The Ethereum network is seeing increasing activity, but in a high-fee environment, some users are doing their business elsewhere. Meanwhile, Cardano developers are addressing complaints with the latest update that aims to reduce transaction costs and provide better privacy protections.

The “cardano gas fees” is a cryptocurrency that has grown in popularity. The “cardano gas fees” are the fees that users pay to use the cardano network.

While Ethereum (ETH) continues to cause trouble for small investors due to rising costs, Cardano (ADA) addresses continue to rise, indicating a strong desire for this cryptocurrency. CryptoCompare published this information in its most recent April market analysis. They covered Bitcoin, Ethereum, Cardano and the entire cryptocurrency sector in their research.

As the cost of Ethereum remains high, users are migrating to Cardano.

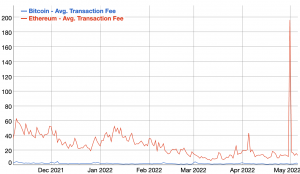

Ethereum transaction fees are still quite expensive. According to crypto comparison, the costs for this blockchain network rose to 21% in April. According to Bitinfocharts, the average transaction price for the Ethereum network has risen to around $200. This is undoubtedly something that has made the Ethereum network inaccessible to small users.

Decentralized financing initiatives (DeFi), non-fungible tokens (NFTs), and many other smart contracts that require gas charges are all part of the Ethereum network. It’s also worth noting that transaction fees on the Ethereum network have been higher than those on Bitcoin since early 2021, due to the growth of a significant number of DeFi initiatives.

Another factor to consider is the fact that Cardano’s address space continues to expand. This also has implications for the bitcoin market. Why? Because this could be the start of a rising trend of people migrating from Ethereum to Cardano in search of better solutions and services.

This could be similar to what happened to Ethereum and Binance Coin (BNB) in early 2021, when DeFi applications like PancakeSwap grew on top of the Binance Smart Chain (BSC). The better Cardano’s solutions are, the more likely it is that Ethereum consumers will migrate to this blockchain network in search of better alternatives.

According to CryptoCompare’s April report, the number of ADA addresses has increased by 2.99 percent. There are now 5.2 million ADA addresses. Not to mention that Cardano has been advertised as a cryptocurrency that can provide fast transactions with minimal fees and promises to tackle the current congestion issues that other blockchain networks are experiencing.

This wave of ADA addresses comes as Bitcoin has fallen below $36,000 and is expected to continue to fall. When the stock market falls, so does the activity on blockchain networks. As a result, we should keep a close eye on the coming months to see how they could affect not only Bitcoin, but Cardano and Ethereum as well.

Ethereum has a price per coin of $2,666 and a market cap of $321 billion at the time of writing. At the time of writing, Ethereum has a price per coin of $2,666 and a market cap of $321 billion. Cardano, on the other hand, has a price per ADA of $0.77 and a market cap of $26 billion. Bitcoin remains the leader with a market cap of over $680 billion..77 per ADA pricing and a market cap of $26 billion. With a market cap of nearly $680 billion, Bitcoin remains the most valuable cryptocurrency.

The “what is ada-crypto” is a cryptocurrency that was created to address some issues with other cryptocurrencies. The currency has grown in popularity, but there are still some concerns about how it will be implemented.

Related Tags

- ethereum transaction fee calculator

- how to get ethereum out of trust wallet

- how to extract ethereum from coinbase

- what is cardano coin?

- Cardano share price