Federal Reserve officials have indicated they could keep interest rates stable at their upcoming meeting in June — pausing after 10 consecutive rate hikes to assess whether their changes so far are enough to slow the economy and curb rapid inflation. to fight.

Central bankers can stay on track for that more patient approach even after jobs data released on Friday showed strong hiring in May. While employers continued to add workers, other aspects of the report, including a rise in unemployment and a slowdown in wage growth, clouded the signal coming from the data.

Investors seemed to think the complicated employment report could make the Fed’s decision more challenging, but not so much as to be a game changer. Wall Street raised the likelihood of a rate hike this month after the report, based on financial market prices. Still, they only saw a one-in-three chance of an increase.

Fed officials have hiked interest rates sharply over the past year and a half to a range of 5 to 5.25 percent, a sharp increase from near zero at the start of 2022. After all those adjustments, policymakers have prepared to halt interest rate movements at every meeting. Pausing gives their policies more time to flesh out, while reducing the risk of policymakers going too far.

Officials want economic growth to slow, as they believe a cooling is needed to bring inflation back under control. But at the same time, they don’t want to strain the economy and cause a more painful setback than necessary by exaggerating their policy response.

Several central bankers have said or suggested they could leave interest rates stable from their June 13-14 meeting so they can assess how the economy is responding to both their policy changes and the recent banking turmoil.

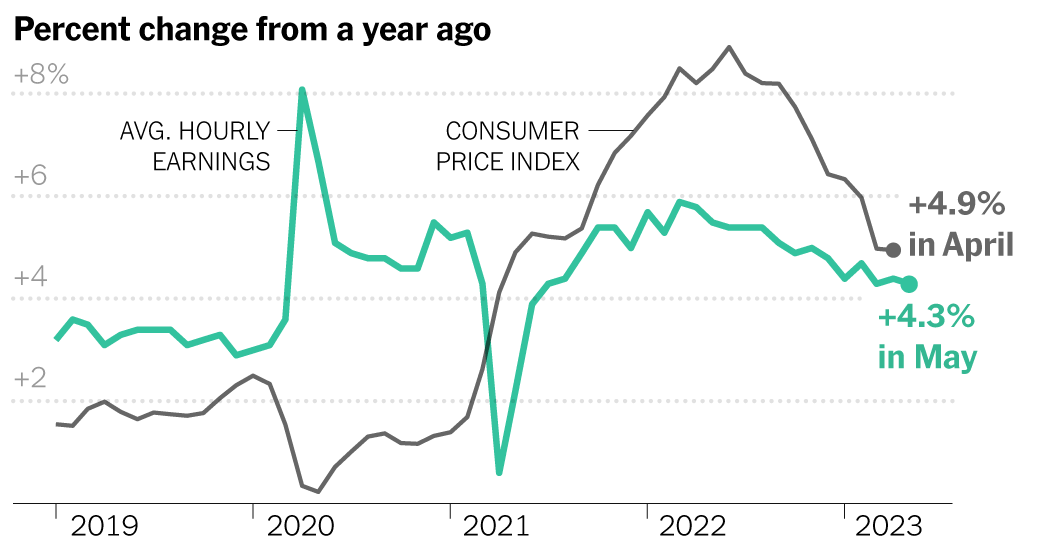

Higher interest rates cool the economy by making it more expensive to take out a loan to buy a house or car, but they take time to take full effect. Companies are gradually pulling back on expansion plans and cutting back on hiring as higher borrowing costs take their toll. This should ultimately lead to weaker wage growth and a slower economy.

That’s why labor market data is so crucial: it’s a referendum on how well policies are working to cool the economy, and they indicate whether inflation is likely to slow. Officials fear rapid wage increases could prompt companies to continue raising prices rapidly while trying to prevent higher labor costs from eating into profits.

Friday’s numbers provided some evidence that the Fed’s policy is working as expected. The unemployment rate climbed to 3.7 percent, from 3.4 percent in the previous reading, and wage growth slowed slightly.

Still, May added 339,000 jobs, far more than economists had expected and an increase from the previous month. And that was on the heels of several months of rapid job growth.

The conflicting evidence – of softening on the one hand and resilience on the other – was due in part to the fact that the jobs report consists of two different surveys, each sending a different signal in May. The labor market split screen may make the Fed’s job of figuring out how to set policy more challenging.

“They have a tough conversation ahead of them in June,” said Gennadiy Goldberg, an interest rate strategist at TD Securities.

But abnormally strong recruitment alone may not be enough to discourage Fed officials from wanting to pause. The report’s other details — from hours worked to the unemployment rate — confirmed that the economy is cooling, said Julia Coronado, founder of MacroPolicy Perspectives.

The big gains in payrolls “is the anomaly here,” she said. “Everything points to a cooling of the labor market.”

Some Fed officials have previously said they prefer to postpone a rate hike in June. Patrick T. Harker, the president of the Federal Reserve Bank of Philadelphia, said this week that he was “definitely in the camp to skip any increase in this meeting.”

And in a signal that a pause could be imminent, a key official underlined this week that it doesn’t mean the Fed is done raising rates if the meeting doesn’t pass rate hikes.

“A decision to hold our policy rate constant at an upcoming meeting should not be interpreted as a sign that we have peaked for this cycle,” said Philip Jefferson, a Fed governor selected by President Biden to be Vice Chairman of the Federal Reserve. become an institution. said in a speech on Wednesday.

“Indeed, skipping a rate hike at an upcoming meeting would allow the committee to see more data before making decisions on the extent of additional policy tightening,” Mr Jefferson added. The Fed Vice Chairman has historically been a key communicator for the institution, broadcasting how core officials feel about the future policy path.

Fed policymakers will receive additional information about the economy before they have to make a policy decision: The Consumer Price Index inflation report will be released the day their June meeting begins. Given that, and the conflicting messages in the jobs report, they can avoid overhauling their plans.

“It’s just a weird, crazy mix,” Ms. Coronado said of the employment numbers.