Wages rose at a rapid pace throughout the year through March and unemployment fell significantly last month, signs of a hot labor market that could put pressure on the Federal Reserve, which is considering how much and how fast the economy should be. cooled down.

The central bank is trying to slow demand to a more sustainable pace at a time when inflation has reached its highest rate in 40 years. Fed officials began raising interest rates in March and have suggested they could raise interest rates by half a percentage point in May — twice as much as normal. Making money more expensive to borrow and spend can slow consumption and ultimately hiring, dampening wage and price growth.

Friday’s employment report could bolster the case for an increase of at least half a point.

Wages have risen 5.6 percent in the past year, the report finds, a much faster pace than the 2 to 3 percent annual wage increases that were typical in the 2010s. At the same time, the unemployment rate of 3.8 percent fell in 2010. February to 3.6 percent in March. Unemployment is now just above the half-century low it had reached before the pandemic.

“The wage figure from a year ago remains very strong; it ends any debate about whether the unemployment rate is a reliable, trustworthy signal about the labor market,” said Michael Feroli, the US chief economist at JP Morgan. “The job market is tight.”

While the strong labor market has given policymakers confidence that they can slow the economy somewhat without triggering a recession, rapid wage increases could also perpetuate price increases by supporting consumer demand and encouraging companies to raise prices as they move forward. trying to cover the higher labor costs.

“The promise of rising wages is a great asset,” Fed chairman Jerome H. Powell said after the central bank’s decision to raise interest rates last month. But the increases “run at levels well above what would be consistent with 2 percent inflation — our target — over time.”

The March employment report showed that wages were growing year on year even faster than when Mr Powell made his comment.

Investors had already expected a half-point gain in May, but after the report’s release on Friday, markets became more determined in that forecast. The likelihood of a major rate hike at the central bank’s June meeting also increased.

Rapidly rising wages come as employers compete for a finite pool of workers. There are about 1.8 job openings for every unemployed worker, and companies complain that they struggle to hire people in a variety of skills and sectors.

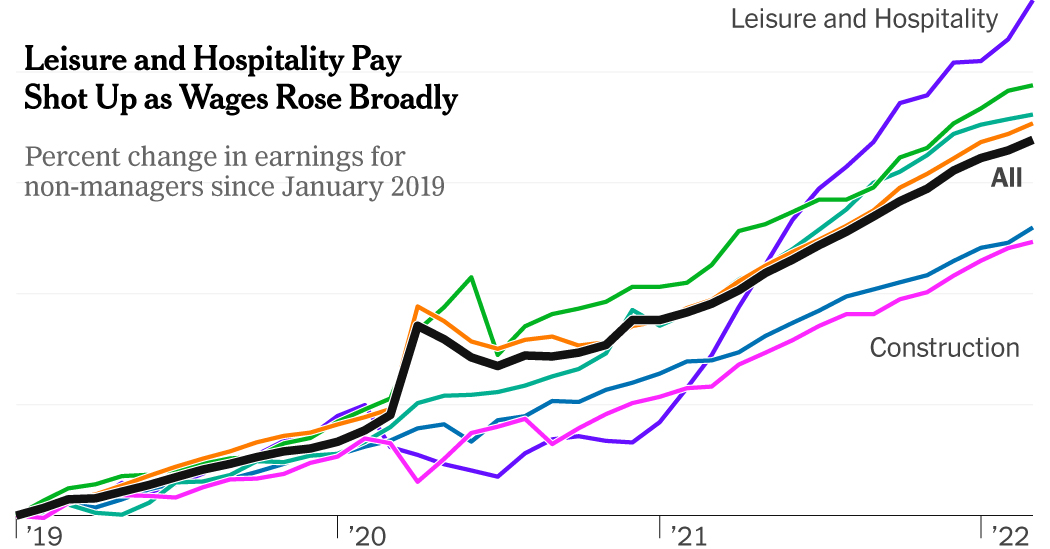

Over the past year, wages have increased especially for leisure and hospitality workers, up 14.9 percent, and transportation and warehousing workers have also received double-digit pay increases. Those numbers are for employees who are not supervisors.

Leisure and hospitality wages rose again significantly last month, while wages also rose sharply for workers in the financial and durable goods industries.

Some economists have welcomed that wage increases, while still rapid, appear to have slowed somewhat on a monthly basis this year compared to the high rates they reached last year.

But several are pointing out that the current pace, following a year of rapid gains and accompanied by lingering labor restrictions, is likely enough to keep the Fed on its toes.

“If it stays this tight, a wage-price spiral will only accelerate from here,” said Mr Feroli. Of the Fed, he said, “I think they probably think it’s unsustainable.”

Rapid wage growth is a boon to many workers, although families find that their pay, while higher, no longer buys as much as prices rise. For many workers, wage increases are not keeping pace with inflation.

Still, President Biden spoke of rapid progress in the labor market and wage increases as a positive for the economy and an “explanation of the kind of economy we’ve been fighting for” as he set policy.

“After decades of abuse and underpaid work, more and more American workers now have real power to get better wages,” Mr Biden said. “Some people see this as a problem – we’ve had this discussion in the past. Not me. I see it as too late.”

But the White House is also concerned about inflation. The Biden administration is extracting oil from strategic reserves to try to lower gas prices. The government will also allow a slightly larger number of seasonal workers from abroad to come to the United States this summer to help ease the tight labor market.

High demand isn’t the only driver of rapid inflation – prices have also risen as supply chains fell behind early in the pandemic and struggled to bounce back. But the fact that people want to buy furniture, clothes and restaurant meals keeps inflation on the rise.

As the economy adds jobs at higher wages, many households are taking in more money than they would otherwise. That could keep consumer demand strong even as the Fed begins to raise interest rates.

“That’s a lot of buying power to fight for,” said Diane Swonk, chief economist at Grant Thornton. “The job market is a very important part of the overall story.”

Gene Lee, the chief executive of Darden Restaurants, said on a March 24 earnings call that he expected consumers could continue to eat out even as pandemic-related government incentives fade from view and gas prices rise, hurting household budgets. Darden’s brands include chains such as Olive Garden, LongHorn Steakhouse and Yard House.

While the restaurant chain increased prices by 6 percent in the final quarter of fiscal 2021 compared to the same period last year, wages at the lower end of the revenue spectrum rose more than that.

“We believe wage inflation across the country is rising at a fairly rapid pace,” he said. “And so we believe that consumers can now handle that.”