Halie Smith’s commitment to Taylor Swift runs so deep that she feels she can trust her as a friend. After the pop star encouraged fans to vote in the 2018 midterm elections, Ms Smith registered. The 23-year-old’s most recent rite of passage — getting her first credit card — was also prompted by the singer.

When the 11-time Grammy winner announced her Eras Tour, her first in five years, Ms. Smith said she knew she had to “do everything in my power to get tickets.” So she signed up for a ticket through Capital One, which partnered with Ms. Swift to promote the tour and offer fans preferential access to pre-sale tickets.

“Taylor Swift was that push again,” says Ms. Smith, who lives in Pittsburgh. In addition to buying concert tickets, she hoped the card would help her build good credit. “When I applied, because of the Taylor presale, I realized the importance of financial literacy and maybe it should be pushed more in schools and colleges,” she said. Ms. Smith, who has cerebral palsy, was able to get four accessible seats for her and her friends for about $1,013, though she used her debit card because the total exceeded her credit card limit.

Still, getting a credit card was already a goal for Mrs. Smith, in part because her mother had encouraged her to build credit so she would have a good credit score when she moved into her own apartment, and Mrs. Swift’s concert deal led Mrs. Smith to take that financial step.

More than a decade ago, credit card companies appeared on college campuses to promote themselves to students, offering them free food or T-shirts in exchange for filling out applications for their first cards. This practice declined after Congress passed a law known as the Credit CARD Act in 2009 that provided sweeping protections for consumers, including limiting marketing to students on college campuses and at off-campus events.

But credit card companies have continued to use marketing practices aimed at young people, including partnering with their favorite music acts. Now, instead of free swag, the chance to see artists like Ms. Swift, Harry Styles or Shawn Mendes perform live many young music fans to sign up for their first tickets.

Like Capital One, Citi offers cardholders early access to concert presales through the Citi Entertainment program, which is free to enter and available to all Citi credit and debit cardholders. American Express offers some cardholders preferential access to Broadway show and concert tickets, in addition to exclusive access to some venues. But access to certain exclusive experiences, such as a three-day package to the Coachella Valley Music and Arts Festival, requires an American Express Platinum Card or Centurion Card – premium cards with exorbitant annual fees.

In the case of the Eras Tour, the demand was so great that millions of fans known as Swifties experienced hours of wait times and frustrating technical issues preventing them from getting tickets. During one of its pre-sale days, Ticketmaster said it received 3.5 billion system requests to purchase tickets for Ms. Swift’s tour. Some fans applied for their first credit card through Capital One to increase their chances of getting tickets. (Capital One didn’t respond to a question about whether the publisher had an increase in requests after Ms. Swift’s tour was announced.)

For other young fans, paying their first credit cards allowed them to pay for shows they couldn’t afford right away.

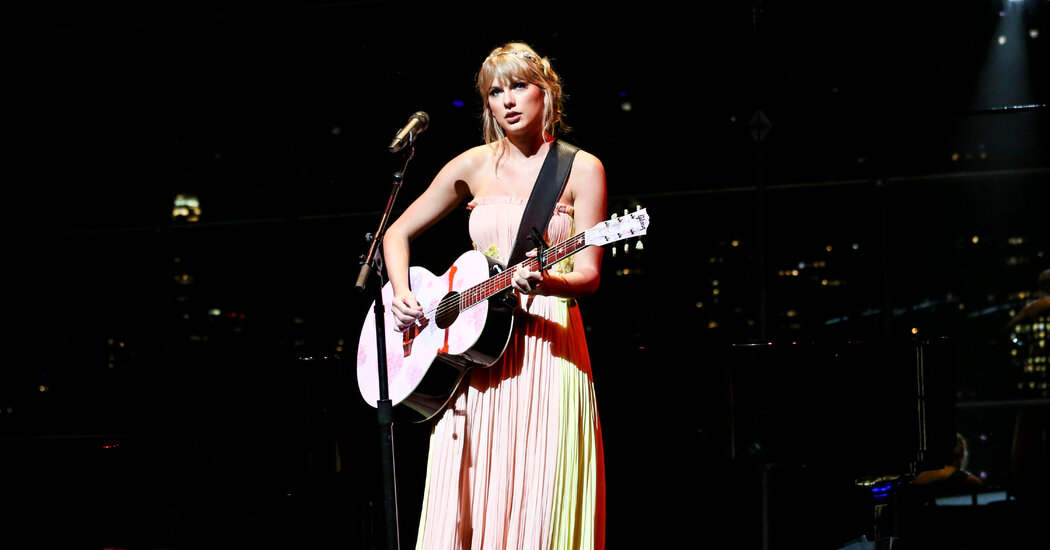

The cultural impact of Taylor Swift’s music

- New LP: “Midnights,” Taylor Swift’s 10th studio album, is a return to the pop pipeline, with production from her longtime collaborator Jack Antonoff. Here’s what our critic thought of it.

- Millennial Antihero: On her latest album, Swift explores the realizations and reckonings of many women in their thirties around relationships, motherhood and ambition.

- Lawsuit Beyond Lyrics: Weeks before a lawsuit to determine whether Swift stole the lyrics to her hit “Shake It Off,” a judge dismissed the case.

- Pandemic Records: In 2020, Swift released two new albums, “Folklore” and “Evermore”. Debuting a new sound, she turned to indie music.

Leah Garcia, a 21-year-old college student living in El Paso, is a fan of artists like Mr. Styles, Dominic Fike and The Driver Era. She recently spent about $800 on tickets to their shows using her first credit card, a Discover card.

“A lot of artists that I really love started announcing tours and I was like ‘Oh God, I don’t have any money in my bank account right now to buy tickets,'” Ms Garcia said. “So I decided to open a credit card just because I thought it would be easier to buy the tickets.”

Ms Garcia said she consulted her mother, who explained to her how to use the card responsibly and told her not to use it just for concert tickets. Ms. Garcia said she paid off her credit card so far before the bill was due with money she earned babysitting.

Nyazia Martin, a 28-year-old graduate student living in Louisville, Ky. lives, saw Reba McEntire at a concert in October and had such a good time that she applied for her first credit card to buy a ticket to another show in Indianapolis. Before signing up, she researched the best credit cards for college students and settled on a Discover card with a $500 limit.

Ms. Martin, who said she was discouraged by her mother from getting a credit card growing up because “it led to money problems,” spent about $280 for the ticket and also used the card to buy new red boots for the show to buy.

“It just feels like my Reba credit card,” said Ms. Martin, who planned to pay the balance in three installments.

Ms. Martin said she receives a grant to teach theater to undergraduate students and her program was fully funded. She now adheres to a strict budget compared to when she worked and had more financial flexibility.

Elliot Pepper, a financial literacy teacher and co-founder of Northbrook Financial, a wealth management and tax planning firm, said it was a positive thing for young people to get credit cards and use them responsibly, but he warned them not to fall for the marketing of companies.

“I’m afraid people are dying to use a credit card, thinking that with all the glitz and glamor of the marketing that credit card companies do, they’re going to get a deal one way or another,” he said. “A credit card is not free money. A credit card is just a short-term loan that you have to pay back.”

Mr. Pepper suggested reaping the benefits of having a credit card by signing up for a credit card that offers rewards and no fees, and paying off the balance in full each month. “Your goal should be to be the credit card company’s worst customer,” he said.

Jena Soliman considers going to concerts a priority and often travels with her friends to see her favorite artists perform. In 2019, the 23-year-old student saw Mendes on tour 10 times. Last year, Ms. Soliman saw Mr. Styles in concert eight times and said she spent between $3,000 and $5,000 on travel and tickets using cash and a credit card.

Ms. Soliman opened her first credit card through Capital One a few years ago to purchase tickets for Mr. Styles, which was postponed due to the pandemic. At that time, Ms. Soliman, who had already talked to her parents about getting a credit card, spent about $205 on one ticket.

“Once he announced his tour, that made it permanent for me,” Ms. Soliman said.

Ms. Soliman, who has since signed up for a second credit card through Discover, said she paid off her balance in full after using the card because her father had explained to her the importance of maintaining her credit score. She mainly uses the card for concert tickets and occasionally for small purchases such as gas.

Alyssa Smith, a 33-year-old living in Salt Lake City, is the same age as Ms. Swift and has listened to all of her albums since the beginning of the pop star’s career.

Ms. Smith, who works in the medical industry, said the Eras Tour was the first concert she felt financially stable enough to afford tickets for, so she decided to do everything she could to get a seat at one of the the shows of Mrs. Swift. She signed up for her first credit card after seeing Ms. Swift in a Capital One commercial and saw it as an opportunity to access presale tickets while also building her credit.

“I’m very excited because this is my first credit card,” said Ms. Smith. “I’ve been scared and financially as a millennial it’s pretty hard.”

Ms. Smith was given priority access during the presale because she bought tickets for Ms. Swift’s Lover Fest tour, which was canceled due to the pandemic, and because she bought merchandise for Ms. Swift’s new album before its release. Still, Mrs. Smith was unable to secure tickets due to high demand.