After a month of mostly sideways trading, July was an eventful month for cryptocurrencies, with ethereum experiencing a major slump and bitcoin nearing its first post-2018 high. What will the future bring?

The “ethereum mining calculator” is a tool that provides an estimate of how much money you can earn by mining Ethereum. The tool also shows the current price of Ethereum and Bitcoin.

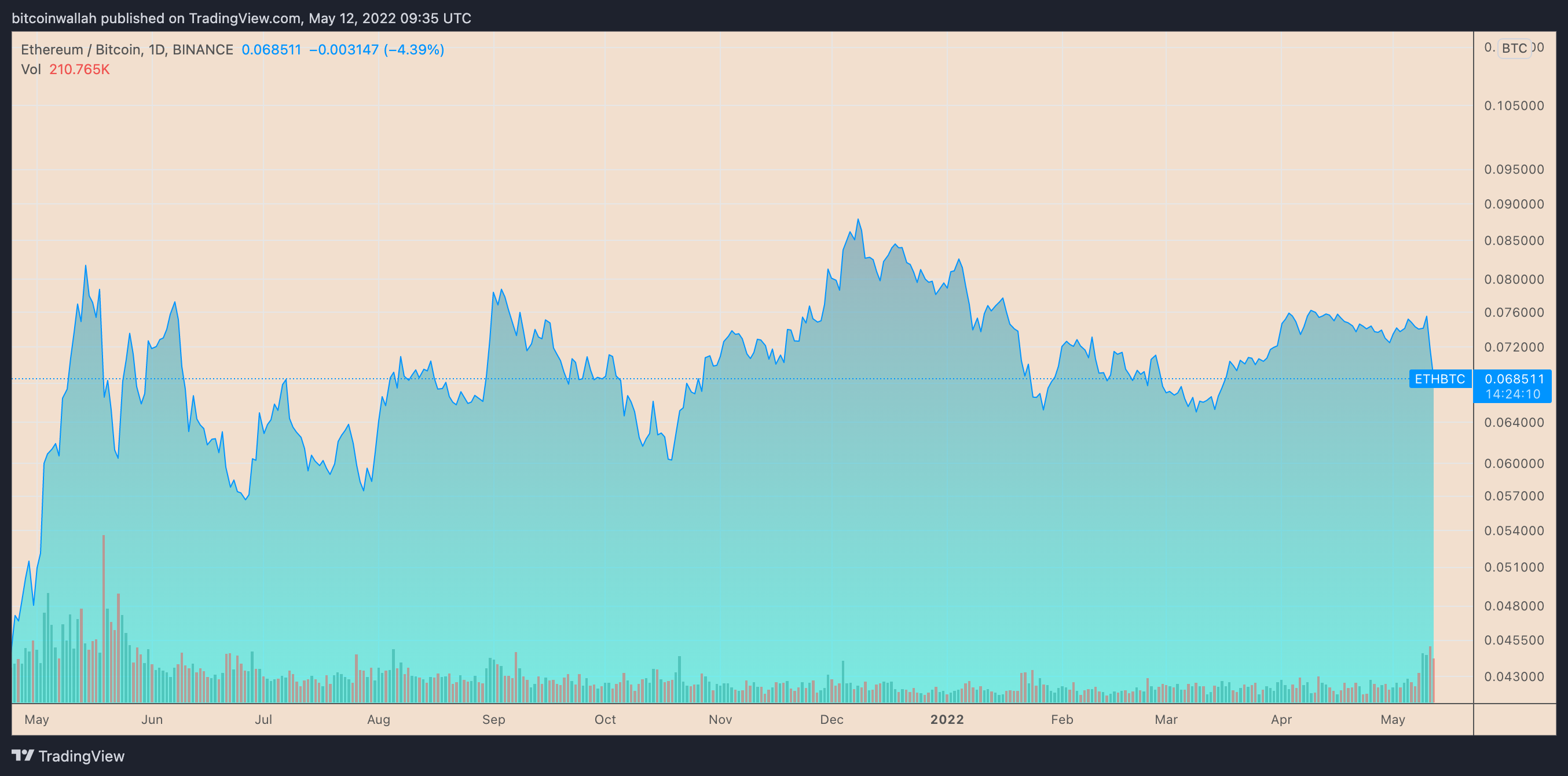

When a crypto market sell-off began on May 12, Ethereum’s native token Ether (ETH) fell to its lowest level in more than two months against Bitcoin (BTC).

Finally, macro headwinds are catching up with ETH/BTC.

In the past 24 hours, the ETH/BTC trading pair is down 7.5 percent to 0.0663. The drop was part of a correction that began on May 11, when the pair traded at a local high of 0.0768. As a result, Ether fell 13.75 percent against BTC.

Daily price chart for ETH/BTC. TradingView (source)

Cryptocurrencies, like stock markets, have been under pressure in recent weeks. Money managers, traders and investors, in particular, are showing symptoms of “winding down” their portfolios for fear of a more aggressive Fed hike.

Ethereum, the second-largest cryptocurrency by market capitalization, has been hit by the same economic headwinds and is currently trading at a 65 percent discount to its all-time high of $4,870, which was reached in November 2021. In the same time frame, Bitcoin has dropped 63% from its all-time high of $69,000.

ETH/BTC has shown resilience despite the market slump in 2022 due to Ether’s significantly reduced decline relative to Bitcoin’s. Nevertheless, the pair is now catching up on the negative trend, suggesting more pain is on the way.

In play is a rising wedge distribution.

The recent decline in ETH/BTC has broken the pair below its dominant wedge rising pattern, indicating that the pair’s technical downside target could be significantly lower than current local lows.

Rising wedges are bearish reversal patterns that push the price down by as much as their greatest high as measured from the breakout point.

After adding the maximum height of the structure (approximately minus 0.009 BTC) to the breakdown point, the breakdown target of the ETH/BTC rising wedge comes to approximately 0.064. (0.073 BTC).

ETH/BTC daily price chart with a rising wedge breakdown scenario. TradingView (source)

By contrast, since June 2021, ETH/BTC has been challenging an upward descending trendline (labeled “LTF support” in the chart above) as support. Traders gathered to buy the dip as the pair attempted to break below the price floor on May 12. As a result, Ether rose 3.5 percent from its intraday low of 0.066 BTC.

DOGE Gets More Love On Twitter While Ether Gets More Hate: Analyze The Data

However, as it continues an uptrend in the coming days, ETH will encounter a series of resistance levels. The 0.236 Fib line of the Fibonacci retracement chart formed from the 0.087 BTC swing high to the 0.064 BTC swing low, followed by the 200-day exponential moving average (200-day EMA; the blue wave) around 0.073 BTC, states an interim price cap of 0.069 BTC.

Bitcoin’s market share has reached its highest point in six months.

On May 12, the Bitcoin Dominance Index — a metric that measures Bitcoin’s market dominance over alternatives — climbed to more than 45 percent, its highest level since November 2021. This could also indicate that, given the current market instability, traders Bitcoin as the safer investment, or ‘digital gold’.

Graph of BTC.D’s Daily Performance. TradingView (source)

The thoughts and opinions of the author are entirely his or her own and do not necessarily reflect those of Cointelegraph.com. Every investment and trading choice has risks, so do your homework before making a decision.

The “why does bitcoin spike” is a question that preoccupies many cryptocurrency investors. The answer to this question can be found in Ethereum’s plunge and Bitcoin’s pursuit of dominance.

Related Tags

- ethereum price forecast 2025

- future of cryptocurrency 2021

- will cryptocurrency crash

- why is cryptocurrency valuable?