-

Nvidia stock is close to bear market territory after falling 17% from its record high in November.

-

The sell-off has intensified since recent comments from Microsoft's CEO suggested the chip craze is waning.

-

Wedbush analyst Dan Ives sees Nvidia's decline as a temporary blip, with strong future AI prospects.

Nvidia stock has entered correction territory and some major shifts in the artificial intelligence narrative could put pressure on the stock as 2024 comes to a close.

The chipmaker's stock has fallen 17% since hitting a record high of $152.89 on Nov. 21. It's closer to a bear market, which Wall Street traders describe as a 20% decline from the most recent peak.

The AI darling's share price decline accelerated late last week after comments from Microsoft CEO Satya Nadella.

In an interview with Bill Gurley and Brad Gerstner of the B2 podcast, Nadella indicated that demand for AI chips may be declining.

When asked if Microsoft still had “supply constraints” as it built out AI technologies, Nadella replied: “I am the power [constrained]Yes, I am not limited in the supply of chips.”

He added: “We were certainly limited in '24. What we've told the Street is that's why we're optimistic about the first half of '25, the rest of our fiscal year. And after that, I think we will are in better shape in 2026 and so we have a good view.”

Since Nadella's comments, Nvidia shares have fallen 7%. Microsoft is considered Nvidia's largest customer, accounting for an estimated 20% of its revenue.

Nadella's comments suggest changing supply and demand dynamics for Nvidia's AI chips, which have seen huge demand over the past two years as companies rush to develop their own large language models.

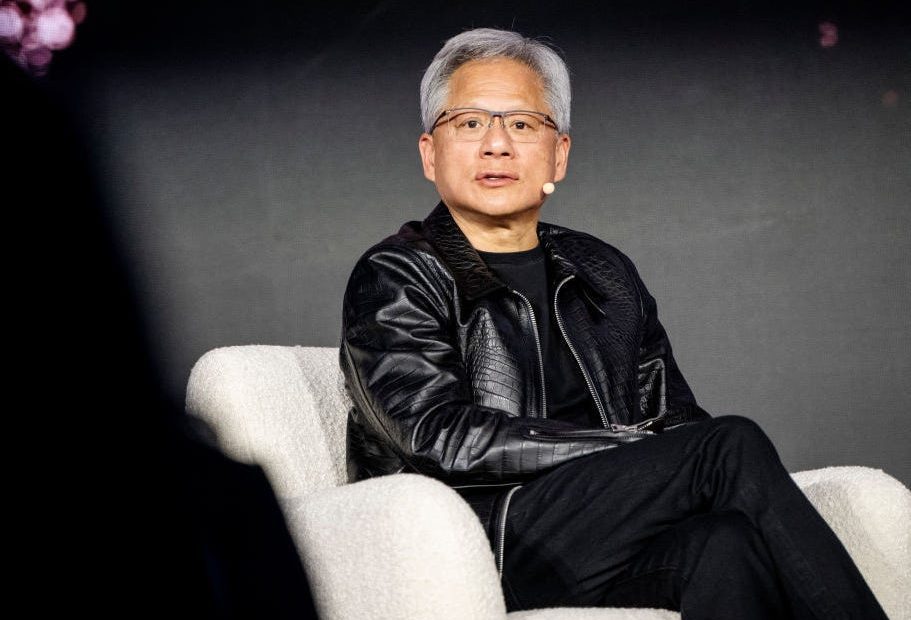

Demand for Nvidia's GPUs was so huge that the company had to selectively choose which companies would be prioritized for its chips, with stories of billionaire tech founders begging Nvidia CEO Jensen Huang for more chips at the dinner.

Nadella's comments that chip supply is no longer limited don't necessarily mean demand for Nvidia's core product lineup is declining. It could simply mean that supply is finally catching up to some of Nvidia's flagship GPU products.

It's fair to say that recent Wall Street analyst commentary has suggested that Nvidia's next-generation Blackwell GPU chip is already facing at least a year's backlog of new orders.

Nadella's comments, however, cloud some of the most bullish views on Wall Street, which likes to hear that demand exceeds supply for a company's products. One of Nvidia's biggest customers saying that's no longer the case could have investors rethinking hopes for another year of eye-popping growth for Nvidia.