Flexible metal hose manufacturers are not exactly the type of companies that come to mind when you think of stocks with market-destructive potential. As a leader in this niche of flexible metal hoses, primarily corrugated stainless steel tubing (CSST), Omega flex (NASDAQ: OFLX) proves that monstrous returns can come from all kinds of stocks.

From the company's initial public offering (IPO) in 2005 through 2021, Omega Flex has delivered a total return more than six times that of the S&P 500 index. Even after Omega Flex saw a 74% share price decline in recent years, largely due to the cyclicality of its business and its sector, the company's returns since Omega Flex went public have been roughly in line with the S&P 500 index.

As alarming as this sell-off is, I can’t help but see it as a once-in-a-decade opportunity for investors with the patience to buy and hold for a decade. This is what makes Omega Flex an attractive investment.

Omega Flex moves hand in hand with the US housing market

Omega Flex CSST systems offer several advantages over traditional black iron fuel gas piping in residential and commercial construction. Unlike black iron or copper piping, which requires threads and separate fittings for each bend needed during construction, Omega Flex flexible piping can be bent by hand and installed in long, continuous lines throughout a building.

In addition to this simplified installation process, Omega Flex CSST outperforms rigid conduit during earthquakes and lightning strikes, making it more resistant to damage. These advantages have led to CSST now accounting for approximately 50% of fuel gas lines in new and renovated residential construction in the U.S. — a niche in which Omega Flex considers itself a leader.

The company continues to build on the patented rotary production process it developed in 1995, making its production capabilities as flexible as the CSST it sells. The company delivers its goods based on demand.

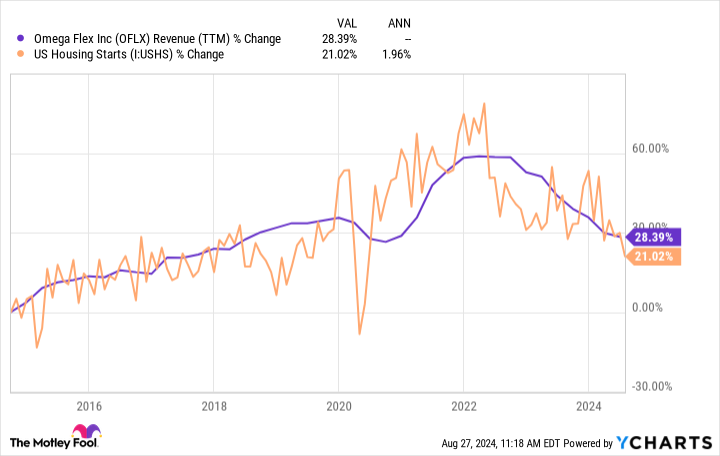

While this leadership position in a growing niche is promising, the vast majority of Omega Flex's revenue is related to the cyclical housing market in the United States.

Omega Flex has struggled in recent years with home sales going hand in hand with U.S. housing starts. As U.S. housing starts continued to slow as the market battled rising interest rates, the aftermath of high inflation, and an uncertain consumer in general, Omega Flex sales declined in tandem.

Research of Zillow shows that the U.S. housing market is still short 4.5 million homes and that consumers are hungry for more affordable housing. In the longer term, this should fuel growth in U.S. housing starts, but when this change will occur is uncertain.

Ultimately, with the Federal Reserve set to cut interest rates in September, the tide could turn for Omega Flex in the short term. And the best part for investors is that the company can currently be bought for what seems like a once-in-a-decade valuation.

An opportunity that only comes once in ten years

Regardless of when the turnaround in U.S. homebuilding growth happens, investors who buy Omega Flex can take comfort in knowing they’re getting a top-tier compounder at an excellent price. Even as the company finds itself in the trough of its economic cycle, Omega Flex currently has a return on invested capital (ROIC) of 24%.

When measuring the company’s profitability relative to its debt and equity, this resilient ROIC is indicative of a wide moat around Omega Flex’s operations. Historically, companies that generate a higher ROIC than their peers have proven to deliver outperforming stock returns, as this article suggests. In addition to this high ROIC, the company has maintained a net profit margin of 18% despite the challenging macroeconomic environment.

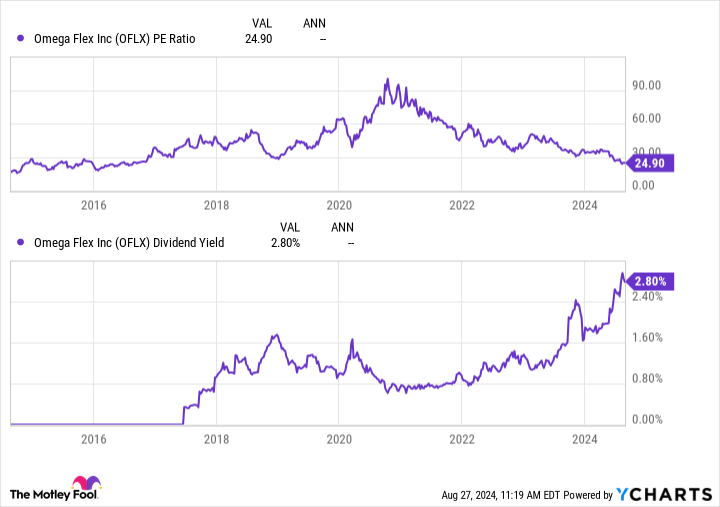

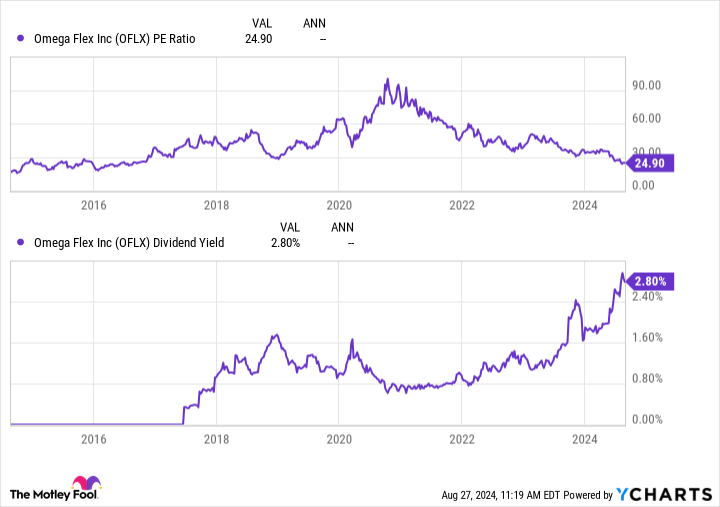

In terms of valuation, Omega Flex's price-earnings (P/E) ratio of 25 is close to a 10-year low and its dividend yield of 2.8% is a record high.

Despite these large dividend payments in a challenging operating environment, the company is only using 69% of its net income to fund its distribution. The company has typically paid out the majority of its profits to shareholders in recent years — including a hefty special dividend in 2019 — and management isn't afraid to give money back to shareholders. With insiders owning 25% of the company's stock, management is well-incentivized to keep growing these dividends — perhaps even at an accelerated pace once revenue growth returns.

Ultimately, Omega Flex isn’t the flashiest investment opportunity out there. However, the short- and long-term trends are starting to tip in Omega Flex’s favor. With the company’s highly profitable (albeit cyclical) business available at a valuation that only comes around once every decade, I think it’s a great dividend stock to buy and hold for decades.

Should You Invest $1,000 In Omega Flex Now?

Before buying Omega Flex stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Omega Flex wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Josh Kohn-Lindquist has positions in Omega Flex and Zillow Group. The Motley Fool has positions in and recommends Zillow Group. The Motley Fool has a disclosure policy.

A Once-in-a-Decade Chance: 1 Gorgeous Dividend Stock Down 74%, Buy It Now, Hold It Forever, originally published by The Motley Fool