According to Nationwide, the average house price in the UK continued to rise in June despite high mortgage rates, with annual growth rising to 1.5% from 1.3% in May.

Average house prices reached £266,604 in June 2024, up from £264,249 a month earlier.

The market is moving towards record highs again, although prices are still about 3% lower than the summer 2022 peak.

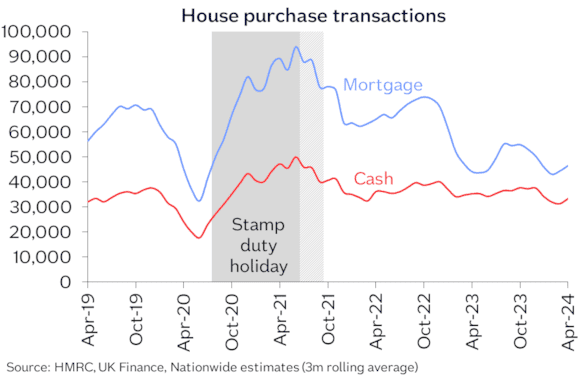

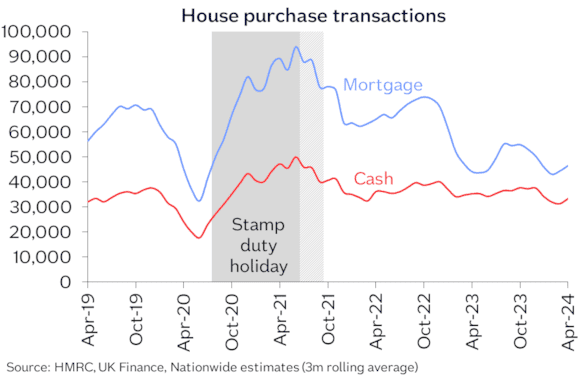

High borrowing costs mean cash is king in today’s market, with cash transactions up about 5% from pre-pandemic levels.

Total transactions were down about 15% compared to 2019 levels, with transactions involving a mortgage falling nearly 25%, Nationwide said.

And inflation is still in the Bank of England's crosshairs, despite a key reading earlier in June putting it at Threadneedle Street's target rate of 2%. Interest rates have been left at 5.25%, a 16-year high, with hints of a summer rate cut still seeping into the bank's narrative. Part of the equation has been looking at wage growth, which is fuelling price rises elsewhere in the economy.

“While earnings growth has been much stronger than house price growth in recent years, this has not been enough to offset the impact of higher mortgage rates, which are still well above the record lows of 2021 in the wake of the pandemic. ” said Robert Gardner, Nationwide's chief economist.

“For example, the interest rate on a five-year fixed-rate mortgage for a borrower with a 25% down payment was 1.3% at the end of 2021, but in recent months it has been closer to 4.7%.”

As a result, housing affordability is still limited, Gardner noted. “Today, a borrower earning the average UK income who purchases a typical first-time buyer home with a 20% deposit would have a monthly mortgage payment equal to 37% of net income — well above the long-term average of 30%.”

Meanwhile, the elections are being cited as a distraction as market watchers hold their breath for housing policy.

Read more: British house prices stagnate due to high mortgages

“The announcement of the general election has certainly led to a drop in demand, at least in the first half of June,” said Emma Jones, director of mortgage adviser When The Bank Says No.

“It's likely people were watching the debates instead of scrolling through Rightmove (RMV.L). But when a number of lenders started cutting rates at the end of June, the market got its mojo back and demand surged .”

Regionally, Northern Ireland saw the biggest increase in house prices in June, with property rising 4.1% compared to the same period a year ago. East Anglia was the weakest performing region, with prices down 1.8% over the year.

Watch: How Much Money Do I Need to Buy a House?

Download the Yahoo Finance app, available for Apple And Android.