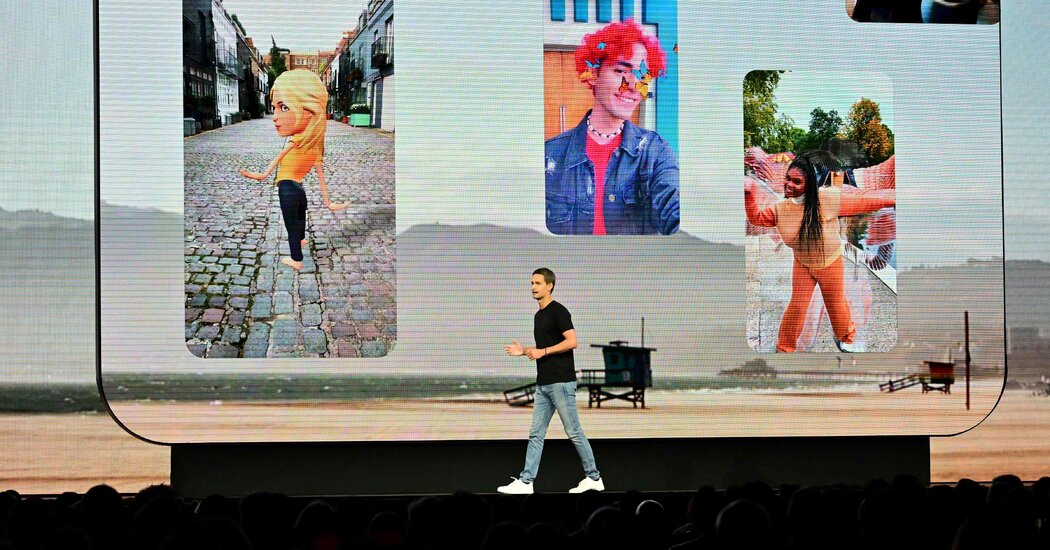

Snap, which is led by one of its founders, Evan Spiegel, is grappling with an industry-wide advertising slump triggered by a broader economic slowdown. Over the past year, the company has made layoffs, re-prioritized some of its business initiatives and reorganized some of its executives to meet the challenges.

But even as lower ad spending has plagued big tech companies like Google and Meta over the past year, Snap’s troubles have been particularly difficult. As a smaller social media company with a smaller audience, this isn’t always the first stop for advertisers. And it faces stiff competition from rivals like TikTok, which has gained users faster and is now bigger than Snap.

In the investor letter, Snap said it made changes to its ad platform this year to try and increase the number of users who interacted with an ad after clicking it. But some major advertisers were “disturbed,” the company said, adding that the shift will nevertheless lead to “sustained revenue growth over time.”

To increase advertising, Snap has also tried to attract more creators with a revenue sharing program and tested sponsored links in its artificial intelligence-powered chatbot, My AI, where users receive ads based on their chat history with the bot. To diversify where it makes money, Snap rolled out a subscription service called Snapchat+ last year, and it’s gained more than four million users.

Still, the company’s challenges are likely to continue. Jasmine Enberg, an analyst with Insider Intelligence, said these new initiatives “weren’t quite enough to move the needle for the company just yet.” She added, “I don’t expect the ad business to kick in until the economy does.”

For the current quarter, Snap projected revenue to be $1.07 billion to $1.13 billion, just catching Wall Street’s estimates of $1.13 billion.

One bright spot for Snap was the number of users, which increased. Daily active users reached 397 million in the second quarter, up 14 percent from a year earlier. Most of that growth came from outside the United States, the company said.