Over the past 7 days, the South Korean market has fallen by 2.1%, while the Information Technology sector has fallen by 3.5%. Despite this short-term volatility and flat performance over the past year, earnings are expected to grow by 28% per year over the next few years, making dividend stocks an attractive option for investors seeking steady income and potential growth.

Top 10 Dividend Stocks in South Korea

|

Name |

Dividend yield |

Dividend assessment |

|

Kia (KOSE:A000270) |

5.82% |

★★★★★★ |

|

LOTTE Fine Chemistry (KOSE:A004000) |

4.71% |

★★★★★☆ |

|

NH Investments & Securities (KOSE:A005940) |

6.29% |

★★★★★☆ |

|

Hyundai Steel (KOSE:A004020) |

4.03% |

★★★★★☆ |

|

Shinhan Financial Group (KOSE:A055550) |

3.98% |

★★★★★☆ |

|

KT (KOSE:A030200) |

5.40% |

★★★★★☆ |

|

Samyang (KOSE:A145990) |

4.06% |

★★★★★☆ |

|

KB Financial Group (KOSE:A105560) |

3.98% |

★★★★★☆ |

|

Kyung Nong (KOSE:A002100) |

7.28% |

★★★★★☆ |

|

HANYANG ENG Ltd (KOSDAQ:A045100) |

3.58% |

★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

We're going to take a look at some of the top picks from our screener tool.

Simply Wall St dividend rating: ★★★★☆☆

Overview: Samyang Holdings Corporation, with a market capitalization of ₩504.94 billion, is engaged in the chemical, food, packaging, pharmaceutical and other industries in South Korea and internationally through its subsidiaries.

Activities: Samyang Holdings Corporation generates revenues through its diverse operations in the chemical, food, packaging and pharmaceutical sectors in South Korea and various international markets including China, Japan, other Asian countries and Europe.

Dividend yield: 5.3%

Samyang Holdings has shown strong earnings growth, with net profit rising from ₩18.55 billion to ₩27.89 billion in Q1 2024. The company trades at a 29% discount to its estimated fair value and offers a class-leading dividend yield of 5.32%. Despite only paying dividends for five years, the low payout ratios (earnings: 15.5%, cash flow: 24.4%) suggest sustainable and well-covered dividends, although the track record is relatively short.

Simply Wall St dividend rating: ★★★★☆☆

Overview: Samyung Trading Co., Ltd. mainly supplies organic and inorganic chemical products worldwide and has a market capitalization of ₩220.88 billion.

Activities: Samyung Trading Co., Ltd. generates revenue from various segments, including Shoemaker (₩212.54 million), Spectacle Lens (₩15.57 million) and Automotive Parts (₩253.22 million).

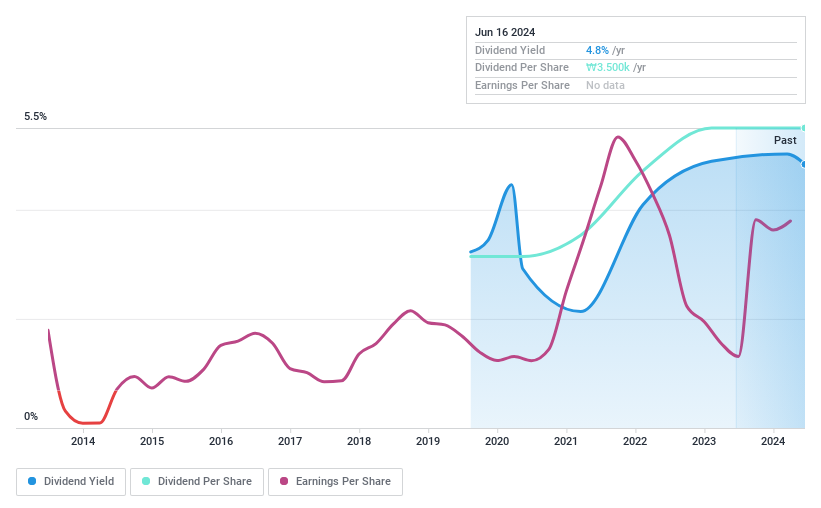

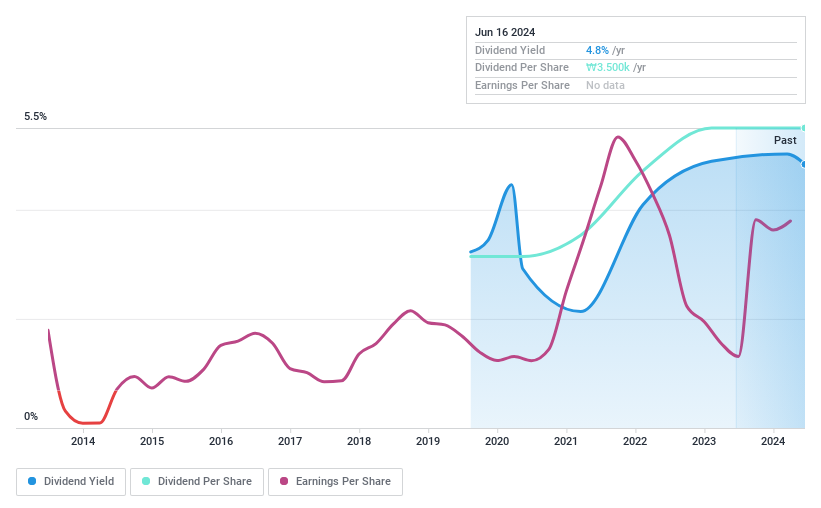

Dividend yield: 4.8%

Samyung Trading’s dividend payments are well covered by earnings (payout ratio: 19.6%) and cash flows (cash payout ratio: 48.4%), with a stable history despite the company being less than 10 years old. The company’s dividend yield of 4.79% places it in the top quartile of South Korean dividend payers. Recent earnings have shown strong growth, with net income rising from ₩11.61 billion a year ago to ₩15.55 billion for Q1 2024, further supporting dividend sustainability.

Simply Wall St dividend rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide, with a market capitalization of ₩185.57 billion.

Activities: Motonic Corporation's revenue segments include ₩354.20 billion from auto parts.

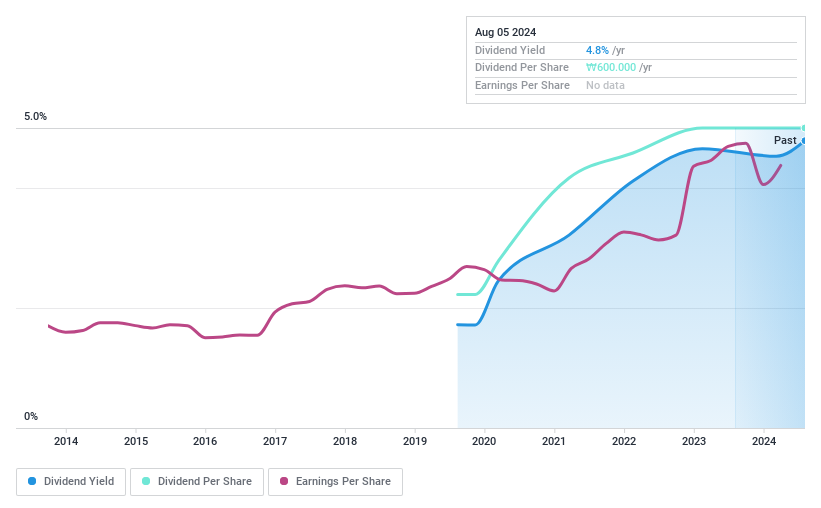

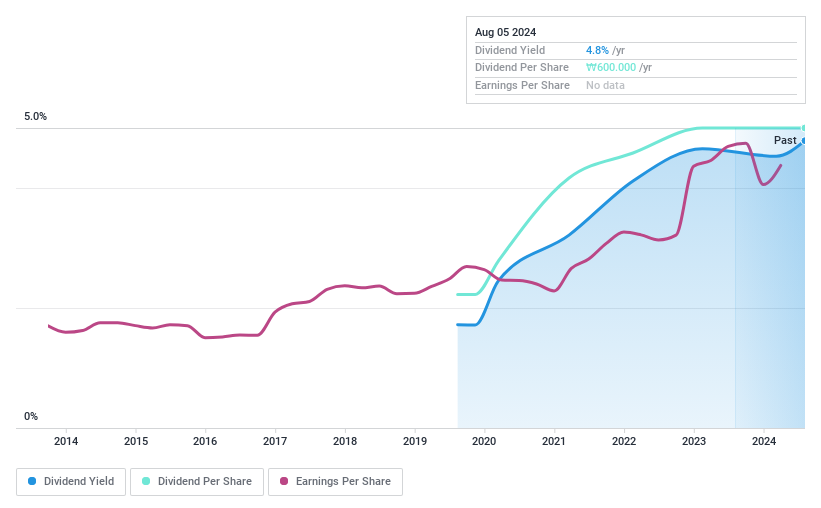

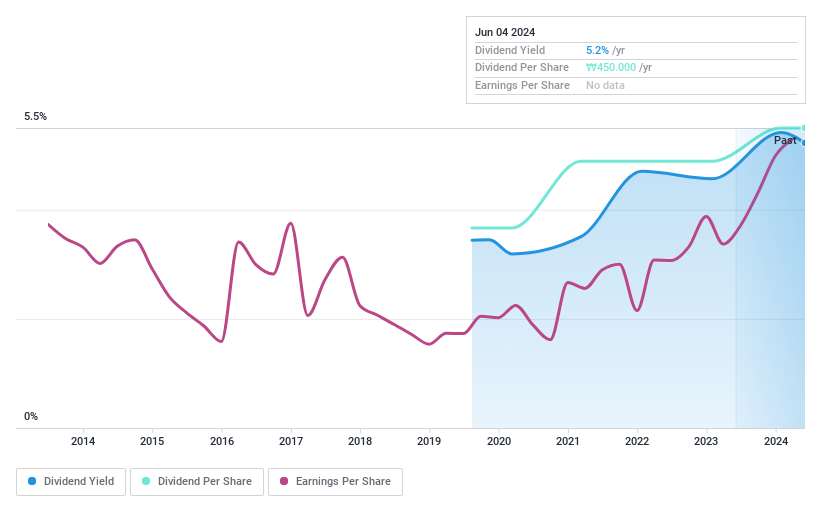

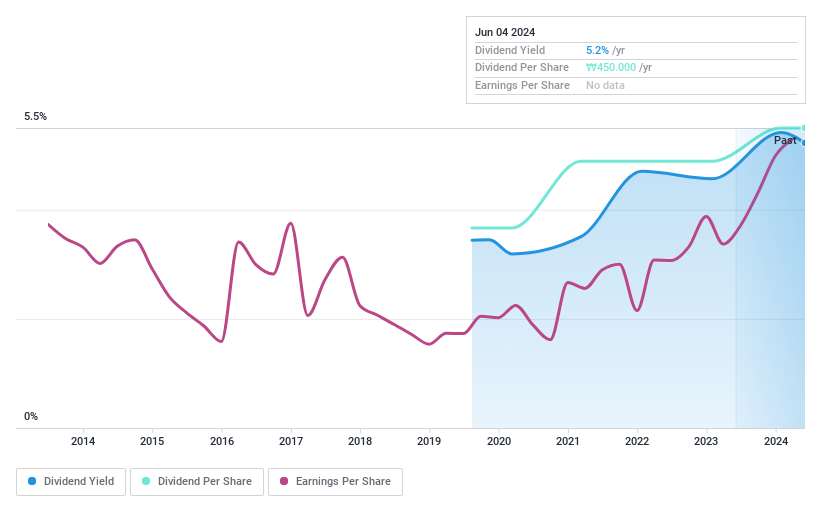

Dividend yield: 5.2%

Motonic’s dividend payments are well covered by earnings (payout ratio: 33.4%) and cash flows (cash payout ratio: 85.9%). The company has a competitive dividend yield of 5.24%, which places it in the top quartile of South Korean dividend payers, despite only having paid dividends for five years. Earnings growth of 56.3% over the past year supports its ability to maintain and potentially increase dividends despite a shorter track record.

Next steps

Ready for a different approach?

This article from Simply Wall St is of a general nature. We comment solely on historical data and analyst forecasts, using an objective methodology. Our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your objectives or financial situation. We aim to provide you with a long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in the shares mentioned.

The companies discussed in this article include KOSE:A000070, KOSE:A002810, and KOSE:A009680.

Do you have feedback on this article? Are you concerned about the content? Please contact us directly. You can also send an email to [email protected]