Gold has been a prized commodity for decades and is the most common form of currency used in transactions. The value of gold fluctuates based on supply, demand, government policies and economic factors. Bitcoin functions as money that is decentralized to avoid centralized manipulation like gold does. Here are five reasons why you should consider investing your time or money in Bitcoin now instead of waiting for gold to rise again

The “will crypto gold affect” is a question that is often asked. The answer to the question is no. Gold will not be affected by cryptocurrency as it is too slow and expensive to mine.

Many financial professionals have recommended investing in gold to hedge against volatility and a likely decline in the value of the US dollar due to the emergence of 40 years of high inflation and the increasingly bleak outlook for the global economy.

Bitcoin (BTC) has been referred to as “digital gold” by crypto traders for years, but is it a better investment than gold? Let’s take a look at some of the common reasons used by investors to defend gold as an investment, and why Bitcoin could be a superior long-term alternative.

Preserving Value

One of the most prominent justifications for buying gold and Bitcoin is that they have a track record of maintaining their value during periods of economic turmoil.

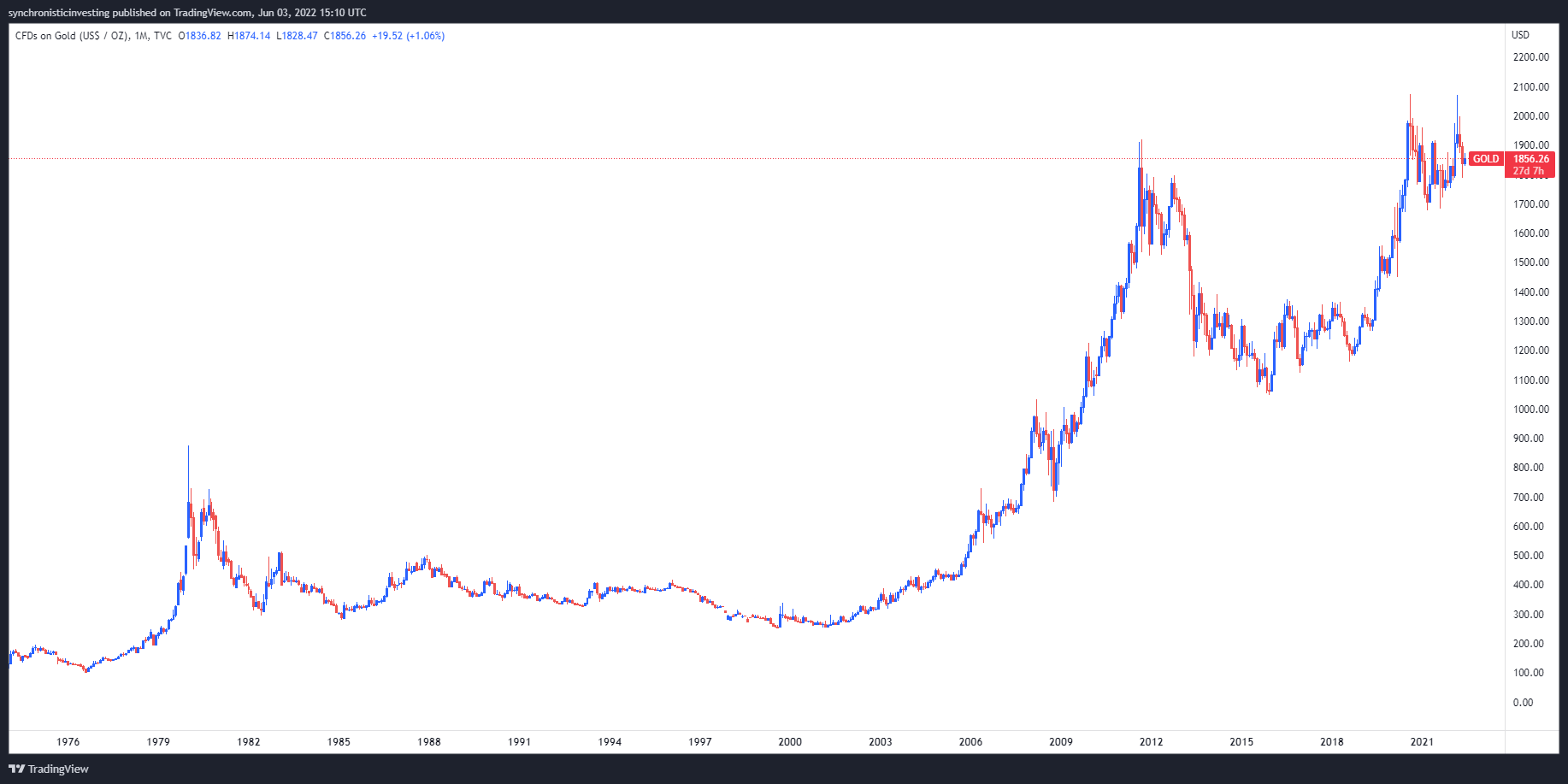

This is a well-known fact, and there’s no question that gold has historically provided some of the best asset protection, but it doesn’t always hold its value. Gold traders have also experienced prolonged periods of price declines, as can be seen in the chart below.

The cost of gold. TradingView is the source of this information.

For example, someone who bought gold in September 2011 would have to wait until July 2020 to be in the black again, and if they kept holding on, they would be nearly level or underwater again.

Bitcoin’s price has never taken more than three to four years to recoup and exceed its all-time high, indicating that BTC could be a superior repository of wealth in the long run.

Is Bitcoin a stronger inflation hedge than other currencies?

Because the price of gold tends to grow in tandem with the rise in the cost of living, it used to be thought to be an excellent inflation hedge.

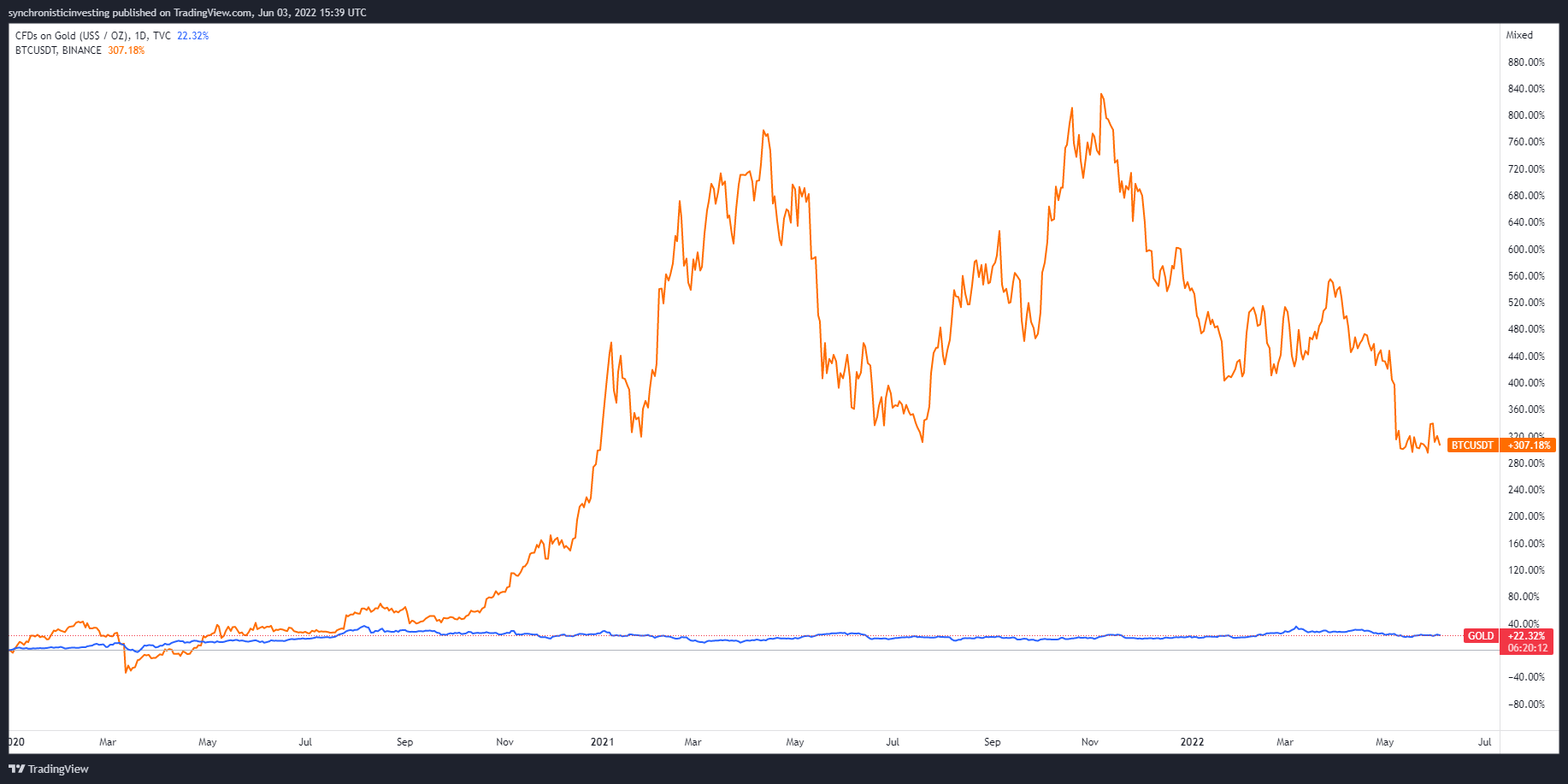

However, a closer look at the gold-to-Bitcoin chart reveals that while gold is up 21.84 percent over the past two years, Bitcoin’s price is up 311 percent.

One day chart of gold versus BTC/USDT. TradingView is the source of this information.

Holding assets that can exceed growing inflation helps create wealth rather than preserve it in a society where the general cost of living is rising faster than most people can sustain.

While the volatility and price declines in 2022 were unpleasant, investors with a multi-year time horizon have seen significantly greater potential in Bitcoin.

In times of global turmoil, Bitcoin can resemble gold.

Gold, otherwise known as the “crisis commodity,” is known for holding its value in times of geopolitical turmoil, with individuals known to invest in gold as global tensions mount.

Since gold is known as the ‘crisis metal’, I expect gold as a commodity to appreciate in value if we hit another recession.

Apr 22, 2022 — Scott Hempstead (@scottytrip1)

Carrying expensive things is a dangerous idea for individuals living in war zones or other unstable locations, as they can be exposed to seizures and theft.

For individuals in this position, Bitcoin is a more secure alternative, as they can learn a pronoun and travel without fear of losing their money. They can reassemble their wallets and access their funds once they arrive at their destination.

The digital nature of Bitcoin, as well as the availability of many decentralized markets and peer-to-peer exchanges such as LocalBitcoins, makes Bitcoin more accessible.

The dollar continues to depreciate.

The US dollar has been strong in recent months, but this is not always the case. Investors have been known to rush to gold and Bitcoin when the dollar’s value falls against other currencies.

If other countries continue to move from a US dollar-centric strategy in favor of a more multipolar strategy, there could be a significant amount of dollar flight, but that money will not be invested in weaker currencies.

Although gold has been the most sought-after asset for millennia, it is no longer widely used or recognized in our current digital culture, and most younger generations have never seen a gold coin.

Bitcoin is a better-known alternative to these groups, as it can be integrated into people’s digitally infused routines and requires no additional security or physical storage.

Argentines are turning to Bitcoin in the face of rising inflation, according to a new report.

Bitcoin is in a state of scarcity and deflation.

Scarcity and supply constraints for gold, due to years of declining production, are cited by many investors and financial professionals as reasons why gold is a smart investment.

It could take five to 10 years for a new mine to be produced, so a rapid increase in supply is unlikely, and central banks slashed their gold sales in 2008.

However, it is believed that there are still more than 50,000 tons of gold in the earth, which miners would be happy to concentrate on mining if prices were to rise significantly.

The promised realm of ‘true scarcity’ will never be reached by gold. The more the price rises, the more mining is done, increasing supply and decreasing the price. #gold #goldprice #bitcoin

March 7, 2022 — DeepSee-er (@ErDeepsee)

Bitcoin, on the other hand, has a finite amount of 21 million BTC that will never be generated, and its issuance is happening at a predictable pace. The public nature of the Bitcoin blockchain makes it possible to know and confirm the location of each Bitcoin.

There will never be one method to truly find and authenticate all the gold shops on Earth, meaning the actual stock will never be known. As a result, Bitcoin easily wins the scarcity argument and is the hardest form of money ever conceived by mankind.

Do you want to learn more about trading and investing in the crypto markets?

The thoughts and opinions of the author are entirely his or her own and do not necessarily reflect those of Cointelegraph.com. Every investment and trading choice has risks, so do your homework before making a decision.

Bitcoin is a cryptocurrency that has been gaining popularity over the years. Bitcoin has many advantages over gold, including that it is decentralized and has no central bank to control it. Gold also has some advantages, but bitcoin is catching up fast. Reference: When Will Bitcoin Overtake Gold.

Related Tags

- gold and bitcoin correlation chart

- bitcoin vs gold chart 10 years

- bitcoin vs gold argument

- is bitcoin gold a good investment?

- is it worth investing in bitcoin in 2021?