The stock market is in turmoil and investors face a tricky question: Will the rally continue?

The S&P 500 index posted gains for the fifth straight week on Friday, its longest winning streak since fall 2021.

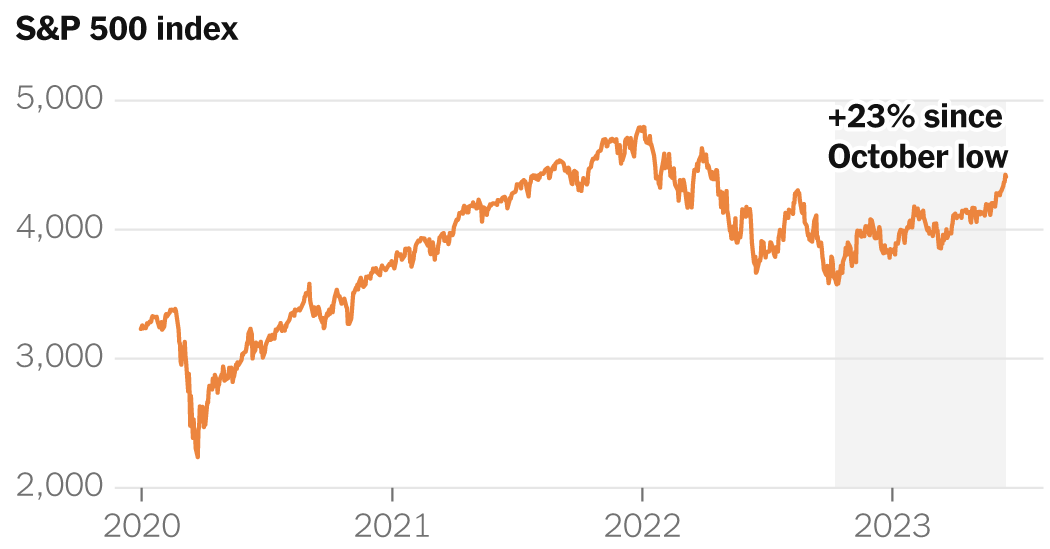

It’s a remarkable run, given the background. After a series of rate hikes by the Federal Reserve to contain historically high inflation, many investors feared that the Fed’s drastic action would push the country into a more serious downturn. But the S&P 500 ended Friday 19 percent higher than a year ago, 23 percent above its October low and about 8 percent off a record high.

Some investors have even labeled this period as the start of a bull market, or a period of exuberance marked by one definition by a 20 percent gain from a recent low. Once stocks cross this threshold, the bulls say, they’ll keep rising.

Others are unconvinced and warn that the recent rise could be a bear market rally – a short-lived period of optimism within a longer-running downtrend.

The reason for a bull market

The bulls base their argument on signs of a resilient economy, cooling inflation and an approaching end to the Fed’s rate hike cycle. So far, if the economy has survived the onslaught of rising inflation and higher interest rates, it may continue.

Unemployment is low and consumers are spending money, leading to higher-than-expected corporate profits. Inflation has eased and the Fed opted this week to leave interest rates unchanged for the first time in more than a year.

Bank of America analysts recently declared that the bear market was “officially over,” noting that historically, after rising 20 percent from a low, the S&P 500 more often than not continued to rise over the next 12 months. According to data going back to the 1950s, the index has risen an average of another 19 percent over that period.

Fears of missing out on bumper returns as stocks continue to rise may also lure investors on the sidelines back into the market, prolonging the rally as they join the buying spree, Bank of America analysts said.

Analysts at Goldman Sachs last week raised their year-end forecast for the S&P 500, predicting the index would rise another 5 percent from last Friday’s level. Since then, the index has risen 2.6 percent.

A general warning about the current rally is that it’s largely the result of a few big tech companies moving higher, such as chipmaker Nvidia’s 200 percent rise in share price. The average stock in the S&P 500 is up just 6.7 percent this year, less than half of the index as a whole.

However, a broader rally is starting to take shape. The average stock in the S&P had hardly fallen until early June, but has since made strong gains. The Russell 2000 Index, which tracks the performance of smaller companies more exposed to the ups and downs of the domestic economy, is up 7 percent in June alone.

Why the bears don’t see it that way

Bears are focused on the obstacles ahead: inflation has fallen but remains high, and cracks are appearing in some key areas of the market.

The fall of three medium-sized banks in the spring has caused other lenders to become more cautious, limiting lending and limiting the availability of cash for businesses and consumers.

When it comes to banks, “I think there are more weak links,” said Kathy Jones, chief fixed income strategist for the Schwab Center for Financial Research.

Business failures are on the rise, and some investors fear this is just the beginning of deeper problems as low interest rate debt falls due and borrowers face much higher costs to refinance. This is a particular concern for the commercial real estate market.

The slow slide into greater economic turmoil is more a result of the extraordinary amount of stimulus that was built up during the pandemic, but even that is beginning to wane. Consumer savings are starting to run out and credit card balances have increased. “It takes time to work through it,” said Ms. Jones.

The bulls believe the Fed is close to ending the war on inflation, but the bears fear the final battle is yet to begin. Inflation is still more than twice the Fed’s target rate of 2 percent and could remain stubbornly high. That could lead to the Fed driving up rates and, crucially, keeping them high for longer, putting further pressure on the economy.

This week, the stock market slumped as Fed officials unexpectedly predicted two more rate hikes by quarter points by the end of the year. But such predictions have been wrong before; investors quickly shrugged them off and stocks started rising again.

George Goncalves, head of US macro strategy at MUFG Securities, thinks that’s a mistake.

“The signaling that the Fed is doing, and the fact that they’re committed to a higher interest rate regime, means it’s hard to fathom that we won’t see other risks popping up and breaking along the way,” he said.