A recession seems less likely and fewer Americans are unemployed. That was bad news for stocks on Thursday.

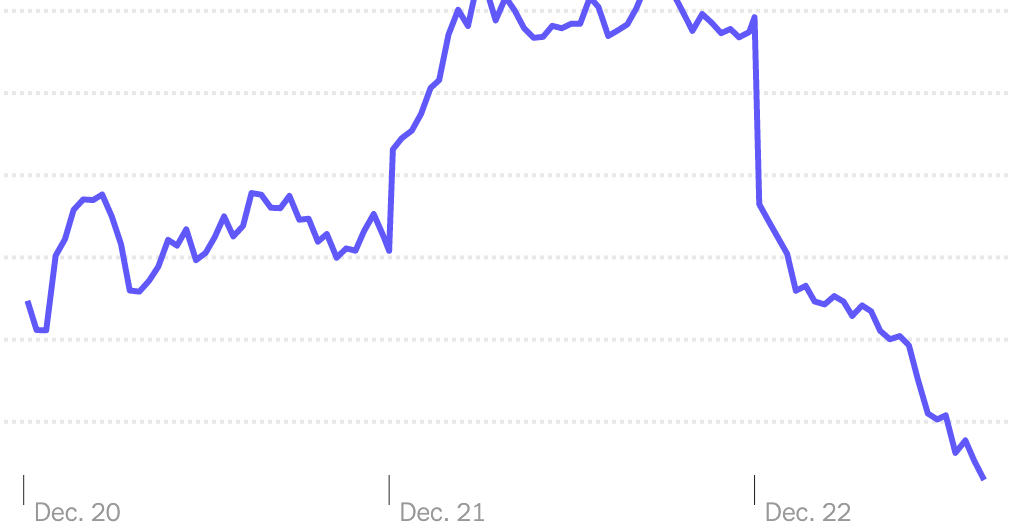

Major indices fell sharply as new economic data reignited concerns about the Federal Reserve’s attempts to fight inflation.

“We’re still in a bit of ‘good news is bad news for the market’ as better-than-expected economic data means the Fed will continue to be more restrictive in its policy,” said Jonathan Krinsky, chief market technician at brokerage firm BTIG.

The number of Americans filing new claims for unemployment benefits rose less than expected last week, Labor Department data showed on Thursday, suggesting the job market remains tight. At the same time, an update on gross domestic product indicated that the economy recovered faster in the third quarter than previously estimated.

Combined, the economic reports to investors suggested that the Federal Reserve may need to raise interest rates further and hold them longer in an effort to slow down the economy.

The state of affairs in the United States

Economists are surprised by the recent strength in the labor market as the Federal Reserve tries to induce a slowdown and contain inflation.

During afternoon trading, the S&P 500 was down nearly 3 percent and the tech-heavy Nasdaq index was down about 3.7 percent. By the end of the day, each index had gained some ground. The S&P and Dow fell 1.4 percent and 1 percent, while the Nasdaq ended 2.2 percent lower.

Stock trading was volatile throughout the week as investors struggled with the Fed’s determination to remain aggressive in its fight against inflation. Fed officials indicated last week that interest rates would rise more drastically than many expected as policymakers tried to fight stubborn price increases.

“We have more work to do,” Fed Chairman Jerome H. Powell said last week. His message reverberated around the world as central banks in Europe also announced new rate hikes.

The sale intensified Thursday after David Tepper, the billionaire founder of the hedge fund Appaloosa Management, said on CNBC that he was betting that stock prices would continue to fall.

“As a hedge fund manager, I’m going to lean short,” said Mr. Tepper, citing the global move by central banks to use higher interest rates and other monetary tightening measures to slow inflation.

“I think the pros and cons just don’t make sense to me when I have so many people telling me, so many central banks telling me what they’re going to do,” he said.

The latest gross domestic product update showed that the US economy grew at an unexpectedly strong annualized rate of 3.2 percent from July through September. That was higher than an earlier estimate of 2.9 percent. The quarter-on-quarter growth followed a contraction in the first half of the year.

Investors will get another update on consumer spending and inflation on Friday when the government releases its November Personal Consumption Expenditures Index. The Fed is following the report as a barometer of inflation.

Despite Thursday’s strong data, recent economic data has been mixed. Experts expect Friday’s report to show that inflation cooled further in November.

For Mr. Krinsky, Thursday’s sale came as no surprise. Stock price movements in December, especially towards the end of the month, reflect the longer-term trend that is already apparent. There are fewer market participants around to trade and they are unlikely to make bold bets at this time of year.

“We are still in a bear market,” Mr. Krinsky said, adding that he saw stock prices caught in a lose-lose scenario for the rest of the year.

“If economic data is better, the Fed will remain restrictive, and if economic data worsens, we are likely to be heading for a much deeper recession. That’s the lose-lose proposition for the market right now,” he said.