Cyptocurrency based on a decentralized network of computer users is designed to provide freedom from centralization and the ability to avoid censorship. However, this model has been compromised as players have become increasingly interested in centralized games that are either limited or sold for other currencies.

The “polygon zk rollups” are a set of tools that help the Ethereum community track their progress. They have just released their figures for the year and they show that the number of transactions on the Ethereum network has fallen dramatically.

In the past two weeks, Solana, like Ethereum and numerous other DeFi ecosystems, has witnessed some of the worst crypto markets as tokens plummeted and others were swallowed by crappy prices.

Solana plunges to its lowest point in more than eight months.

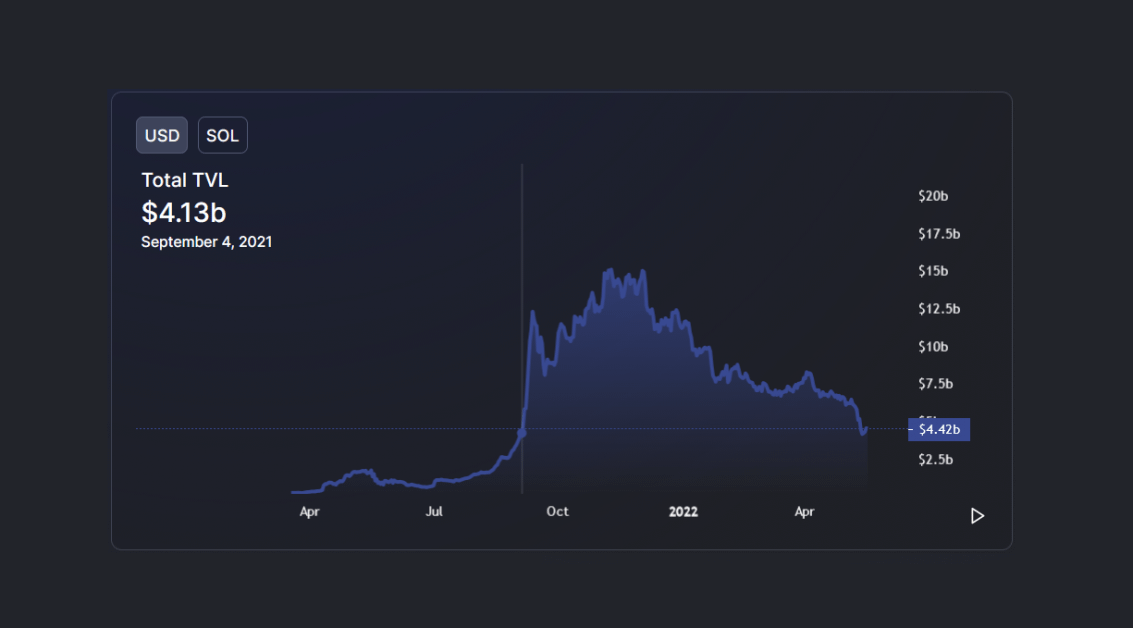

The total value of the Solana chain plunged to an eight-month low of $4.05 billion late last week. According to statistics from DeFi Llama, it fell below $4.50 billion for the first time since September last year. While the amount has now risen to $4.42 billion, it remains well below the TVL at the start of the year.

Since early April, the Solana ecosystem has lost more than half of its TVL, and more than 33.50 percent in the past 30 days. On an annual basis, the decline is much more pronounced. The current TVL value is about 60% lower than the TVL figure of $11.22 billion as of the beginning of the year.

TVL chart for Solana

Solana’s TVL is down 11.49 percent in the past seven days, with virtually all 65 procedures showing red in their one-week changes. Despite this, Solana ranks fourth in TVL with a 3.95 percent market share, behind Ethereum, BSC and Avalanche. Solend, the company’s most popular protocol, is up 5.52 percent that day. Only the third-placed Marinade Finance saw a larger increase of 5.33 percent during this period.

Visit our Investing in Solana guide for more information.

While Ethereum TVL is declining, DeFi’s market share is increasing.

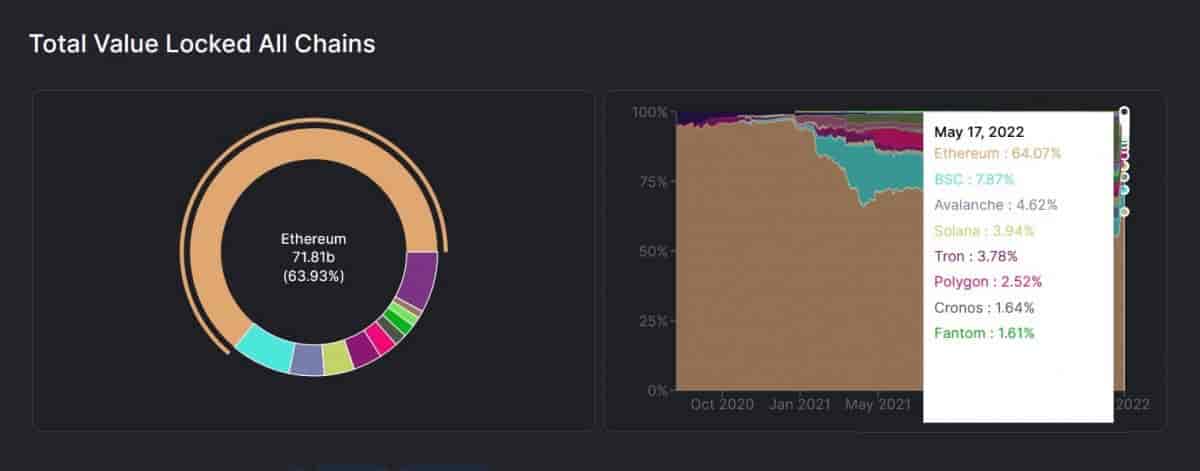

When the markets collapsed last week, the largest DeFi ecosystem also went into freefall. According to DeFi Llama, Ethereum TVL fell to its lowest point on May 15 this year, reaching a low of $70.81 billion. Following the recent market collapse, the Ethereum ecosystem has fallen by more than 50% from an all-time high of $160 million late last year.

At the time of writing, the TVL was trading at $71.81 billion, down 22.17 percent from the previous seven days. This drop has grown to 38.55 percent in the past 30 days, and the dominant DeFi ecosystem is down 51 percent since the start of the year. Other DeFi networks have also suffered losses as a result of these losses. Over the past 30 days, the total value locked on Avalanche, Polygon and Fantom has fallen by 50.29 percent, 30.46 percent and 68.05 percent, respectively.

Interestingly, despite losing so much TVL during this bearish cycle, Ethereum has shown more resilience. During the current crypto market collapse, Ethereum’s market share dominance has strengthened, implying that its rivals have not been as resilient to the declining markets.

On May 8, the first day of market-wide losses from UST depegging, Ethereum’s DeFi market share was 55.69 percent. This share increased as the crypto market fell sharply, reaching 63.72 percent on May 15. It is worth noting that Ethereum lost approximately $32.873 billion in TVL (or 31.70 percent) during this period.

Visit our Investing in Ethereum page to learn more about Ethereum.

Cardashift for initiatives that matter

Dan Gambardello, the founder of Crypto Capital Ventures, called Cardano the “most solid, secure and scalable blockchain” in a tweet to his 226,000 Twitter followers on May 12.

Gambardello, who also hosts the YouTube channel Crypto Capital Venture, praised Cardashift, a recently created launch pad focused on funding innovation through fundraising, development and acceleration. The community-run launch pad, which is powered by the CLAP coin, is seen as one such venture demonstrating Cardano’s potential.

Cardashift is the latest addition to the Cardano ecosystem’s various initiatives. The methodology enables community members to invest in initiatives that have a positive impact. Holders of CLAP tokens will be given voting rights in the project selection process, as well as the opportunity to follow the development of the projects. Tokens can also be used by community investors to fund certain initiatives.

Visit our Investing in Cardano guide to learn more about the cryptocurrency.

The “mir crypto news” is a piece explaining how the price of Ethereum’s native currency, Ether, has fallen and the overall market cap for all cryptocurrencies has fallen.

Related Tags

- polygon mir

- polygon mir protocol

- coinbase defi proceeds

- mir protocol news

- genesis digital asset mining